Some believe that the global economic climate is getting worse by the day, with the collapse of Cyprus, Greece (Grexit), Argentina, Venezuela, Zimbabwe in our rearview mirror. The potential implosion of Italy, Spain, and others looking to vacate the European Union appear to be on deck.

These are trade winds, or economic tea leaves to be read. Do you believe what the mainstream media’s eyes and ears are telling you? I say get all the information, from all sides, to make an educated decision that will affect your financial future, because it looks like the future is about to get affected in a major way.

This article will drop some nuggets out of “The Information Age” you may have missed while “The Olympics” were going on, and it may help someone in the weeks and months to come.

I thought there was enough here to collect and present as noteworthy, if still merely speculative ‘bro-science’ from around the globe. Call it fear-mongering, ‘broscience,’ or conspiracy theorist junk food for the mind (I vote ‘broscience’ myself. My broscience always works out, sometimes.)

It could turn into nothing, or it could mean everything. If you plan on being around for the rest of the year, it is probably worth some attention. And yes, it could easily affect Bitcoin’s economic future, as well.

Mogul Movement

Let’s begin with the crux of the subject. The Rothschild family, currently led by Lord Jacob Rothschild, recently announced that they are moving out of the U.S. Dollar, the global reserve currency, into gold and ‘other currencies.’

Lord Jacob Rothschild explains in the semi-annual RIT Capital Partners report:

"Our significant US Dollar position has now been somewhat reduced as, following the Dollar's rise, we saw interesting opportunities in other currencies as well as gold, the latter reflecting our concerns about monetary policy and ever declining real yields."

Hundreds of books and conspiracy theories have been created about the Rothschild family and just how wealthy and powerful they are. With alleged connections in everything from the Bank of England to M16, to The Bilderberg Group, suffice it to say it is common knowledge that the rumored trillionaire family could buy and sell billionaire Donald J. Trump and not even notice the transaction.

So when a Rothschild says they have reduced their position in the U.S. Dollar, it is a big deal worth noting, or even taking advantage of. ‘Follow the money,’ right?

Jeff Berwick of The Dollar Vigilante surmises that the Rothschilds are looking to get ahead of the downward trend curve, and cash out before a global collapse, and use gold to pick up the pieces. I know it’s hard to imagine a bunch of banking interests colluding and timing a market exit, only to capitalize on the aftermath, but here are Berwick’s thoughts in the video below:

George Soros, another Trump-trampling magnate, who’s Soros Fund Management LLC is loaded with an estimated $30 billion in investment capital, is also moving in on gold. In his emailed opinion sent to the Wall Street Journal, the “continued weakness in China will exert deflationary pressure, a damaging spiral of falling wages and prices, on the US and global economies.”

Deflation, or the restriction of the money supply, can have devastating short-term effects in the fiat currency-based economy. Deflation is the solid foundation that Bitcoin is built upon due to the fact that Bitcoin is not debt-based but value-based through the solid economic principles of supply and demand.

This is truly how ‘sound money’ is created, yet this is not how national and global economics are handled anymore since the age of central banking has lead us to this point.

What point is this? The point where the world’s central banking system has tried to print their fiat currency into oblivion to get ahead of their debt crisis, and it has failed. The point where negative interest rates, which many said would never happen just 2-3 years ago, are now becoming the norm.

The point where China is hedging the bets and is looking to establish their own digital currency, while also buying and mining every piece of gold in existence. They are rumored to have as many as 10000 tons of gold. Their BFF and fellow BRICS bank member, Russia, is also bullish on gold, having tripled their holdings since 2005.

American bank runs and end of USD Global Reserve Status?

What could be the fallout of a shift to negative interest rates? Jim Willie of GoldenJackass.com states that a run on the banks could be one scenario. Since the “bail-in” concept debuted in the Cyprus collapse of 2013, and it may cost depositors money to store their fiat currency in banks going forward, why wouldn’t savers ‘cash-out?’

The real rate of inflation is closer to 5% than the stated 1-2%, so you’re losing money, anyway. Why lose 25 basis points to 1%, risk a bank “bail-in,” lose money to inflation and the opportunity costs that could await them in gold, silver, or Bitcoin? At what point will bank investors get the picture and say ‘Enough?’

This movement by the Rothschilds, Soros, and others is a clear sign of greater value in gold over the U.S. Dollar. Willie also speculates that the Chinese banking interests are negotiating with the BIS, the Bank for International Settlements, the central bank of central banks, on a revaluation of gold into a $5000 per ounce neighborhood.

According to Willie, a treaty between them could switch international contracts from a U.S. Dollar exchange to gold, which would have major ramifications on USD and gold values, further eroding the global reserve status of the U.S. Dollar, if not ending it altogether.

Gold values are already up over 25% in 2016, the first year it has shown YTY growth since 2010. Bitcoin is up over 33%, after rising over 36% in 2015, when it was the best-performing currency on the planet. is Bitcoin one of the ‘other currencies’ the Rothschild family is investing in? Most probably not, but they seem like the types that like to bet on a winning horse, and Bitcoin is out-performing gold versus the U.S. Dollar.

Now if the Rothschilds and the Soros fund know that gold will begin to replace the USD in global trade in the very near future, and they might, that would explain the move, but what ‘other currencies’ was Lord Jacob referring too? I didn’t know gold, or possibly silver, is a currency? Who uses them as currency? Bitcoin is at least a currency, and I would argue it is better money than the U.S. Dollar, which the Federal Reserve will tell you themselves is currency, not money.

Bitcoin is still on the table as an investment play until I see otherwise. Who doesn’t like 30+% returns? Much more, if the USD gets devalued?

Where does this leave us?

IMHO, something is clearly afoot in the global economic markets, and the Rothschilds would know it, and move on it, well before the markets at large. You know what they say, “Follow the money.” If, or when, the U.S. Dollar moves to its true inherent value, which is zero, as noted financial expert Robert Kiyosaki has stated before, will you be able to buy food with a gold bar? Will you be able to get a gold bar to begin with?

It is estimated that, in the U.S., less than half of a percent of American’s investment accounts have exposure to precious metals, and even less to Bitcoin. Everybody is on the same ship, counting their dollars, and watching the rigged stock markets. When that boat sinks, and it will, what will be in your (digital) wallet?

Personally, I’m expecting the unexpected this October. Between the massive ramp up of military drills and weapons testing, the ascension of Donald Trump in the Presidential election polls, the end of the economic fiscal year and Super Jubilee Year, which ties in with last year’s Shemitah, only five weeks away, and the announced movement by kings makers like George Soros and Jacob Rothschild, something big is coming, and we are being kept in the day about what it is. Too many stars are in alignment to ignore.

Now, this all may be nothing, or it could be a bunch of financial tea leaves that may lead to prosperity, or a doomsday scenario. I’m hoping nothing much comes of this, but I fear the worst. This may help someone in the weeks and months to come. At least you have some alternative information from those darned “conspiracy theorists.”

We all know what the mainstream media will tell you. ‘Trump is bad. Hillary Clinton is healthy. Watch the Olympics!’ They also told you to buy gold for the last 5 years, and it has lost value each of the last five years, so the MSM don’t seem like a sound investment resource to me.

BTW, if major players are now moving out of the U.S. Dollar, and are making a point to say so, this will lead to some level of devaluation in the markets. This will be a net boon to Bitcoin investors, worldwide, regardless, as a lower USD value will spike Bitcoin values in comparison. So what affects the USD value is important to monitor for all holders of Bitcoin.

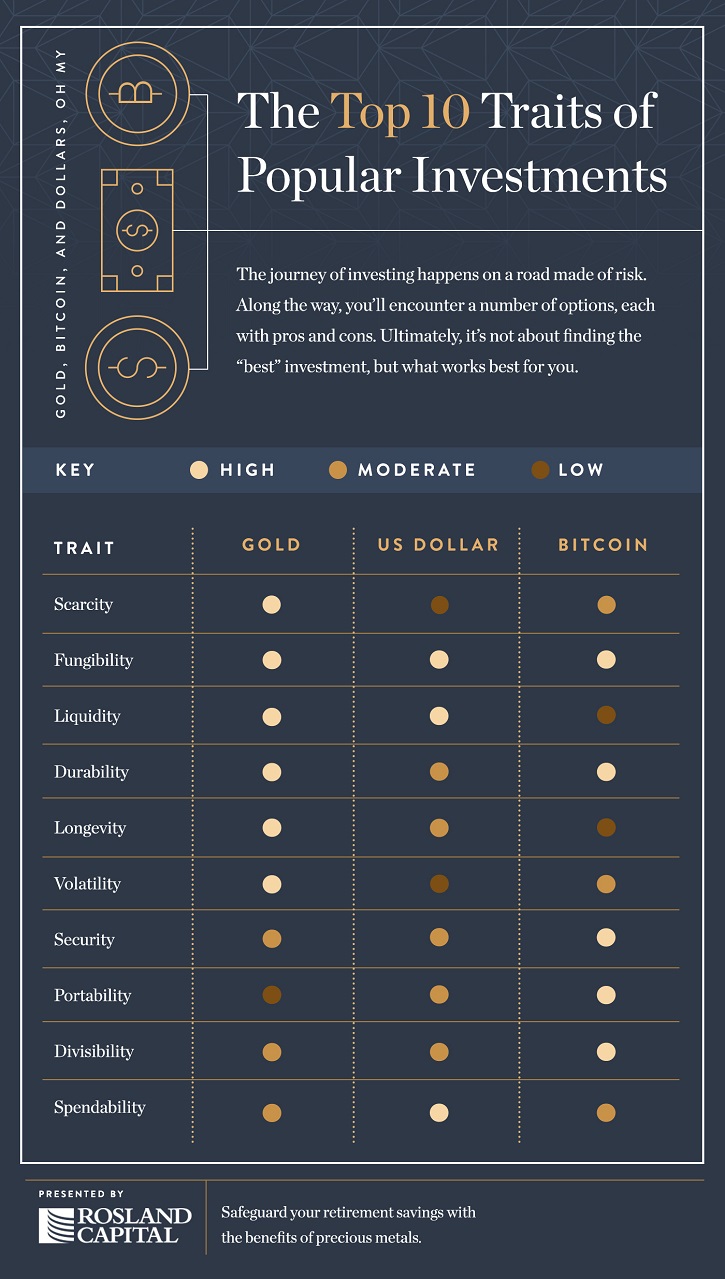

Source: Rosland Capital LLC

During the dog days of summer, it might be wise for you to stock up on the bear market in Bitcoin, before ‘the bulls’ return from Martha’s Vineyard next month. September and October are always a bulling time of year for speculators.

Meanwhile, the financial elite are getting ready to implode the failing central banking system, while they buy gold and ‘other currencies.’ Now, not 3-4 years ago, may seem like the optimum time to make a move into Gold, Silver, and Bitcoin.

IMO, something big is coming in the near future, and the elite are getting ready for it. Go and do likewise, gents. Follow the money. Or not. Either way, consider yourself warned.

Disclaimer: Keep in mind this may be the ramblings of a Bitcoin madman, and this Op-Ed piece does not reflect the views of Cointelegraph. Viewer discretion is advised.