With a combination of external punitive measures and internal strife, Russian financial turmoil looks set to continue – and the mood about Bitcoin’s future role is definitively mixed.

In a resolution adopted Thursday last week, the European Parliament called on member states to move to block Russian access to the SWIFT payment system. The legislation will now move forward to the European Commission, whereupon it will rest with individual states to act together if it is to come into force, Russian news agency RIA Novosti reported.

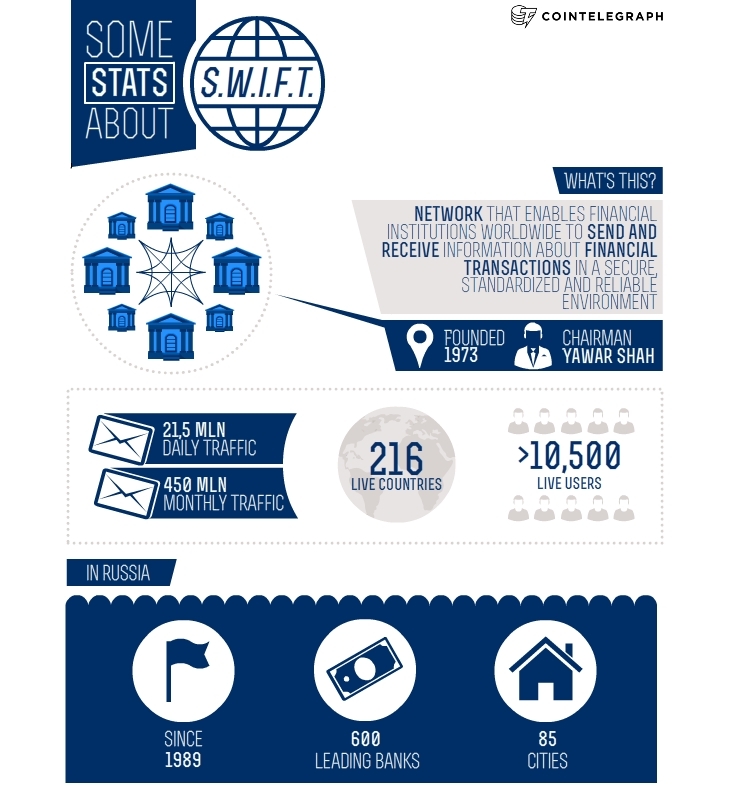

SWIFT, or Society for Worldwide Interbank Financial Telecommunication, is the system used for most of the international bank-to-bank payments, which occur every day. Russia has for the past six months been searching for an alternative, having highlighted a desire to move away from the existing USA-dominated system.

“Experts say that switching to an alternative transaction system may take at least a year,” RIA notes.

In terms of Bitcoin, Russia is perhaps one of the most hostile environments for use of the currency, with an outright ban still very much on the cards and little hope of digital currency technology becoming a loophole for financial flexibility should external measures come into place. It is unsurprising that the views among the Russian community are thus less than positive.

“I believe that Bitcoin is strongly overestimated, and now we are seeing not just a drop in Bitcoin, but a return to the real value. My prediction is US$250 for 1 Bitcoin in the short term, until the New Year for sure.” Cryptocurrencies Foundation Russia CEO Igor Chepkasov told Cointelegraph via email. “… If SWIFT listens and abides by the recommendations of the European Union, Russia, disconnected from SWIFT, will lose access to the interbank market. This means that Russia will be one big step closer to [becoming] a rogue state.”

Chepkasov however alluded to SWIFT’s dissatisfaction with the EU resolution, which it voiced in a statement on its website following its adoption.

“… The singling out of SWIFT … interferes disproportionately with SWIFT's fundamental right to conduct business and its right to property. It also constitutes discriminatory and unequal treatment,” it writes, adding that “[SWIFT’s] mission remains to be a global and neutral service provider to the financial industry.”

Irrespective of changes in this aspect of the financial climate, Bitcoin in Russia faces its own battles, and not those pitched by domestic banks.

Today, the Russian Security Council will meet together with President Vladimir Putin to discuss the issue of control of the Russia segment of the Internet.

“Officials of the Ministry of Communications will report to the President on the results of an exercise performed during July, the purpose of which was to test the stability of the Internet in Russia and prevent violations under unfriendly ‘concerted action,’” sources from the Russian telecommunications industry told local media publication Vedomosti.

The goal behind the exercise was to investigate the feasibility of performing the unimaginable; a total shutting off of Russia from the external Internet.

“Exercises conducted by the Ministry of Communications showed that [the Russian network] is vulnerable, and measures are now being discussed to minimize risks, including the ability to temporarily disable IP-addresses from the outside world,” a source further confirmed to Vedomosti.

While this idea perhaps sounds more like something from a science fiction novel, it is refreshing that even this worst-case scenario would still provide opportunity for digital currency to prove itself in the space.

With the rise of SMS transmission services, for example, having an Internet connection is already no longer a necessity for Bitcoin holders. It would seem that, regardless of the gravity of governmental measures, digital currency is a step ahead as a solution for financial liquidity.

Did you enjoy this article? You may also be interested in reading these ones: