Expert Blog is new Cointelegraph series written by leaders in the crypto industry. It covers everything from Blockchain technology and cryptocurrencies to ICO regulation and investment analysis. If you want to become a guest author and get published on Cointelegraph, please send us an email at [email protected].

Introduction to “spreads”

The cryptocurrency markets are often volatile and suffer from periods of limited liquidity. Combined, they increase the risk profile for Blockchain asset investors.

But with increased risk, the potential for reward should increase as well. In this post we explore one method professional traders use to handle volatility and liquidity issues and explore ways to profit from these inefficiencies.

Introducing mean-reversion strategies

Volatility is driven by uncertainty. Some strategies, however, profit from volatility and even illiquidity. At the same time these strategies help mitigate market inefficiencies and should be rewarded for that.

Mean-reversion is the assumption that a stock's price will tend to move toward its average price over time. In other words, deviations from the average price could be exploited for profit, based on the knowledge that the price should tend to revert to the mean in time.

A simple implementation of this strategy is to quote both a sell and a buy price, like a market maker. If the market is in fact mean reverting, then the strategy profits from the difference between the buy and sell price. The difference is also called the quoted spread.

Mean-reversion strategies trade the market as if the market oscillates around a fair price for an asset. The swings are driven by the uncertainty of other market participants or illiquidity at different market levels. Mean-reversion strategies bridge the gap between buyers and sellers and can expect to generate a profit from that.

This strategy is most effective in markets that are both high in volatility and are mean reverting. Volatility measures the size of the market’s swings. With high volatility, market swings are large and the mean-reversion strategy has a high probability of generating a profit. In markets with low volatility only small spreads are possible and the strategy is less profitable.

The best market scenario for mean-reversion is a sideways market with large volatility or market swings. This market scenario is damaging for trend-following strategies but profitable for market making or mean-reversion strategies.

Simple example

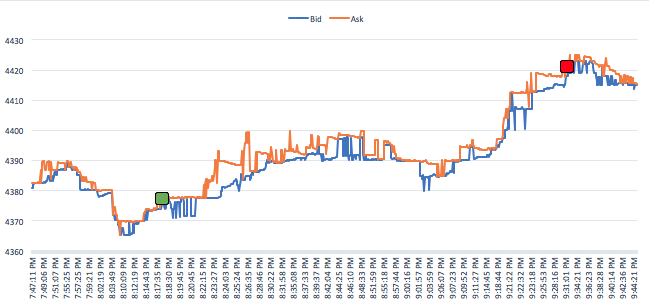

The figure below shows an example of a profitable trading day using a mean-reversion strategy. At the beginning of the day, both buy and sell orders are placed in the market. The day develops and volatility drives a random walk of the price.

Throughout the day, the strategy buys one Bitcoin at $4377.70. At some point later during the day, you sell this Bitcoin at $4421.48 and generate a profit of 1%. From this profit, fees have to be added or deducted. Some exchanges charge as little as 2.5 basis points for providing liquidity using such passive strategies.

Source: Kraken, 02/10/17, Buy: $4377.70, Sell: $4421.48

Implementing mean-reversion?

As we have already learned, mean-reversion strategies capitalize on the spread between buy and sell prices. These are usually placed around a mid price. The mid price incorporates all assumptions about the true price. For example, if the market exhibits large trends, these would be considered to adjust the mid price.

In general, buy and sell orders are determined by

Buy/Sell = Mid Price +/- Spread

The spread is determined largely by the market’s volatility and the skew of the its returns. The skew is determined by the probability of up or down moves of the market. Such moves are usually not equally probable and therefore the spread is adjusted.

The volatility determines the size of the spread. With a high volatility, buy and sell orders are executed with a higher probability because the market shows larger price swings. On the other hand, if the volatility is small, the buy and sell might not be hit and the strategy keeps a long or short position, i.e. either ends up holding the underlying asset or holding cash and being short the asset.

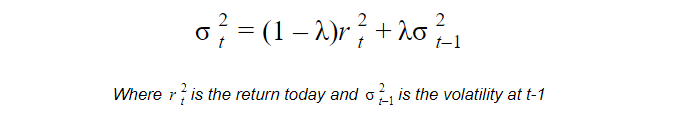

To measure the volatility σ of cryptocurrency markets, usually an exponential weighted moving average (EWMA) is applied with:

The recursion is usually initiated with the variance over the first 10 days. λ determines the half-life of the EWMA system. The half-life is the time required for the system to forget half of its former value. With daily data, the half-life is usually set to 10 days and therefore λ set to 0.93.

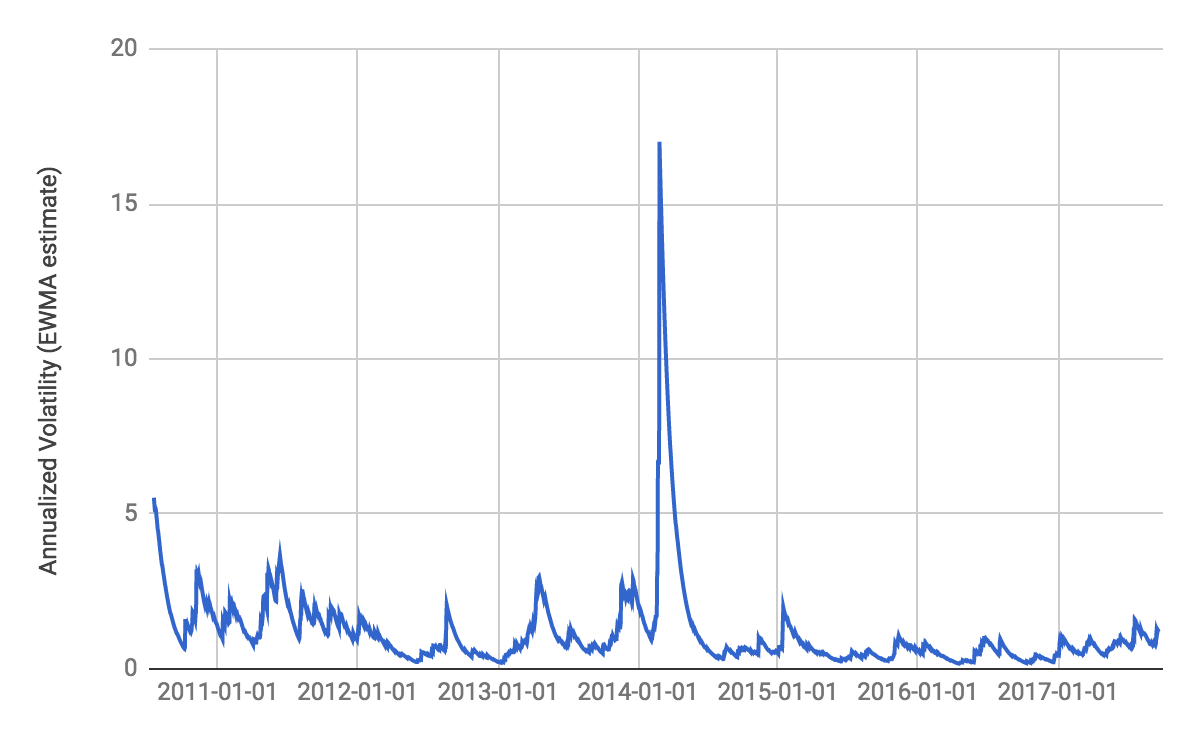

The figure below shows the annualized volatility for Bitcoin prices as estimated by the EWMA model. Bitcoin is fluctuating around an annualized volatility of 116%.

Strategy’s performance

To test the mean-reversion strategy we explored to quote buy and sell prices every day since the inception of Bitcoin through the end of September 2017.. All data is taken from Cryptocompare. Given a 116% average volatility, we chose the quoted spread as 1% between buy and sell prices. If returns would be normally distributed this spread would be hit with a probability of 99.6% over, for example, 10 days.

Of course, Bitcoin returns do not follow a normal distribution. So what is the likelihood that a trader could both buy and sell Bitcoin over the course of 10 days and earn 1% each day?

Based on our data, this strategy would have been successful in 2297 out of 2615 days, or 87.84% of the time.

For this backtest, we calculated the buy and sell orders on +/- 0.5% of the last closing price and compared this price with the highs and lows over the course of the next 10 days. Of course, this strategy would result in some large long or short positions in Bitcoin. In fact, for 189 of the days, the strategy would have sold Bitcoin, but not bought. And for 129 of the days, the strategy bought Bitcoin, but did not sell it. The main reason for this is the large upward trend in Bitcoin prices.

To account for the trend in Bitcoin prices, we use the moving average return as an estimate and arbitrarily chose the look-back as 60 days, based on a previously published strategy. We also tested other look-back periods which produced similar results, and the look-back of 60 days is in the range of general trend-following strategies.

Adding the moving average to shift the spread increases the number of days the mean-reversion strategies buys Bitcoins and reduces the number of days that it only sells Bitcoins. Therefore the strategy ends up with a long position in Bitcoin rather than a short position.

In total, this strategy would have made 1% profit on 2288 days out of 2615. On 327 days, the strategy either only sold Bitcoin or only bought Bitcoin. Adjusting the mid-price for trend resulted in more days that the strategy only bought Bitcoin and therefore accumulated Bitcoin over time. As an additional rule, the strategy could sell the additional Bitcoin at the end of each month or even keep them as a market position.

A trader can improve this strategy by considering the volatility estimate and adjusting the spread. With higher volatility estimates, the strategy would aim to profit from a larger spread and vice versa.

Other models use more sophisticated supervised learning algorithms to predict market movements. While some search for trading signals in order books, others use market news as an input to make directional predictions (Li et al., 2014; Kanagal et al., 2017).

When trading a mean-reversion strategy, the liquidity of the market has to be considered. Here we did not consider any limitations to the ability to trade at the quoted prices. Obviously, that is not always the case and largely depends on the deployed capital.

Broader market benefits

Trading a mean-reversion strategy also plays a crucial role to establish efficient market mechanisms. While efficiency has already improved dramatically over the recent years, cryptocurrency markets still face fundamental issues that are typical for any new market.

Illiquidity, matching inefficiencies and unstable spreads are frequent symptoms that can be observed across all currently available exchanges. Mean-reversion strategies provide additional liquidity to the market and therefore resolve these frictions. They bridge the liquidity gap, for which they get paid.

Market making strategies extend mean-reversion strategies, in that they trade on the spread many times a day with relatively large volumes on both sides of the trade. Market making strategies provide the liquidity that is essential for any well-functioning financial system. Abrupt spikes of demand or supply, like when traders either buy or sell large volumes, are absorbed by market makers.

Any successful Bitcoin buy order requires a seller who is willing to take the opposite side and sell the particular volume of coins to the quoted price. The exchange (broker) matches both parties to make the trade happen.

This frequently leads to order delays and varying fulfilment prices, at the cost of traders. By placing orders at each side of the trade, market makers have the capacity to make more trades happen and thereby eliminate fulfillment delays. Bitcoin markets still observe very unstable spreads, which are absorbed by the market makers.

By fixing bid and ask prices for other traders, market makers profit from keeping spreads low and stable. The more liquidity they provide, the narrower and more stable the spread becomes.

Conclusion

Mean-reversion strategies are very profitable in high volatility markets and can be adjusted for trends. This strategy can be easily applied to Bitcoin trading and improve the performance of a buy-and-hold strategy. The mean-reversion strategy would post buy and sell quotes around the current market level and earn the spread.

Since the strategy is independent of the market level, it can add an independent performance to a buy-and-hold strategy. As an example, the strategy could use 1% of the portfolio assets and then aim to earn an additional 1% per day on this part of the portfolio. Historically, this strategy would have added 24% per year to the portfolio performance.

Mean-reversion strategies are providing liquidity to the market. On the other hand, these strategies might end up long or short the asset, if the market does not revert to the mean. In that case they are taking a market position. On the other hand, providing liquidity should earn these strategies a potential profit that rewards the trader for his risk. Market making strategies extend mean-reversion strategies by quoting bid-ask spreads more frequently.

Thanks to Bosse Rothe for his valuable contribution to this article.

Dr. Philipp Kallerhoff is a Founder at Protos Cryptocurrency Asset Management. He is a senior portfolio manager and quantitative analyst in the fintech and hedge fund industry. Philipp holds a PhD in Computational Neuroscience and is a Singularity University Alumni.