Lieferando, one of the the largest food delivery platform in Germany, officially integrated Bitcoin. Users on the platform will be able to pay for food deliveries using Bitcoin.

Originally, Lieferando obtained over $18 mln in funding as a regional food delivery application and service provider. Due to the platform’s success regarding the rapidly growing user base, revenue streams and popularity, Netherlands-based Takeaway.com acquired Lieferando.

The acquisition of Lieferando by Takeaway.com is important to note as the Takeaway.com development team initially integrated Bitcoin back in 2013. Most of its subsidiaries including Pizza.fr have started to accept Bitcoin after the acquisition by Takeaway.com.

It is equally crucial to acknowledge the fact that Takeaway.com completed its initial public offering (IPO) in 2016 to raise hundreds of millions of dollars at a $1 bln valuation. Despite the IPO, the board members and corporate executives of the company continued to show support for Bitcoin and integrate the digital currency into newly acquired subsidiaries.

Before the acquisition of Takeaway.com, Lieferando briefly accepted Bitcoin from 2014 to 2015. During the company’s rebranding acquisition process, the company dropped its Bitcoin integration but reimplemented it once the acquisition was finalized.

Why are companies continuing to accept Bitcoin?

Earlier this week, Japan’s largest Point of Sale (PoS) service provider AirRegi officially began the integration process of Bitcoin as a payment method. Upon the completion of the integration process, more than 260,000 merchants will accept Bitcoin in Japan, including restaurants, cafes, bars and stores.

Less than a week has passed and Germany’s leading food service provider has announced its integration of Bitcoin.

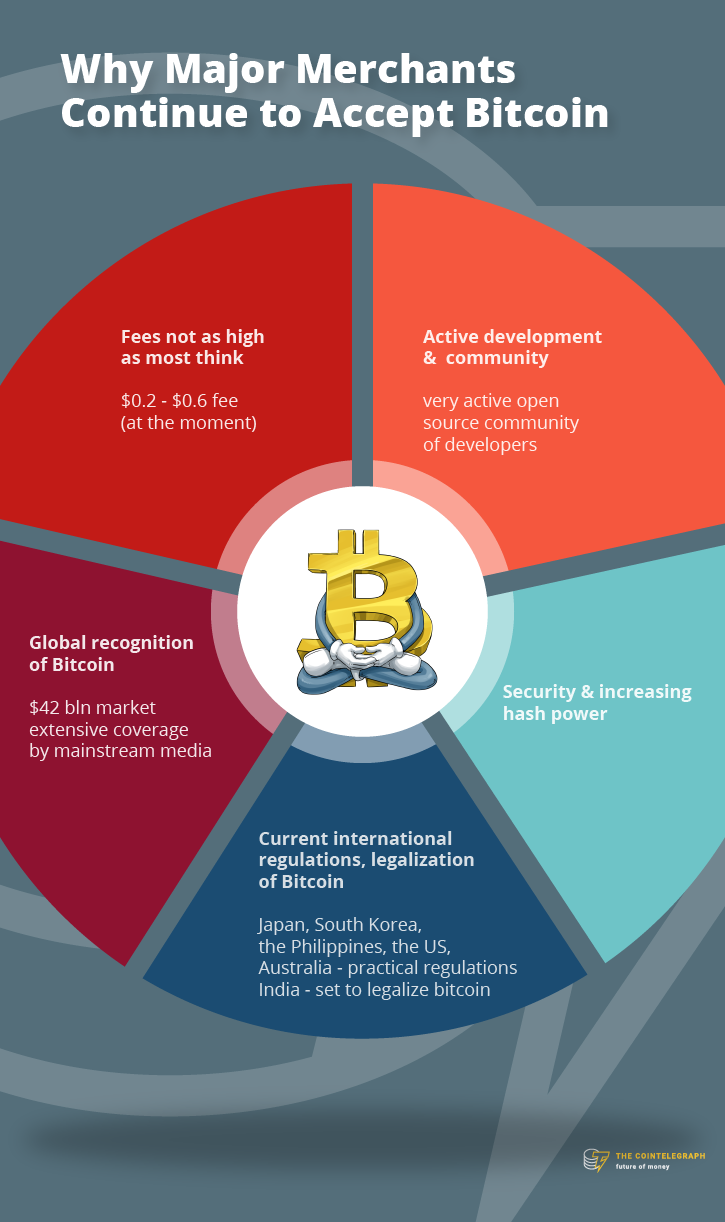

Anyone following the technical and scaling discussions within the cryptocurrency and Bitcoin communities should be aware of the fee market debates that are taking place. Some argue that the fees are too high and that it is transforming the Bitcoin network into a premium store of value which is inefficient as a digital currency.

In contrast, there are many analysts, users and investors that also claim that the size of the Bitcoin mempool, as well as the Bitcoin block size, declined significantly over the past few weeks.

Leading Bitcoin wallet platforms including Blockchain, which operates more than 15 ml wallets, have recommended a fee of around $0.2 for median-sized transactions at around 50 satoshis per byte.

For merchants, Bitcoin fees are much more affordable than the two percent credit card transaction fees they have to cover. Most consumers are unaware of that fee because merchants are usually made to cover the transaction fees for consumers. Thus, current Bitcoin fees that range from $0.2 to $1 aren’t that costly for merchants to deal with.

In Japan, some of the largest and most influential companies already accept Bitcoin. Japan’s largest electronics retailer Bic Camera has been accepting Bitcoin for months and some users claim that Bic Camera along with many merchants accepts zero confirmation transactions due to the current status of the Bitcoin mempool.

The activation of Segregated Witness (SegWit) will likely spur the demand for Bitcoin from merchants as transaction fees become cheaper and the network becomes more efficient.