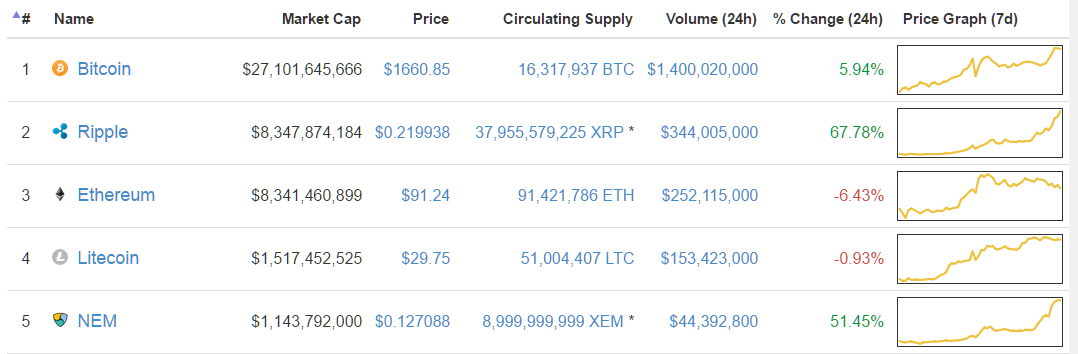

Rather unexpectedly, Ripple officially took over Ethereum by $200 mln in market cap to become the world’s second largest cryptocurrency with a total market cap of $8.5 bln. Over a 24-hour period, Ripple price recorded a 71.6 percent increase, while Ethereum price decreased by 6.85 percent.

Several cryptocurrencies including Ripple, NEM and Stellar Lumens experienced inorganic short-term price growth in the last 24 hours, each gaining 71.6 percent, 53.4 percent and 94.81 percent daily gains respectively.

Although Ripple has made significant progress in establishing strategic partnerships such as the recent addition of 10 new financial institutions including MUFG, BBVA, SEB, Akbank, Axis Bank, YES BANK, SBI Remit, Cambridge Global Payments, Star One Credit Union and eZforex.com, it is difficult to justify its 71 percent gain in such a short period of time.

Japanese Consortium announced

The latest partnership or initiative launched by Ripple was 11 days ago and no major exchanges or trading platforms globally have integrated support for Ripple trading in the past few weeks. Thus, to be critical, a 71 percent increase in Ripple price seems fairly inorganic.

The only driving factor that could explain Ripple’s latest price surge is the establishment of a collaborative project amongst banks in the Japanese Consortium for cross-border and domestic payments.

According to its official introduction video, Ripple is powering the entire network with its Blockchain-based cross-border and cross-bank payment protocol.

Japan Bank Consortium stated:

“In order to address these emerging needs, banks have come together to launch the Japan Bank Consortium for cross-border and domestic payments which enable a flexible and efficient payment system. It is the world’s first case to implement Ripple solution in a cloud environment.”

With its partnership with Japan Bank Consortium and other leading banks and financial institutions in Europe such as BBVA, Ripple has solidified its position as the base Blockchain protocol for the global financial structure and industry.

What does it mean for Ethereum?

Ethereum has implemented a similar partnership-based strategy with the launch of the Enterprise Ethereum Alliance earlier this year.

While it is still uncertain whether Ripple’s short-term growth will stabilize over the long run, Ethereum and Ripple are both utilizing the same strategy to appeal to large-scale conglomerates and banks. Although Ethereum has attracted the likes of JPMorgan, Ripple seems to have grasped the attention of multi-billion dollar banks and financial institutions.