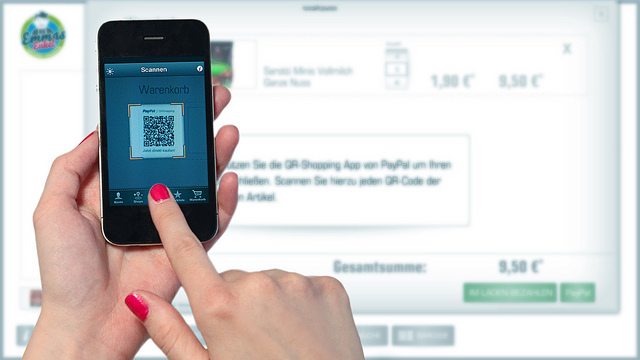

Five years ago, the notion of paying for items via your smartphone was seen as something of a novelty. Although brands such as eBay managed to integrate mobile payments into their apps many years ago, thanks to its ownership of the ever-popular PayPal, the practice is still somewhat new.

Where companies such as eBay blazed a trail, however, others languished in the distance, either too cautious or too under-equipped to make mobile payments a standard part of their service. Unsurprisingly, though, things have changed and they've changed in a big way. Thanks to improvements in technology and the push by Apple and Google to introduce their own native wallets, almost every major consumer-facing company now offers a secure mobile payment system.

Simple Payments on the Move

By pr_ip

Although some mobile users are still skeptical about making big money purchases via their smartphone (as they were with their computers a decade ago), many will now buy anything from used goods on eBay to flights across the world. Mobile purchases are now at an all-time high and this trend is predicted to continue over the next few years.

Estimates regarding the number of annual mobile payments vary between experts, but the majority agree that spend will increase by around US$300 billion. According to Statista, mobile spending in 2015 will hit US$431 billion globally, but by 2017 this figure will increase to more than US$720 billion. Naturally, for this happen, technology must continue to improve and users need to feel less "scared" about anteing up via their mobile.

One of the major turning points in the mobile payment industry could come courtesy of an agreement by credit card companies and Apple. With iOS 9 poised for general release, Apple has reportedly come under mounting pressure from credit card companies to drop its fees for the highly anticipated Apple Pay.

Bye-Bye, Credit Cards

For those who don't know, Apple Pay will essentially replace credit and debit cards in some situations by allowing users to make payments via their phone with a single swipe. By digitizing the magnetic strip found on the back of a credit or debit card, Apple Pay users will be able to make purchases at a range of outlets with a quick flash of their phone.

For this technology to really take off, however, Apple will need to remove the fees it charges for Apple Pay transactions. With news that Google Pay has already made this step, companies such as Visa and MasterCard are pushing for Apple to do the same in order to reduce costs and help the system proliferate.

By the time Google Pay had created its payment system, banks had already made their key card security free, which essentially blocked Google from being able to charge fees. Visa and MasterCard want a similar arrangement with Apple, which would allow the credit card companies to reduce their own fees to companies who use their system, and therefore also to the customer.

Although it's unlikely some of the major global brands will shy away from Apple Pay just because of a US$0.50 charge on transactions, it could deter small and medium businesses and, therefore, could stunt the growth of the product. However, if Apple agrees to scrap its charges, then this mobile payment method could explode in the coming months and soon replace the humble credit and debit cards.

While Apple continues to debate with financial groups behind the scenes, the world outside continues to move forward, and users are still making payments via their phones regardless. Indeed, a quick glance at some of the world's biggest consumer industries shows that many of the market leaders now have mobile payments as standard.

Mobile Payments in Action

As stated, eBay has long been a fan of mobile payments, but in recent years the company has been joined by a number of equally recognizable brands.

British Airways

By markyharky

Paying for flights using a mobile phone used to be a daunting task. However, with major airlines such as British Airways (BA) now offering a complete service for smartphone users, it's now becoming a common practice.

As it stands, users can purchase flights and extras using the BA app, as well as manage their bookings and boarding passes. According to recent reports, however, users will soon be able to use Apple Pay to jet off across the world. Although the new system will probably take a while to catch on (because making large purchases via a mobile is still viewed with some suspicion), it's highly likely that people will soon control every aspect of their journey (passport, ticket and payment) using nothing more than their mobile device.

Starbucks

Coffee lovers have long been able to download the Starbucks app, load up their account with credits and make purchases in store using their phone. In the coming months, however, a new mobile payment system is being rolled out. Dubbed "order and pay," the new system will allow iOS and Android users to place an order and pay for it ahead of time and then skip the line in store.

In the modern world, coffee has become as much a part of the daily routine as getting dressed or filling up your car with gas, so having the ability to streamline the payment process, courtesy of a mobile app, is fantastic because it basically means a few more precious minutes in bed.

Foldapp is another convenient application for users who prefer paying with bitcoins while getting a 20% discount.

PokerStars

By uzi978

The common theme running through all mobile payment products is speed, and there are few realms in which speed is more crucial than the online poker world. Having the ability to "ante-up in an instant," as the pros say, can often mean the difference between a profit and a loss in the poker world because you may miss out on a lucrative opportunity if you can't join the action when you want.

Fortunately, the leading online poker sites, such as PokerStars, have made it possible to control your bankroll from your mobile or tablet. When you download the PokerStars mobile app, you'll be able to use a fully integrated web cashier and make secure deposits using Visa, MasterCard, Skrill, etc., to play poker and more. In fact, the most impressive part of being able to "ante-up" on the move is that you can watch poker shows, manage your own poker games and learn new skills, as well as play poker, all via your mobile device.

McDonald's

By JeepersMedia

A burger war recently broke out in the mobile payment world, with Apple Pay and PayPal going head to head with two of the biggest players in the industry — McDonald's and Burger King. The result of the battle was that McDonald's mobile payment system will now be powered by Apple, and Burger King's by PayPal.

Essentially, the bottom line is that fast food junkies will now be able to pay for their favorite burger using nothing more than their phones. Of course, having a more efficient route to junk food might not be the greatest innovation for those with a penchant for the unhealthy. The fact you can now pay for your Big Mac or Whopper using your phone certainly adds a new dimension of mobility to the takeout industry.

Angry Birds, Heroes of Warcraft and More

By mseckington

Two of the original and still the most efficient mobile games such as Angry Birds and Heroes of Warcraft have made millions thanks to their mobile payment systems. Users are able to pay for upgrades and special in-game power boosts through Apple's app store payment system with a touch of their screen. Often seen as the benchmark for in-app purchases, these games continue to offer a slick way for users to pay for things via their phones.

As the world continues to shirk into the palms of our hands, mobile payment systems will continue to increase in both number and stature. With Apple and Google leading the way into a new, more efficient way of paying for things, it's clear that mobile spending will increase dramatically in the next five years and could easily move to the trillion dollar mark by the start of the next decade.