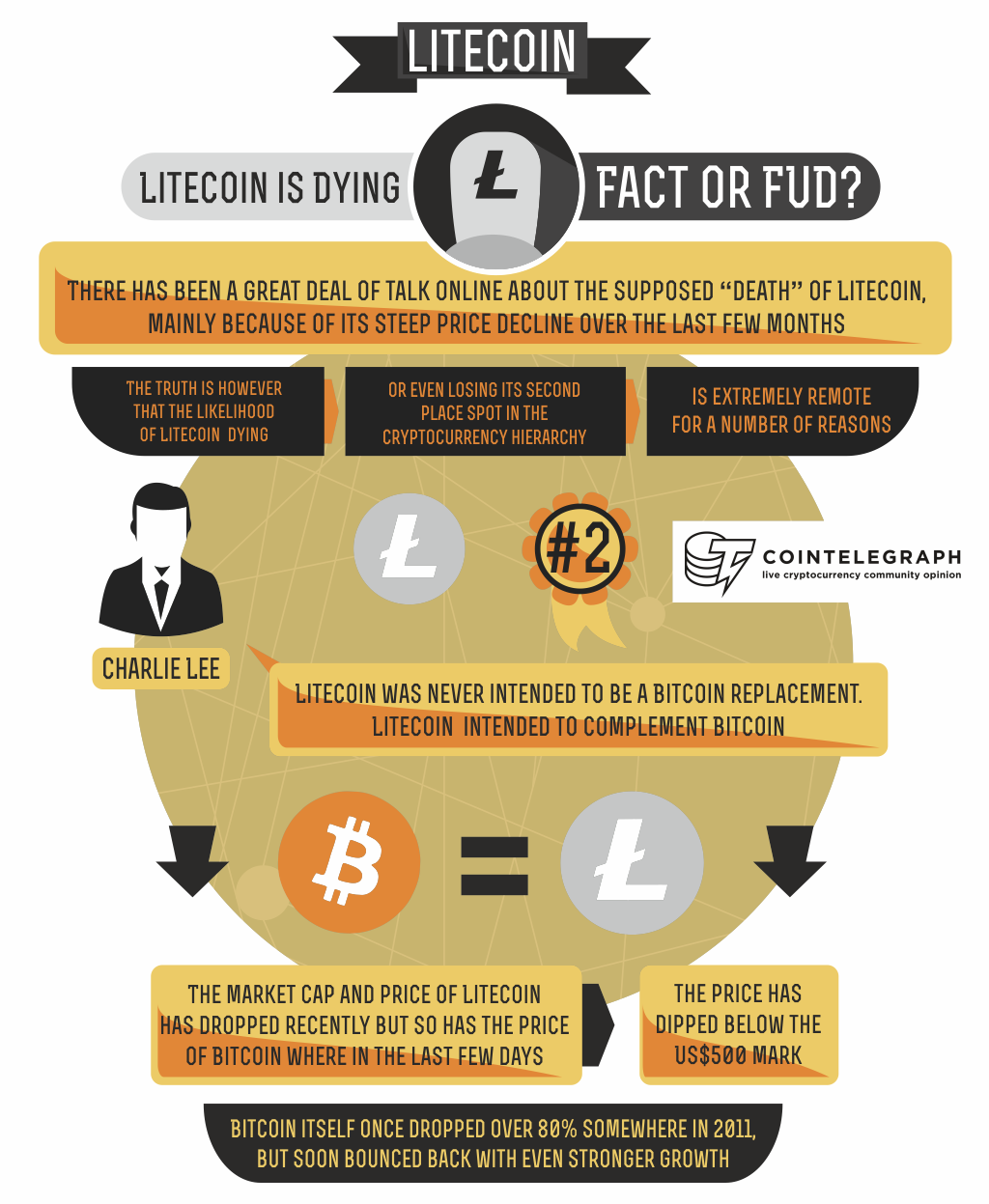

There has been a great deal of talk online about the supposed “death” of Litecoin, mainly because of its steep price decline over the last few months.

Is Litecoin Dying?

The truth is however that the likelihood of Litecoin “dying,” or even losing its second place spot in the cryptocurrency hierarchy, is extremely remote for a number of reasons. There are also indications that the rumors were actually begun by fans of other coins, not from the Litecoin community itself.

The problem seems to be a general misunderstanding in the Cryptocoin community about finance in general and Litecoin in particular. Litecoin creator Charlie Lee was recently interviewed by Money and Tech at the Coin Congress and his description of not only Litecoin but the currently perceived mining issues will easily calm most investors’ fears of a Litecoin collapse.

Lee explains that Litecoin was never intended to be a Bitcoin replacement. Instead he intended Litecoin to complement Bitcoin in the same way that silver complements gold. Gold is generally used for capital investments of large amounts while silver is used for smaller investments. Lee foresees a future where consumers use currencies like Bitcoin for major purposes, like automobiles, houses, even businesses, and smaller, faster coins such as Litecoin for smaller, everyday purchases such as lunch or coffee at Starbucks.

The Mining Problem

The mining problem however is a different issue. The number of Litecoins to be produced is higher than the number of Bitcoins which means that profit for miners is lower for each block. When mining first began Bitcoin miners were using GPUs and a Litecoin miner could make a profit using a CPU.

The problem is that ASIC mining equipment designed specifically for Litecoin is not nearly as powerful. A top of the line Bitcoin miner for instance can offer 2TH/s while most Litecoin miners seldom exceed a GH/s. The transaction time for Litecoin is much lower as well, 2.5 seconds to Bitcoins 10 seconds.

The Litecoin community does not seem too concerned with the rumors and some have even banded together to repel the rumors surrounding Litecoin. The Bitcoin community has even been accused by one commenter directly of spreading these FUD rumors to cause tension in the Litecoin community. One user remarked:

“It’s so interesting, that every time there’s a big price move (up or down) the readership of this sub increases 3-4x its normal amount…and half of them are the “peanut gallery” coming from the Bitcoin sub or other altcoins with one tenth of Litecoin’s capitalization and daily trade volume, declaring it dead.” -FreeJack2k2

Other Issues

The market cap and price of Litecoin has dropped recently but so has the price of Bitcoin where in the last few days, the price has dipped below the US$500 mark. There are no speculations that Bitcoin might be going belly up on any of the forums, however. Litecoins success or failure will not depend on the success or failure of Bitcoin anymore than the price of silver depends on the price of gold. They have their similarities but there are also vast differences as well and these differences are what define a particular coin.

Lee further asks people to consider Litecoin as an alternative to painfully slow Bitcoin and the highly-speculative range of altcoins, while leaving its market cap and prices aside. He, and many other Litecoiners, believes that their coin is the only one entity that has come close to challenging Bitcoin in terms of speed, daily volumes, and economics. They further criticize the army of speculative, feature-rich coins for being useless and pointless to the average Joe. Litecoin, as per them, tries to stay from being speculative and is largely focusing on merchant adoption. User FreeJack2k2 also stated:

“Even though the mining imbalance due to ASICs has had a negative influence on price, that is not going to last. The protocol is secure. Litecoin has had almost no issues. It is so strong that any other Scrypt alt that wants to survive has to [merge] mine with it, or switch algorithms.”

Indeed, this mine-merger has already occurred with Dogecoin. However, it is the miners that can make or break a cryptocurrency. With the very core of Litecoin being unsatisfied with its income, there is a huge chance that most of them will prefer a move to other profitable coins. Some moral boosting posts might stop them for a while, but eventually what they are waiting for is good returns from their investments in expensive ASICs. One cannot ignore the ongoing dumping in the Litecoin market, which can have a negative effect on the entire Litecoin community.

But still, there is not a single coin out there which hasn’t seen this phase of disillusionment. Bitcoin itself once dropped over 80% somewhere in 2011, but soon bounced back with even stronger growth. Litecoin still has the benefit for being the second biggest cryptocurrency in the world. All they need to focus on is their miners for now.

Expert commentary

Cointelegraph asked the community what they thought about the prospects of Litecoin and whether or not it is on its last legs.

Brian Fabian Crain (founder of the Bitcoin Startups Berlin group):

“Yes, I do think Litecoin has no future. The Scrypt-PoW doesn't seem to be better than Bitcoin's PoW in preventing centralization. And the big advantages of Bitcoin are the network effects. More users [and] infrastructure make it way more useful. I don't really see any scenario in which Litecoin can overcome that advantage.”

Jeffrey Smith (CIO of CEX.IO and GHash.IO):

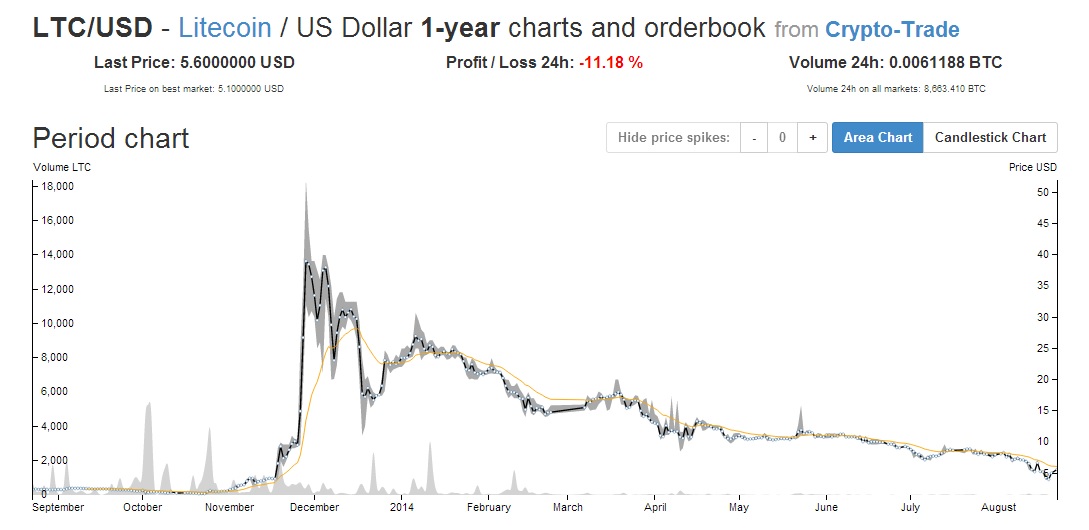

“Litecoin's value has plummeted from 45 USD to 5 USD due to the fact that Litecoin's mining methods have shifted from graphic card mining by Litecoin enthusiasts - to industrial mining by profit oriented people, who only care about their return of investments, hence, Litecoin enthusiasts have lost interest in this cryptocurrency. The same thing happened to Bitcoin, when the switch was made, but in the Bitcoin situation - industrial miners also actively participated in developing the Bitcoin business infrastructure, which enhanced Bitcoin. Litecoin can either survive, by expanding its infrastructure as well, or it will die, without people having any purpose to use it.”

Joakim Herlin (CMO, Goobit/BTCX):

“I think that the pro’s of Litecoin over Bitcoin is not big enough to make it a serious contender and give Litecoin serious longevity. Bitcoin is quickly about to build up such a momentum that for something to beat it in its own game would have to offer some very big advantages to it. Not that this ‘something’ necessarily has to ‘beat’ Bitcoin in order to make itself relevant, but to ‘be a cryptocurrency that has some advantage over Bitcoin,’ as I have understood it, is how Litecoin is positioned.

“Altcoins as a phenomenon though, I think, definitely has a future but an altcoin needs to offer something special, like a connection to a geographical location or it could be a connection to a certain product or product segment. Different subcultures even could maybe start to use their own altcoin within their group. There are lots of possibilities. But the bottom line is that for any altcoin to be successful I think it will need to offer something special distinguishing itself in some way, technically or otherwise.

“Concerning Litecoin specifically, I do not think it possesses enough of a unique value proposition to stay with us in the long run.”

Did you enjoy this article? You may also be interested in reading these ones: