Here’s a revolutionary technology and using it requires stepping on pebbles in a market with a 5 billion dollar capitalization but 1/500th the liquidity and depth of a stock with a similar market cap.

There is no question, and you don’t have to be an expert to verify this - it is intuitive:

The biggest thing holding Bitcoin back from its Mass Adoption phase is volatility.

No matter how pretty the interface, no matter how canny the copy, if your product is an easy way for people to buy a highly speculative financial instrument that might pay or cost them over the hour it takes to move across the blockchain and sell elsewhere, then you are going to find a limited audience.

But what if people could just have a dollar balance in their wallet?

Or a dollar balance, a euro balance, a peso balance, a synthetic gold balance, a Bitcoin balance, and maybe some DOGE just for kicks.

What kind of world would we be living in after a few years of that power? 2 billion people with Android phones, able to enjoy the security and predictability of traditional banking on a free platform that allows unrestricted payment to anyone, anywhere, in 30 minutes.

The volatility of BTC/USD and other trading pairs has been reduced. Derivatives like futures will further tranquilize the party animal who once had >100% daily variance into something better behaved, with most days seeing 1-2% movement. Market makers and a greater number of private traders will facilitate tightening spreads. But ultimately the thing you want to do is not just minimize the volatility, but net it out.

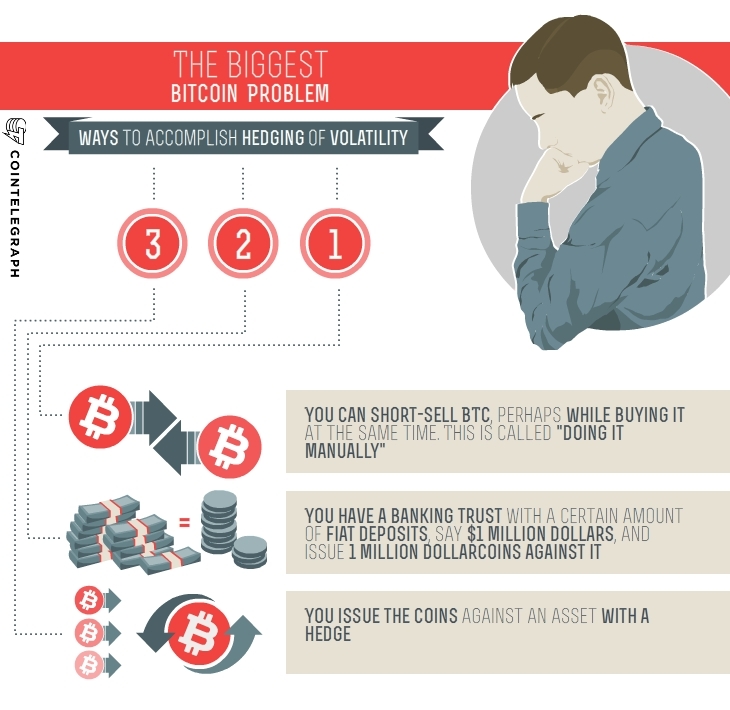

There are three ways to accomplish hedging of volatility:

1) You can short-sell BTC on Bitfinex or OKCoin, perhaps while buying it at the same time. So now you have Bitcoin and an equal sized short position, so you'll be paid for every dollar drop in the price minus some fees. This is called "doing it manually" and is how professional clearance of payments has had to work this year.

2) You have a banking trust with a certain amount of fiat deposits, say US$1 million dollars, and issue 1 million dollarcoins against it.

3) You issue the coins against an asset with a hedge - this is the decentralized and automated version of #1.

These points became clear to me in the first half of 2014, as doing #1 led to business development around #2 while I wrote specifications on how to implement #3.

I've known these crypto-dollars were coming. But now, faster than we may have expected: they're heeeeere. You know, like that movie Poltergeist.

Different angles

These financial instruments are essentially different angles, different attempts, at taking a stab at a pegged currency that can ride a blockchain without price volatility. Like the ghosts who haunted that family, each crypto-dollar has its own quirks, their own character flaws that are holding them back from crossing over. The question is which of the crypto-dollars will turn out to be The Beast? The winner is going to end up representing billions of dollars in value within a few years. Millions of people would be storing their savings in a crypto-token deposit.

Don't find the Poltergeist reference to paint these instruments as friendly? Ok, how about an alien invasion? But not like those aliens in Independence Day, more like a mix between E.T. and Under the Skin [SPOILER ALERT].

One or two of these instruments is going to be reliable enough that it almost never breaks the buck, and it will be a friend to humanity, empowering bicycles to fly over the heads of government employees. But the others, well, I think early adopters will buy them thinking they are about to get it on with Scarlett Johannsen, only to find that they are trapped in a barely liquid group that will eventually tear off their skins.

Which brings me back to the question of government employees: If they didn't like E.T., imagine how they would treat Scottish-Alien Scarlett Johannsen. It is unacceptable that a full-scale Goxxing of an early adopter deposit base should be allowed to happen. Any such losses must be kept minimized. It's on the community that is providing the early liquidity in these instruments, selling their BTC at times for USD in token form, rather than exchange promissory deposits, to hold centralized issuers of fiat-pegged tokens to at least the same standards as exchanges are.

Like it or not, if you're interfacing with the banking system i.e. you need some level of Know-Your-Customer in place - rules of the road - but beyond that, some rigorous form of auditing should be offered as a key differentiator in this competitive landscape.

Testing

To consider a nightmare scenario, imagine if the BTSX-backed bitUSD were to crash irrevocably from $1.00 to the $0.30's; the hornet's nest would be effectively broken in half by that large stone of public losses. The resulting swarm of regulatory attention would sting not just that issuer, but over half the industry most likely, with a series of subpoenas and requests for information. It's just a bad time we don't need to have as an industry.

Likewise, any systematic promises of effective hedging enabling automated dollar coins redeemable in BTC need to be rigorously tested in both theory and practice. Complementing the field of fiat-pegged tokens, there are emerging instruments on different blockchains representing Futures or Cost-for-Difference contracts.

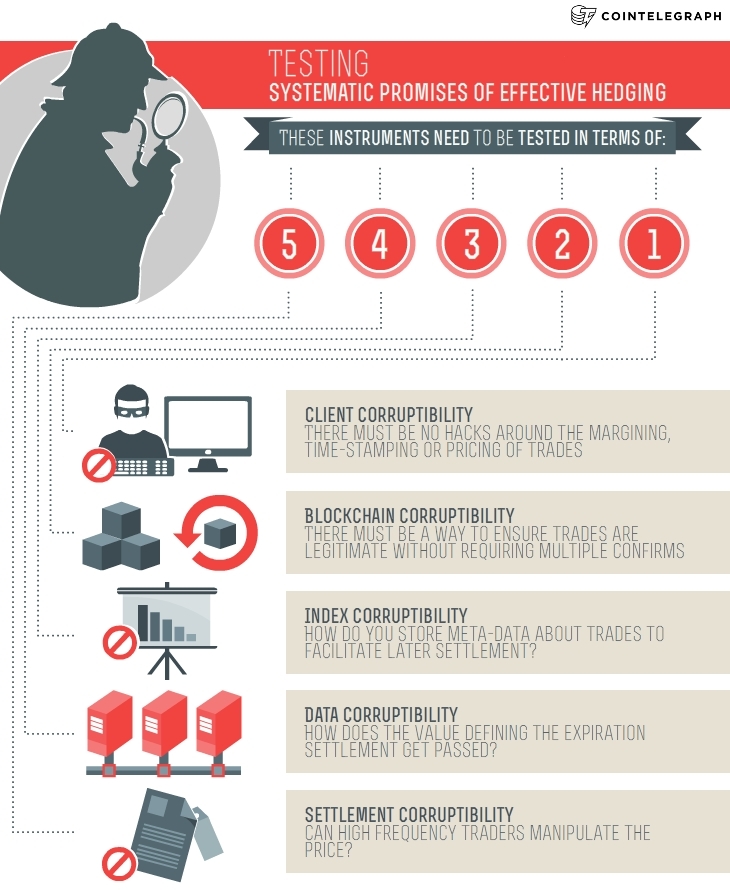

These instruments need to be tested in terms of:

- Client corruptibility

There must be no hacks around the margining, time-stamping or pricing of trades.

- Blockchain corruptibility

There must be a way to ensure trades are legitimate without requiring multiple confirms, and yet, double spend attacks that allow quick profits to be taken before confirmations are made will be extra-attractive.

Can you prove that mining groups or large staking groups can't head-fake futures trades by running ahead of the chain?

- Index corruptibility

How do you store meta-data about trades to facilitate later settlement? Is this done on a Federated server network (i.e. Notary Chains against the Bitcoin blockchain) or is this done on the same chain (possibly Bitshares X) or on a side-chain (e.g. specific contract chain against Ethereum blockchain) - depending on the answer, you will have different ways of proving that the index can't get injection attacked.

- Data corruptibility

How does the value defining the expiration settlement get passed? SSL server? Blockchain publication? Is the data signed as belonging definitively to the stated source? You must prove that you can be sure that tick_value came from Thompson Reuters and not Gustav, the man-in-middle.

- Settlement corruptibility

Can high frequency traders manipulate the price in order to arbitrage contracts about to expire against their own spot-trades in a very thin order book?

How do you calculate the settlement price? Do you use Coindesk's Bitcoin Average? Barry Silbert's? Do you do something “quanty” like 5-min trailing VWAP? How effective are these different settlement formulas at reducing piranha-like predatory trading?

Once you've checked off those 5 boxes, you know you've got a good hedge, right?

Sure, but how about a banking-proof hedge?

Banking-proof hedge

If you post 1 BTC and short sell 1 contract, issuing US$400 dollar coins against the locked up Bitcoin, how can you know that a move toward US$800 won't break the buck on those 400 coins? It's possible to protect the dollars from downside risk, but upside risk is a different beast. Even someone shorting without leverage can lose 100% of their margin if the shorted asset doubles in price.

The answer is futures contracts will have to trade at a slight premium to the market. This represents the cost of leveraging for those buying the contract and it means those shorting to back pegged-tokens can collect some yield. If you can keep selling a contract 0.25 cents over the market, and you've still got your Bitcoin in reserve, whether the market is up or down you're going to be 0.25 cents ahead when the contract settles based on spot price.

Multiply that by 10 or 100 bitcoins (or 10,000 or 100,000 BTSX) and compound it for every time a contract settles, and you're doing decentralized banking and collecting between 10-40% a year. Just look at the Swaps Market on Bitfinex for the centralized predecessor and it's not so hard to image. The yield here would be have to be higher than the secured rate of return Bitfinex offers, but lower than the yield one can get from selling covered options, because the depositor is essentially short small amounts of volatility, small amounts of what option traders call "gamma", against a potential upside price explosion in the price of Bitcoin.

Imagine if you could tell people that they can put in as little money as they can save, and start seeing low-risk growth happening to it. You'd get a lot of pegged-tokens floating around.

Enough money could come in to the system that it becomes much cheaper for someone to get leveraged on Bitcoin by going long futures contract. Then the speculators will be the ones the market needs, instead of now, where the market needs more liquidity. And in the process, all those people looking for an exit, all those people looking for a better yield than the negative-real rates their banks offer, they would become real, everyday people using cryptocurrency by the hundreds of millions.

Before that scale-marketing begins, on any significant front outside some pilot programs where everyone has full disclosure and consent, it will be necessary to do simulations that shock test different levels of decentralized banking capitalizations. Does a 4:1 leveraged contract offer enough stability? That means 1 BTC + 0.25 BTC on the long-side (US$500 in the system) creates US$400 dollar coins. Should it be 4:1 instead? Should depositors have to provide extra capital to buffer volatility? 10% extra? 15%? 20%? What would the outcomes be for different tranches of dollarcoins with those different parameters in different volatility shock scenarios over different timeframes?

My plug

I've been working with a really talented technical co-founder on building trading infrastructure for cryptocurrency - our data capability allows for random walks and Montecarlo simulations, and we intend on tracking derivatives contracts and the disparate pegged currency tranches across blockchains and issuers. Resolving the myriad questions raised in this article in a scientific manner is one of our R&D goals - alongside making profitable trading systems - got to pay the bills.

Now I'm going to plug a list of other start-ups:

Realcoin Inc. - Founded by Mastercoin Foundation CTO Craig Sellars, Brock Pierce, and Reeve Collins.

Their product will take dollars in a banking trust, held by a reputable commercial bank, and use it as collateral for the issuance of Real Coins backed 1:1 by U.S. Dollars. They will support SWIFT wires to banks outside the US, and will be integrated with three major payment providers, one of whom is a top Bitcoin exchange, at launch.

The design here is initially a centrally-backed 100% reserve with legal guarantees put in place by a 3rd party. They will be using the Master Protocol to issue and redeem Realcoins against a list of options.

Coinomat - Offering the USD-peg for the NXT blockchain, with their corporate stock trading at 9 times the volume of their xUSD (or CoinoUSD) product, which has seen 22 BTC in volume over the last 30 days (source: www.cryptoassetcharts.info/assets/info). Their site Coinomat.com is an automated market maker converting BTC, LTC, PPC, and a few different USD forms at significant spreads, and now they are doing a promissory USD tranche alongside it. CoinoUSD is redeemable for EgoPay, OKPay and Perfect Money deposits, as well as credit to Visa or Mastercard.

Coinomat is a project of Intelligence Unitrade LTD. which is registered in the British Virgin Islands, which we know because they host their article of incorporation on their About Page, next to a linked chart showing 20-40 BTC in daily volume. Their stock trades at a market cap of about 750,000 USD and has traded over 1 million, a decent seed round valuation given them by the market. They pay a dividend on the stock regularly.

Coinomat is a proud collaborator with Bitcoin Dark on the superNET project, the details of which can be found here.

Invictus Innovations Inc. - Hailing from my alma mater, working out of the Virginia Tech research campus where a teacher once told me never to tell the university about anything proprietary I was working on, comes a company that was among the first to achieve a pegged currency. With the recent launch of Bitshares X, the first of ostensibly many decentralized autonomous corporations running on the Bitshares blockchain, Invictus has launched the bitUSD asset, which currently has about half the marketcap of the Coinomat crypto-equity, according to Coinmarketcap.

Conclusion

Of course the BTSX reserve asset that their exchange is hinged on has a market cap 20 times larger, at almost 70 million USD, and is the top 4 currency on the same website. This is the more extreme version of the pattern where the reserve asset is way more liquid and capitalized than the USD token it hopes to support.

Looking at the three current competitors here, it’s clear that most traders prefer to take credit risk with their preferred exchange than to try out these new tokens. There was already a major break-the-buck incidence with bitUSD, sudden volatility in the BTSX asset caused a wash-out in their hybrid model of automated hedging and centralized intervention. The xUSD markets on Poloniex are extremely illiquid, even against ol’ BTC. Real Coin is just now making their debut as the MasterCore client gets road-ready and its MetaDEx enables its trade.

However like all invasions, things can be proceed very quickly, and a phase shift of market adoption will be sooner faster than imagined. In the meantime, we must remain vigilant, doing our own due diligence on these neophyte financial experiments by trading them, understanding the companies behind them, or better yet, making sure the process-based infrastructure behind them is resilient against Black Swan events that seem to happen about once every 4 months.

Maybe there is no sharp difference, fundamentally, between the tokens backed by bank deposits and those backed by decentralized hedging. Keynes had this idea of “liquidity preference” that came out of his musings about how the ordinary person handles money. There is no incentive to take risk, to surrender liquidity with something that offers little to no return, so when it comes to basic forms of holding money, people are going to want to hold it in their mattresses where it is safe (like how US$160 billion is held by Argentine savers who trust NOBODY) or they’re going to want some kind of rate of return as compensation.

In the modern age of banking, banks can’t fail because the government will bail them out, bailed out by printing from the central bank, so nobody can ever lose their bank deposits, because everyone will pay for risk in the form of inflation eventually instead. Keynes dreams came true - but at what price?

If your dollar coins are hyper-fungible, as cryptocurrency is by nature, and you have multiple layers of redemption capability, it is then possible to take bank-backed dollarcoins, buy Bitcoin, and issue more Bitcoin-backed dollar coins. We might see something similar to the money multiplier effect that exists in fractional reserve banking, but at the bottom of the pyramid are actually more than enough BTCs and USDs to make everyone whole.

If a company defaults on their obligations, the losses can be contained, as people will prefer to get more liquidity from the Bitcoin-backed tokens. If a short-covering rally takes the price of BTC up 200% in 2 weeks, the return for depositing Bitcoin would rise as well but not enough to cover the loss due to extreme volatility, and people would trade discounted Bitcoin-backed dollar coins for centrally-backed dollar coins.

It is my perhaps naive hope that free market competition between these different blockchains, protocols, futures contract designs and pegged-liquidity provisions will converge on a diverse and thus extra-resilient liquidity environment that can grow exponentially in terms of total deposits and total depositors.

There will be disasters; there will be 1907-esque moments of panic and special provision. But then in 5 years, when we get to our 1913 moment, will we create a DAC that would act as central banker? It seems much more likely that we will arrive at decentralized banking, and let the 21st century proceed accordingly.

I for one, welcome our Crypto-Dollar Overlords.

Full Disclosure: I have worked on specifications for the Mastercoin Foundation and received compensation in BTC and MSC for my work, relating to decentralized futures and pegged currencies (and more). I have a bit over 1 BTC in MSC form and no position in NXT or BTSX, but this can change at a moment’s notice.

Did you enjoy this article? You may also be interested in reading these ones: