The idea of backing Bitcoin with a physical commodity is nothing new. In May, 2014 Mina Financial, a Toronto-based financial services innovator announced the creation of “Minacoin,” a gold backed cryptocurrency that would, like Bitcoin, create 21 million coins that are backed by two 400-ounce bars of gold worth US$1,050,000 (£618,000). Late last year the people of the Island of Alderney in the Channel Islands flirted with the idea of physical Bitcoin to try and reverse dependency on the British Crown and Pound Sterling, making itself a global hub for digital currencies. And just recently, US gold merchant Anthem Vault released its own “gold-backed” coin.

But it turns out that people in Asia have been considering this idea as well. The post appeared on a Chinese blog (Simplified Chinese) anonymously suggests that a new coin might soon become available that is not only backed by gold, but is exchangeable for Bitcoin…in a way. To be honest the entire plan, as it so far appears, has been quite confusing, especially when it comes to the coin’s value.

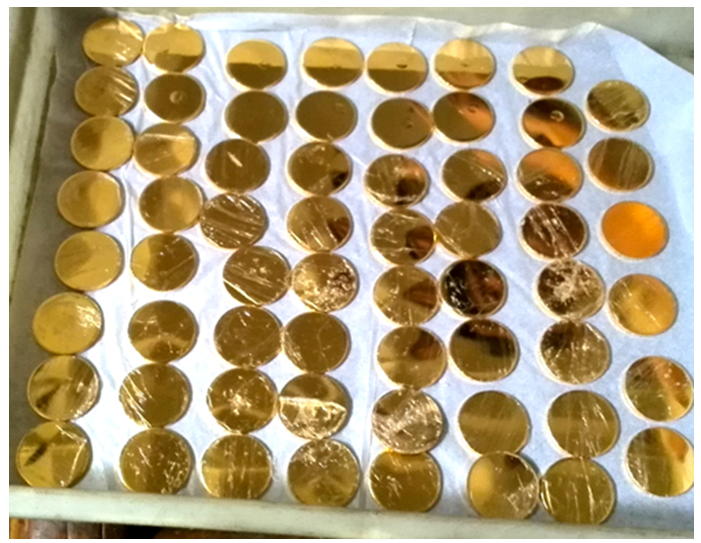

The suggested coins are actually made of pure gold, one ounce of 24 ct. gold, and have engraved on their features a 2D bar code private that is said to be worth one BTC. According to the post when the coin is traded you will get a private key and all past private keys will be deleted. How this is accomplished is not explained.

But there are a number of serious flaws in this plan. The most glaring flaw is pretty simple: What could possibly be the point? It is one thing to say that your currency is backed by gold and quite another to actually make a physical currency out of pure gold and then stamp a code for a Bitcoin transaction onto the gold coin.

This begs yet another question. What is the real value of the coin? The coin is advertised as being one ounce of pure gold, yet it is worth one Bitcoin. But with gold listing at more than US$1,300 an ounce, which would make the coin worth at least 2 BTC, there appears to be another reason to scratch your head.

So is the value based on Bitcoin or gold or both? Is one coin worth almost US$2,000? Adding to the confusion is the fact that only 100 of these coins will be made as they are backed by 4kg of gold. Interestingly enough, however, the post is using standard ounces instead of troy ounces, which is much more common for precious metals.

The maker of the coins said that he had been commissioned by a businessman to produce the coins and was told that they were not for circulation or as a currency. They were instead to be used by collectors. Although it’s interesting to see whether digital currency could somehow complement collector coins in the future, several questions still need to be answered such as the issue with private keys and the coin’s total value.

Special thanks to www.8btc.com for the photos.

Do you want to read Cointelegraph from your mobile device? Then go to our Indiegogo campaign, contribute, collect your prize and enjoy the mobile app!