Modest, Inc. is an interesting name for a company started by someone who proclaims himself to be “probably one of the coolest guys ever,” but the company is rising and worth keeping an eye on.

What makes the company interesting from a Bitcoin community perspective isn't that they accept Bitcoin, because they don't. It's that their founder, Harper Reed, tells me that he has been a bitcoin enthusiast since 2010, and he still thinks bitcoin isn't ready for the mainstream.

With more people using their phones for everything, mobile commerce is of growing importance. It doesn't take a genius to figure that out. If cryptocurrencies are going to be the wave of the future, they need to support the platforms of today and tomorrow.

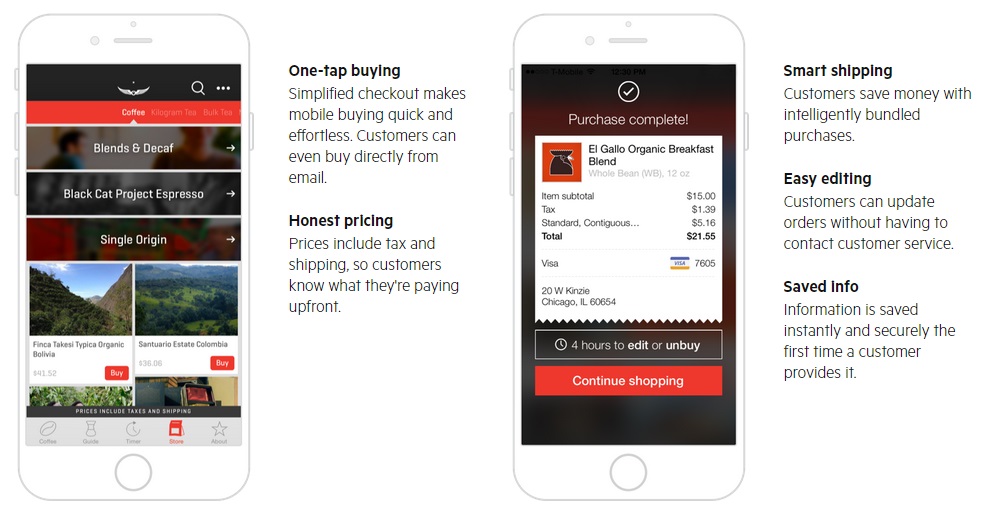

Modest is a payment processor focused on mobile apps. The idea is that you can simply drop a Modest store into your app (like an SDK, or software development kit) and with very little leg work, start selling your products through your mobile app.

Reed started work on Modest after leaving the Obama 2012 re-election campaign, where he was in charge of fundraising through social media. Before that, he worked at various startups, including Threadless, an early example of Internet crowdsourcing.

We talked about where Bitcoin is now, what it would take to get Modest on the Bitcoin bandwagon, and the state of crowdfunding online, inside and outside of Bitcoin.

There are a few points that I disagree with him on and a few perceived problems with Bitcoin that have been solved through third-party offerings, but this isn't meant to be a debate. Rather, my task here as a journalist is not to assert my opinion on the interviewee, but to get to the heart of what he is trying to say. If I believe he is lying or being dishonest in some way, asking tough questions would be a crucial function of the job, but the goal is never to win debate points for “our” side.

I will use this space to voice this opinion: We need to listen to what people like Harper Reed have to say.

Too often, we in the Bitcoin community are isolated from the rest of the tech world. It can be easy to forget what the rest of the world thinks about us. Reed and Modest aren't in banking. They aren't threatened by bitcoin. Modest itself is a product that, from my (and I suspect much of the community's) perspective, seems to be an ideal candidate for Bitcoin adoption.

We could find some excuse to explain why we think Modest is not taking bitcoin. We could blame Reed, question his “nerd credentials” and say he never really liked bitcoin. Then we could pat each other on the back, confident in the knowledge that we are the future and he is not.

Or, we could ask what is stopping him, we could listen to what people on the periphery of our community are saying about us and find out what problems, perceived or otherwise, prevent them from jumping in. This is what I tried to do with this interview.

Cointelegraph: You told me before that you guys are not accepting bitcoin, but that you are watching it closely. What are you looking for, and what would it take for you to utilize blockchain technology in some way?

Harper Reed: Well, I think for us, it has to be more than just a mechanism. There are a few things: In our business, we have to make sure transactions are very fast. After years of watching e-commerce and being involved with very high-transaction organizations, the point is to make it easy, fast and exactly as the customer expects. Thus far, I don't think Bitcoin is quite there yet.

Besides the fact it's not necessarily holding its value — and I'm not really worried about that — I'm more worried about the fact that when I think about my mom using Bitcoin as a payment method, it is very, very complex. The people that are consumers are not test people. They are normal retailers, normal customers, just normal people. What I really want to see is it working super well with those normal people.

I would love to see Bitcoin work, but I'm just not willing to sacrifice our user's experience to make it work for us.

CT: So would you say that complexity and transaction times are the two biggest concerns?

HR: Usability is the key, I think. Usability and transaction times.

CT: Bitcoin companies have mobile app payment APIs. What would you say to a mobile app developer trying to decide between one of those and Modest?

HR: Well, it's not so much that the question is “Modest or Bitcoin?” As much as it is the tool that helps facilitate the transaction, but we are pretty agnostic in how you pay. For an example, we have talked a lot about how we would enter into a country like India. In India, a lot of the transactions are done by a COD [cash on demand], where they come to your house and ask for money. Now, we don't care if that is how you want to pay. The key for us is that it is fast, easy and the customer gets what they want.

Bitcoin has its place in there. I think it is important to figure out how it fits in a way that is really solid. I think right now we could wrap a nice interface around it, but I don't think there would be a really good [way to do it]. The transaction times would make it confusing, I think.

That is really the thing. We are just waiting. It's not so much Modest or Bitcoin, or that Modest can't use bitcoin. We are just waiting and watching. I think you said it better than I could, that it doesn't use it now, but hopefully in the future, it could.

CT: Building on that, could a developer use Bitcoin in Modest, or have the two co-exist in the same app?

HR: Not yet, but hopefully sometime soon.

CT: Do you want to talk about the one-click email purchase feature Modest recently launched?

HR: What we have been thinking about a lot is how do we quickly and easily complete a transaction. One of the big pieces here is: how do we very quickly and easily put that stuff into an email?

This is what happens now: I send you an email with a product in it, and you are really stoked and you think, “yeah!” and you click the email. Then it goes to the product page and then you go through the same set of emotions and you still think, “Yeah, I do want this,” so you click buy and it goes to “Add to cart” and then you are getting less excited and you are getting more opportunities to fall out. You really just wanted it that first time.

We did a lot of work, looking at email and where email is supposed to be. What I mean by that is, 60% of people — or something around there — check email on their phone. There should be a big asterisk there because I forget the exact number. [Writer's note: 61% of email users check at least “some” of their emails on their phone as of 2013, according to Yesmail, via emailmonday.com, so Mr. Reed isn't far off.]

The key and the hard part here is, how do you make sure that same magic we have on our mobile app can exist in email? Because if our emails are being checked on our mobile phones, then we have the same problem but even more so.

We thought, “Why don't we put the transaction as close to the email as possible?” So, what we went ahead and did was put a buy button in the email, and it's basically the product page and you decide, “Yes, I do want to buy this product!” Then you hit buy and then it’s, “Okay, you have it, its done,” and that's it.

CT: Does the customer pay with credit cards, how does payment integrate into that?

HR: The best case is we know who you are. If you come to “Harpers Store” and we already know who you are, we already have the data. We already have your credit card, we already have your email address and your billing and shipping addresses.

If we don't know who you are, and this is where it kind of gets exciting, we will only ask for the information we need. Lets say you ordered something before but you didn't save your credit card. We will just ask for that information and use the other information we already have. It is all about making it very easy and very straight forward to get a user to give us that information. Then, the next time you check out, it is super, super fast.

If you think about this, this is a custom e-commerce experience for you and for one product. You can't buy other products, because what we have found with email is that people really just want the one product.

CT: You guys do have Apple Pay and PayPal listed as coming. Can you talk about the decision to add those and how that will work?

HR: Apple Pay is an interesting piece of technology. The thing about it is, and it’s pretty open about this, it is pro-consumer. So, if you're a company — let’s say Cointelegraph started accepting Apple Pay — you get less data than if it was a credit card, and more importantly, if you use Apple Pay at Home Depot and Home Depot gets hacked again, your credit card information won't be leaked. You aren't as susceptible to these hacks that seem to keep happening. Now, if Apple gets hacked, we are all screwed, but at least you are not distributing your credit card everywhere.

In Chicago, I have an iPhone, I take the bus and I can use my iPhone to use Apple Pay to pay for the bus. What that means is that the CTA [Chicago Transit Authority] doesn't actually have my credit card information. What they have is a token that allows them to charge my card. They basically have the same thing, but they don't actually own the number. This is incredibly progressive and really pro-consumer. Much safer and much better. When this came out — we are primarily iOS — we were pretty stoked about how this works. The thing is though, if you are using Modest and are not using Apple Pay, buying things takes one tap. If you are using Modest and are using Apple Pay, buying things take two taps.

So, we don't necessarily like it because it is simpler or easier, we like it because it is safer.

CT: How do you think that compares to Bitcoin, where there is no credit card. While you can get your bitcoin stolen or hacked from you, there isn't a central point of failure if you hold your own bitcoins. Do you want to talk about the difference in a decentralized system like Bitcoin and centralized systems like Apple Pay and PayPal, and which one is preferable for a company like Modest?

HR: I don't think we have an opinion on where or how, or if something is centralized. I think we have an opinion on consumer ease and safety. Like I mentioned, I am a huge bitcoin fan, playing around with the software and mining and all that stuff, since 2010. It has been fun to watch and fun to play with, but you don't see as many people losing all of their money because of credit cards, as you often as you see someone losing all their Bitcoin because they messed up storing their wallet.

I do not think Bitcoin is ready for mainstream. I don't think that is a judgment on how it is built. What happens if Coinbase gets hacked? It would be terrible for the community. What happens if the exchanges are hacked, which they all eventually are — it is terrible for the community.

Just read the darkmarket subreddit. All these people are freaking out because their various vendor of choice disappears, with their money, their bitcoin. They have no recourse for that.

A lot of pieces of our financial institutions were created to build up safe guards for the consumer. It is one thing to have a nice technology that is decentralized, somewhat anonymous in certain cases and allows money to be transacted without some laws and some rules, but then you also don't get the other rules that are pro-consumer.

One thing I really like watching is how people are using Bitcoin. Because it really is the future of payments. However, that doesn't mean that it works now. That's the problem. People keep trying to push it into, “well, why isn't it mainstream?” When I read r/bitcoin or hackernews about bitcoin there are a lot of people saying things like, “Well, this wouldn't happen if it was bitcoin.” It is like, “Yeah, that is true, that wouldn't happen, but if you bought something and it broke, you couldn't return it.”

So we need to solve the tech problem, which I think Bitcoin does in a good way. We also need to solve the consumer problem. We also have to solve the problem that no one I know who actually uses Bitcoin actually keeps it in Bitcoin. They change it to all these different kind of monies. Once it starts holding value, instead of going to sub-200 or where ever it is headed now, then I think things will start to be easier.

I actually think the coolest technology to come out of Bitcoin, which you can see by all the investments, is aggressively the blockchain. That is exactly the right thing, the fact that you can put things in there and its distributed and it’s a good tally of what is happening. I would love to see more financial institutions use that technology. But, I don't think we can do that, or I don't think it matters so much if that technology is good or bad — if I don't think the consumers themselves, the people actually using it, don't have any of the protection they would normally have.

Dude, I hate credit cards. I hate the whole system. It is not a great system. It could be so much better. But that doesn't mean we need to trade it for another slightly broken one.

CT: What was behind your switch from managing the social aspect of a political campaign to working on a mobile payments platform?

HR: Basically, we have always been doing [these kind of things] for years and years and years and the campaign was kind of the intermediary between those. I was the CTO of Threadless for many years, worked on my own stuff for a while, worked in venture capital a tiny, tiny bit. So for me, the vacation from startups was the campaign. It's not so much that I stopped working on the campaign, as much as it was that I [stopped working on startups and then] started to work on campaigns, so it's interesting to get it going again.

CT: You have a pretty unique perspective with political campaigns. Rand Paul recently became the first major U.S. political presidential candidate to accept Bitcoin for his campaign. Would you like to talk about that?

HR: I would be interested in seeing if he can legally do that.

CT: Yeah, the FEC (Federal Election Commission) ruled that it's okay last summer. There have already been a few state politicians who started accepting Bitcoin. Rand Paul is the first presidential candidate to accept it. It is already on his website.

HR: Well, it is a cool thing. I think it is an exciting thing. [Reed looks over Paul's website.] This is interesting. I think it will be interesting to see what happens. There are a lot of very weird rules about money and the campaigns. Specifically about the co-mingling of funds.

This goes back to, I think, one of the issues with Bitcoin. Bitcoin is becoming a method of payment, but not as a method of storing money. If Bitcoin just maintains as a method of payment, that is not losing, that is not a problem. If you just look at Rand Paul's website here, it is really straight forward. You can see that you can pay with credit card, you can pay with Bitcoin or you can pay with PayPal. They are all first class citizens here.

But it is pretty interesting. The thing about bitcoin is that we could theoretically figure out Rand Paul's Bitcoin wallet, and see how much money he has. That is probably a pretty big liability for campaigns. Even though they have to report it, they probably don't want everyone to know immediately how much money they have.

That is pretty awesome though. That is pretty cool. I like it, it is awesome. I have been waiting to see how it would work.

CT: Threadless was one of the earliest cases of crowdsourcing and crowdfunding. How do you feel about how that has evolved since then? And what do you think about the cryptocurrency ICO and IPOs that have turned out to be scams all too often?

HR: It would be neat to see how they can interact better with the blockchain, because it is pretty tricky. It is a hard thing to handle. Crowdsourcing is a pretty complex thing. It seems like it should be easy, but I think Bitcoin could really make it better. The problem is once again, that you need the consumers to get on it, or it really doesn't matter. The thing is, you are staking your business on that Bitcoin will work, and your business will work. It is hard enough to get your business to work.

CT: Is there anything else you want to say to our readers or the Bitcoin community?

HR: I left Threadless in 2009, and the first time I installed a bitcoin client was at Threadless. I've been playing around with this for quite a while. I think the thing that is missing, and the thing I really want to make sure everyone remembers, is that there are a lot of people who are not us. They don't care about Bitcoin. They don't want to worry about getting ripped off, they don't want to worry about having a cold backup of their wallet, they don't want to worry about all the things we have to go through to safely use bitcoin. We have to fix that problem. If we want this to succeed, we are the ones that have to make sure my mom can use Bitcoin without having to worry about “am I going to get screwed,” or whatever.

If there is one thing I want people to think about, it is: how do we make it easier? That is the important thing, because if we make it easier and people start using it, then every political campaign will start using it, every business will start using it and people will start being stoked by it.