After months of heated debate over whether the Bitcoin network should scale or not, there seems to be no consensus in sight. The community is at a crossroads with two differing opinions on forking the network from 1MB to 20MB.

Yet, getting most of the validating nodes, miners and the rest of the bionetwork on board in an appropriate manner is a very significant issue. One camp thinks that the current network with its mere 7 transactions per second is debilitating and uncompetitive. However, the other camp believes that promoting a hard fork will revert transactions, which is the opposite of the basic principles of the Blockchain technology and its immutable ledger.

Roger Ver: Split of ETH was a good thing

Cointelegraph spoke to Roger Ver, CEO of Bitcoin.com, on whether Bitcoin should scale or not at this crucial moment in its march to become a global digital currency of choice. Asked whether scalability will lead to a split in the Bitcoin community as already has happened with Ethereum, Roger had this to say:

“The market clearly stated that the split of ETH into two forks was a good thing as shown by the increased market cap after the split. I think letting the two camps with incompatible visions for Bitcoin go their own way will also be a good thing.”

Cointelegraph: Why is Bitcoin hard forking a necessary step?

Roger Ver: Any time two camps have incompatible views they should go their separate way.

CT: What accounts for the animosity towards hard forking?

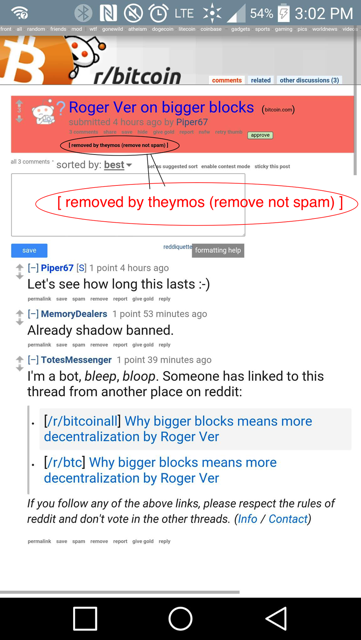

RV: I think 99% of the animosity in the Bitcoin ecosystem is a direct result of Theymos’ policies of not allowing dissenting opinions on the main Bitcoin discussion platforms that he controls. The fact that the side benefiting from the suppression of certain opinions has hardly complained about it at all, while some even openly support it, added a huge amount of fuel to the fire. Before that happened, there was almost no anger or animosity at all. Luckily /r/BTC and Bitcoin.com are providing alternative platforms for people to have open discussions.

|

Greg Maxwell openly refusing to condemn the censorship.

Having two Bitcoins to choose from

CT: Do you think there's a chance for scalability in the near future without significant ramifications?

RV: I don’t think a hard fork is as big a problem as some people believe. Some people like to call the Ethereum fork a disaster, but I don’t see it that way at all. The real disaster was the poorly designed DAO.

CT: What about the view that it will reduce Bitcoin’s proposition of distrust and value?

RV: I don’t think having two Bitcoins to choose from is a bad thing at all. I’m glad I have lots of choices in my life, and I don’t see the problem with having one more choice with regards to money.

CT: Is this not going to reverse global adoption and investment?

RV: Global adoption and investment is on hold already because the current Bitcoin core development team have ignored businesses and users around the world, and have refused to allow Bitcoin to scale to keep up with demand. Bitcoin used to have more than 95% of the cryptocurrency market both by market cap, and exchange volume. Now it is down to 79% and 60% respectively. For anyone who is paying attention, this should be seen as a giant warning sign that Bitcoin is going to become the myspace of cryptocurrencies if this path continues. I know directly of a company with over 100,000,000 monthly active users who put their Bitcoin integration on hold because Bitcoin has not been allowed to scale. We can directly thank the current Bitcoin core development team for this lack of global adoption. I’m busy putting together a competing development team to try to save Bitcoin before it completely loses its market lead.

Ethereum Classic is the real Ethereum

CT: Is the process of reverting a transaction not a contradiction to the basic principle of the Blockchain?

RV: I think it is, but the majority of Ethereum users disagree. I haven’t paid close attention to the Ethereum issues, but from what I know, it seems to me that Ethereum Classic is the real Ethereum.

CT: Do you have an idea of what a hard fork will look like?

RV: Ideally everyone ends up with the Bitcoin that they find most attractive.