In what seems like a never ending stream of bad news for cryptos coming out of China, a new statement condemning cryptos within the Chinese financial system has been issued by a leading PBOC think tank.

Image: Asia Times

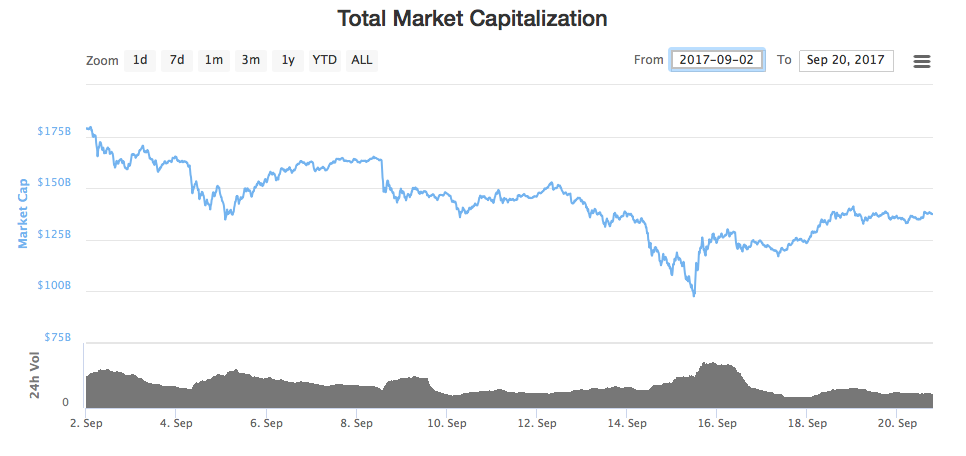

With ICOs being banned, crypto exchanges being shut down, and rumors of putting up the “Great Firewall” against foreign exchanges, markets have been getting hit with their fair share of negative news coming out of China. However, after dropping almost 30 percent from the all-time high last week, it seems as if markets have begun to accept negative crypto stories from China as the norm.

Perhaps, they might also believe that China will re-open to cryptos and ICOs after the nineteenth party congress. However, in a recent interview, Zhou Ziheng, an associate research fellow at The Chinese Academy of Social Sciences Institute of Finance, all but dispelled these ideas.

Perhaps, they might also believe that China will re-open to cryptos and ICOs after the nineteenth party congress. However, in a recent interview, Zhou Ziheng, an associate research fellow at The Chinese Academy of Social Sciences Institute of Finance, all but dispelled these ideas.

After talking about the rise of cryptocurrencies, and quasi digital currencies, he goes on to say:

“Supervision authorities must take stringent measures to limit and ensure that the real monetary and financial system remains stable.”

When asked if whether or not, once the situation has stabilized, the authorities will reopen private digital currency transactions, Zhou Ziheng again had a negative outlook.

He goes on to claim that cryptocurrencies pose realistic threats to financial stability, and that they must be terminated - with the only solution being to replace private cryptos with fiat cryptos issued by PBOC.

Is this the end of cryptocurrencies in China? If history has anything to say about it, it’s safe to say it’s unlikely.