Monero’s recent tenfold surge in price set off a firestorm of speculation. While some point to the Bitfinex hack possibly increasing demand for stolen Bitcoin to be converted into something less traceable, other indicators point to dark market integrations, especially from AlphaBay, as the catalyst for the price spike.

Cointelegraph reached out to Fran Strajnar, co-founder and CEO of data and research provider BraveNewCoin, for more concrete data to provide insights into the reason for Monero’s price spike. According to Strajnar, cryptocurrency is entering a new cycle of hype, and the market will reflect that:

“From what we've been seeing out of our data, we're entering a new hype cycle for crypto in general. Substantial amounts of new capital are entering the space. Total market capitalization across the Asset-Class is increasing. Investors are looking for 'the next big thing' and these various cryptocurrencies are prone to being quickly inflated on news and bullish sentiment."

What the data reveals

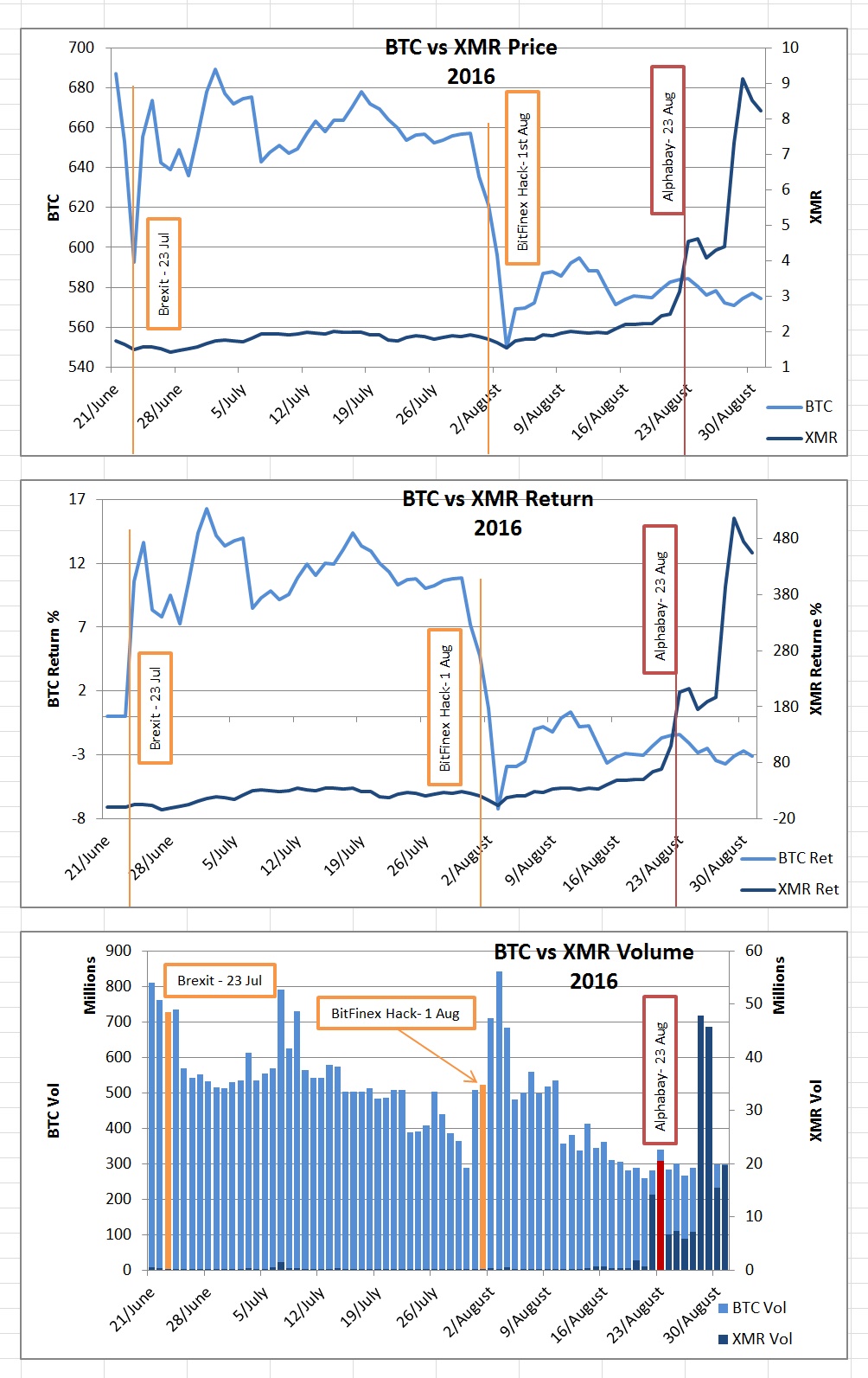

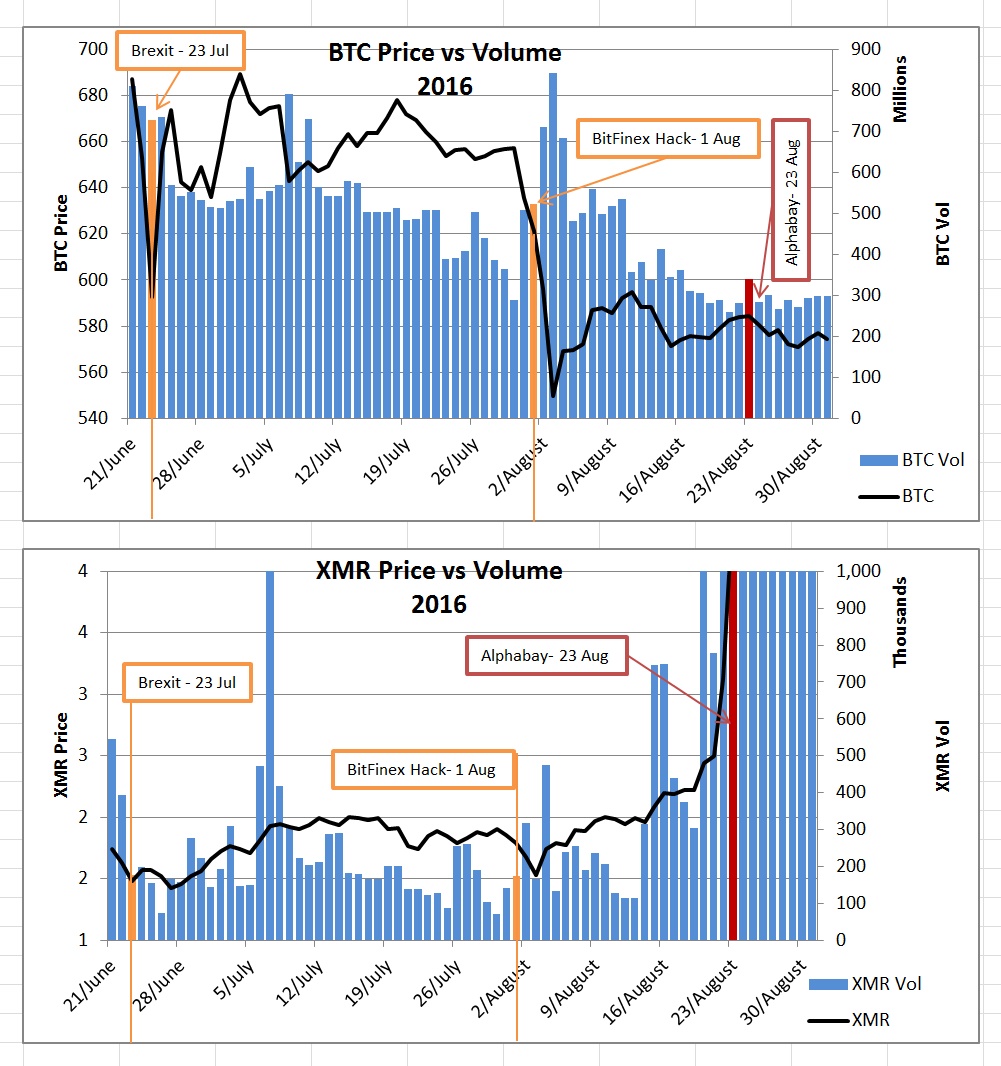

BraveNewCoin pulled data on both Bitcoin and Monero, correlating their relative price against three major events to the cryptocurrency world: Brexit, the Bitfinex hack, and AlphaBay’s XMR integration.

In terms of price, Bitcoin received a small dip right before Brexit, but the following “yes” vote caused the price to rebound. Immediately prior to the Bitfinex hack’s announcement, the price began to sharply decline, likely because of all trading over the exchange had stopped. Meanwhile, Monero’s price remained stable until the hack, at which point it began to rise slowly but steadily, gaining over 50% value. Then, the price shot up sharply immediately preceding, and then again after, the AlphaBay announcement. During this time, Bitcoin’s price remained relatively stable and unaffected.

Source: BraveNewCoin

As for Bitcoin’s volume, it remained relatively consistent with price, and then immediately prior to the hack it dropped off sharply, with the price following shortly afterwards. Immediately after the hack was announced, volume spiked before gradually tapering off. The AlphaBay announcement occurred during a noticeable increase in Bitcoin volume, possibly indicating darknet users liquidating their coins for Monero.

Source: BraveNewCoin

Altcoins get a lot more attention

Trends show Bitcoin was clearly affected, both with price and volume, by the Bitfinex hack. Monero’s price also seems to have been partially affected by the hack, though its increase during this time period is gradual enough that it could be simply an increased interest in a more private currency, or merely a coincidence that the hack’s aftermath lined up with XMR’s growth that had been set in motion prior.

According to Strajnar, the clear lessons to be derived from the hack are the typical increase in altcoin attention when something negative happens to Bitcoin, but especially that the AlphaBay integration set of Monero’s surge:

“We cannot clearly conclude that BFX hack coins went into Monero. But we can conclude that due to the sideways action of Bitcoin, altcoins received lots more attention. The news about AlphaBay was clearly the catalyst of the XMR volume and price rise."