The Russian Ministry of Labor’s updated income, expenses and property declaration guidelines for government employees for reporting on 2017 includes a point about cryptocurrency, local media outlet Izvestia reports. The updated regulations state that government employees do not have to declare “virtual currencies” they obtained.

The note about cryptocurrency was added to an already existing point that stated government employees were not required to declare “goods and services in their natural forms,” adding laconically “as well as virtual currencies.”

Representatives from the Ministry of Labor told local news outlet RBC that they do not currently require cryptocurrency to be declared because of Russia’s general lack of legislation in the space, stating:

"At present, approaches to the definition and regulation of cryptocurrencies in the Russian Federation at the legislative level are not defined.”

Risk for corruption

Russian officials have been required to make public declarations about their income since 2009. ‘Experts’ pointed out to Izvestia that the ruling increased the risk of receiving bribes in cryptocurrency that would go undisclosed, according to the guidelines.

However, Vladislav Tsepkov of the “Business Against Corruption” Center, an organization created by the Russian government in 2011 to protect entrepreneurs’ rights, told Izvestia that they saw the risk of government workers taking bribes in crypto as “minimal,” noting:

“But cryptocurrency is not a means of payment, it cannot be spent. If they [government workers] sell it and get real income, then it will need to be declared, so the risks are minimal.”

Izvestia noted that according to the same regulations, it is required that government workers declare gifts of “real,” or fiat, money from friends or family.

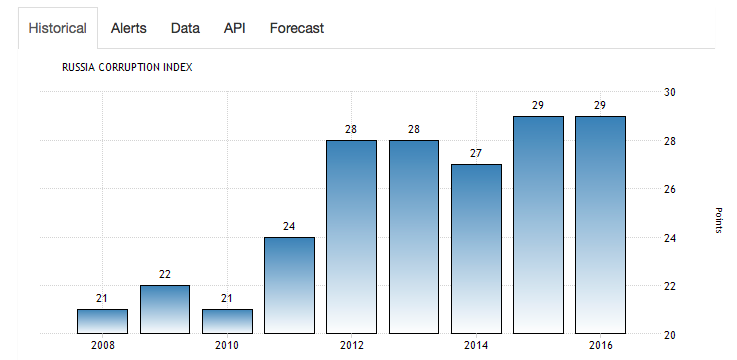

These changes come at a time when Russian corruption is at an all time high. According to the statistics on the matter, corruption has increased more than thirty percent in Russia since 2008.

The Russian government has yet to create legislation that explicitly covers digital currencies. The country’s government and central bank generally have a negative stance on the subject, calling cryptocurrencies “high risk,” especially for mainstream investors.