Dilip Rao, Managing Director of Ripple Labs in Sydney, has announced that Ripple will continue to expand its “highly demanded” real-time settlement protocol in the Asia-Pacific region.

‘Ideal time’ for expansion

Ripple appointed fin-tech veteran and experienced salesman Dilip Rao for the new Ripple Labs Asia Pacific subsidiary back in April. According to Ripple, the company established the new facility to support the “growing demand for Ripple’s real-time settlement protocol in the region” and to connect with Ripple Labs partners in the Asia-Pacific market.

In a press release, Rao explained that countries in the region are seeing a rapid increase in cross-border trades, stating that “some think ASEAN could overtake the EU in total economic output in the next 10-15 years." Due to such high volume of cross-border trades between the countries, Rao believes that this is the “ideal time for expansion” to the Asia-Pacific region.

Rao added that “there is also a strategic shift happening to trade in RMB rather than USD for business with China. This is creating new opportunities for financial institutions for trading partners like Australia."

New Vision

Ripple is planning to connect major banks with its institutional payment service to allow real-time transactions, instant cross-border remittance and corporate payments, which can potentially reduce significant chunk of the banks’ compliance costs.

Upon the launch of Ripple Labs’ new office in Australia, Rao announced:

“We can more effectively serve eager markets in India, Singapore, and the Middle East and across APAC.”

Ripple sees a huge potential for their payments infrastructure in the Asia-Pacific region, as Rao states that “Ripple can help build a strategic capability for the region to connect with the world and drive global economic growth over the next 50 years.”

However, Ripple is required to comply with all the rules and regulations set down by FinCEN for money-transferring companies, which requires Ripple to provide financial audits every two years until 2020.

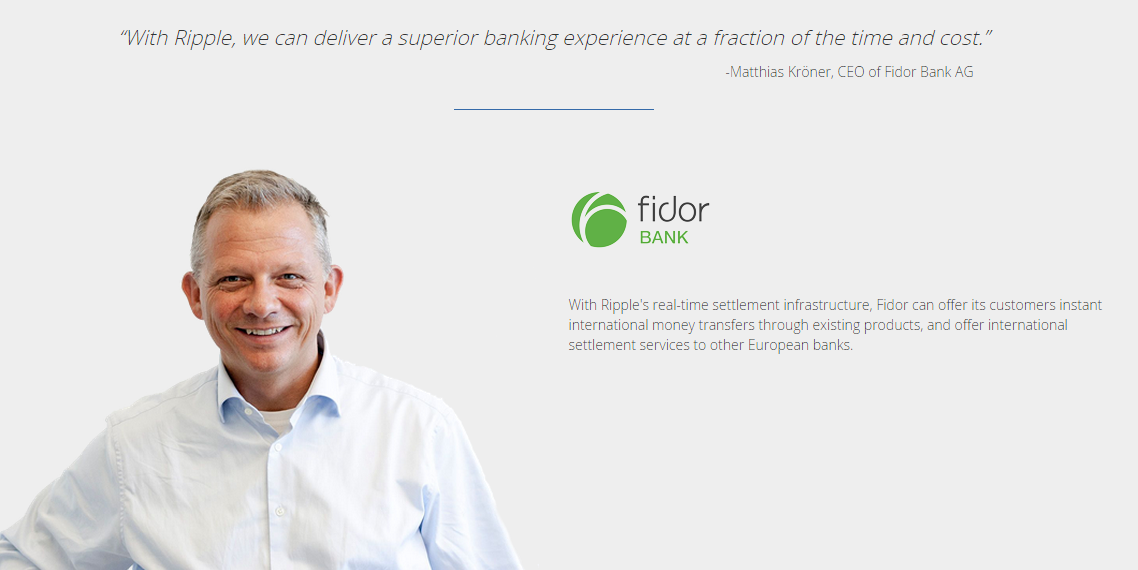

German Direct Bank Fidor in 2014 was the first bank to integrate Ripple’s payment protocol and infrastructure for cross-border money transfers. Fidor Bank CEO Matthias Kroner stated “Ripple enables us to securely and instantly send money anywhere in the world at no additional cost and through the same customer facing products and relationships we offer today."