Spoiler alert: You can’t predict Bitcoin’s price.

The best any of us can do is rely on mathematical models to give us confidence in our own educated guesses as to whether the exchange value of a Bitcoin will go up or down tomorrow. Anyone who tells you any differently has a wagon full of snake oil to sell.

“Predicting the future price of any asset is a very difficult undertaking,” cryptocurrency researcher Fernando Ulrich told Cointelegraph. “Even more so for a totally new and unprecedented asset like cryptocurrencies in general, and Bitcoin in particular.”

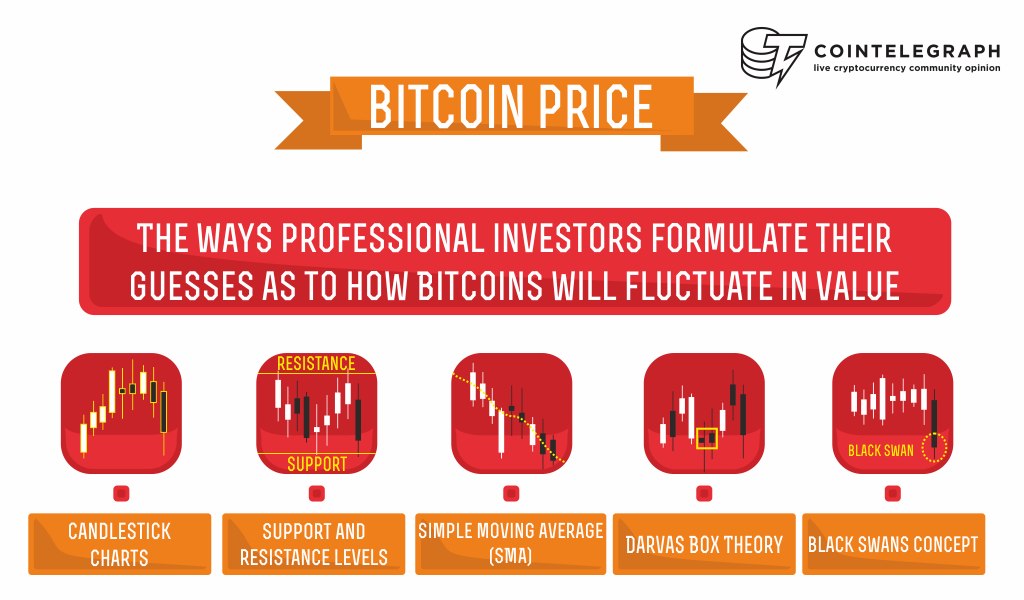

With that caveat out of the way, it might be useful to have a look at the ways professional investors formulate their educated guesses as to how Bitcoins will fluctuate in value.

First, let’s look at a definition of terms, as suggested to us by investor Jose Rodriguez. The following links all point to Investopedia:

- For anyone who has never traded forex before, get familiar with candlestick charts, which display the opening, closing, high and low prices for a security on a given day.

- Then, get comfortable with the ideas of support and resistance.

- Next, understand SMA, or simple moving average, which is just the sum of its closing prices for a period of x days, divided by that same number of x days.

- Rodriguez also suggested investors learn about the Darvas Box Theory.

- Finally, I also suggest investors understand what a black swans are, because Bitcoin’s exchange rate is particularly susceptible to them.

Use the concepts above to support your technical analysis of Bitcoin’s historical prices. There are plenty of other values to take into consideration, but these will at least get you started.

What Affects Bitcoin’s Price

“News and rumors which I think will benefit or harm Bitcoin, bringing up or down the price,” are what Rodriguez suggested investors watch.

“One of the most important ones, which convinced me to start investing into Bitcoin, was the venture capital investors, institutional investors, hedge funds that were investing and developing the ecosystem.”

Ulrich said that demand for Bitcoin is unlikely to decline in the near future, and that is by design.

“From a supply perspective, the quantity of gold and Bitcoin is constrained by the laws of nature and math, but fiat currencies’ issuance is dictated by central bankers’ whims — fiat money will be inflated, sooner or later.

“At least from a supply standpoint, we know how Bitcoin will behave in the future — its issuance is given. The great forecasting exercise lies in understanding how the future demand for Bitcoins will play out.”

Ulrich pointed to news that companies such as Newegg had begun accepting Bitcoin payments and institutional investors such as Temasek were experimenting with the currency as evidence that the demand was growing.

With that said, he was careful not to attach a number to his forecast.

“But I refrain from targeting any precise figure for its price, as it would be plain wild guessing.”

And, that, in a nutshell is why investors warn newcomers to never put in more money than they are willing to lose. Investing in Bitcoins is still a gamble, no matter how confident you are in the currency’s future.