The original online payment platform, PayPal, has decided to leave the populous island of Puerto Rico next month. The commonwealth has imposed a 2 percent take on any money transmission, forcing Paypal’s hand. So what does this mean for those who need to send money from Puerto Rico?

Puerto Rico Begins Capital Controls

When a country’s economy or currency is struggling or on the brink of collapse, the citizens start to move money out of the nation to protect their savings from the devaluation. Nine times out of ten, the economic downturn is caused by poor governance and economic policy, not the citizens. Therefore, the people would rather invest their money in appreciating assets, not poor leadership and economic decline.

Greece, Argentina, the United States (Foreign Account Tax Compliance Act, or FATCA) and now Puerto Rico have recently used legislation to force capital controls on citizens, or even people living and working overseas.

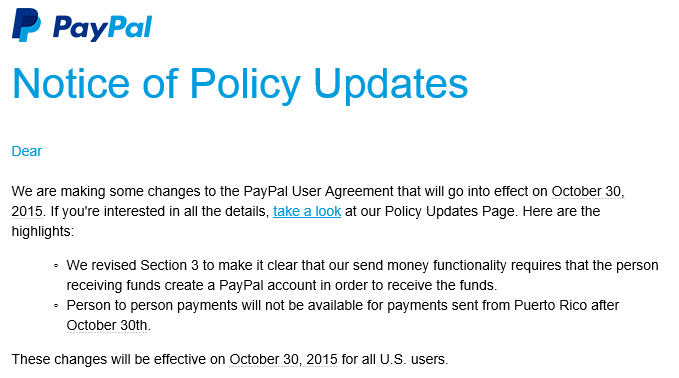

Puerto Rico passed a law, originating from House Bill 2191 last December, wherein all peer-to-peer transactions are now taxable at a 2% rate. PayPal had the following response:

“Due to new government policies in Puerto Rico, we have made the difficult decision to no longer offer our person-to-person payment service to our Puerto Rican customers as of November 1, 2015. Our customers in Puerto Rico will no longer be able send money to friends and family abroad with Venmo or PayPal, but will be able to continue to use PayPal to pay for goods and services and receive payments. We regret any inconvenience this may cause our valued customers in Puerto Rico.”

The fact that this only affects outbound peer-to-peer monetary transfers demonstrates the true intent of this law to extract “additional sources of income” from Puerto Rican citizens. Here is the direct quote of intent from the legislation itself:

“This Legislative Assembly deems it necessary to establish recurring sources of income by imposing special charges on certain transactions carried outside and inside the jurisdiction of Puerto Rico. […] it is in the public interest to impose charges on transactions originated in the local jurisdiction involving assets that no longer circulate in the local economy (bold type)[…].”

The bitcoin alternative

Where does bitcoin fall into this? It would make a perfect substitute for Paypal, as many in the West feel it is destined to replace PayPal in years to come. Not only would it work in a faster and more secure fashion completing within 10-60 minutes instead of 1-7 days, but it would be fairly difficult for these cryptographic funds to be taxed by government. Maybe the world’s most technologically advanced nation, the United States, could actually watch every transaction, and figure out where it came from and from whom, but Puerto Rico?

In reality, taxing each bitcoin transaction would be quite a feat to accomplish for any government, regardless of where you are. Every time a government makes an economic mistake, and imposes a new tax to cover for it can force the citizens to make economic countermeasures against such impositions.

PayPal will end its service for Puerto Ricans moving money off of the island on October 30, 2015.