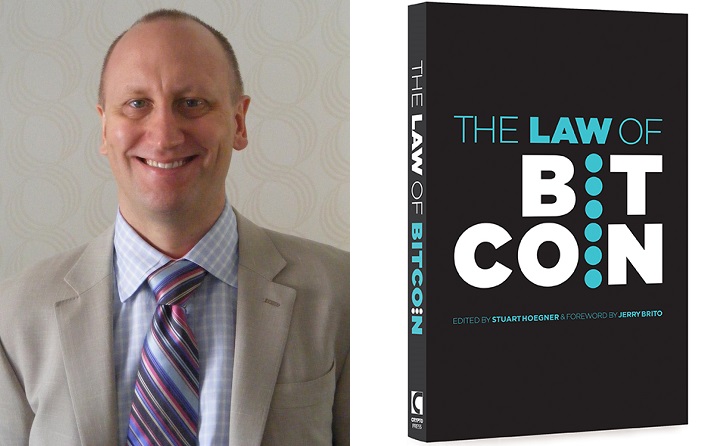

Cointelegraph spoke with Stuart Hoegner, the editor of the book titled “The Law Of Bitcoin” on his experience in being part of the team behind the project as well as his opinion on bitcoin regulation around the globe.

The Law Of Bitcoin is a book published in June that provides legal guidance on Bitcoin issues in four countries; Canada, Germany, United Kingdom and the United States.

Cointelegraph: In The Law Of Bitcoin you explore the legal status of Bitcoin in Canada, Germany, United Kingdom and the United States. How did you arrive at this list of countries?

Stuart Hoegner: We wanted to delve into the details in each jurisdiction we covered. There are many resources out there that cover more countries, but in a cursory manner. Our project strives to cover fewer countries but in greater depth. We sought to include a non-common law jurisdiction (Germany), as well. We wanted truly expert and informed commentary. We had other countries on our list and could have included more, but we were only happy with the level of expertise that we had in these four, to start with.

CT: The title of your book implies that it is a legal guide on Bitcoin and cryptocurrency. Why was it important to explain the technology in the first chapter?

SH: This was our strategy for two critical reasons. First, this is still a new technology, especially to many members of the legal profession. To have a resource that's effective for lawyers and others working in the space, we absolutely had to try to describe the technology first. Second, we didn't want authors – and readers – to have to waste their time revisiting the intricacies of Bitcoin technology over successive chapters. So the introductory chapter describing the technology was imperative.

“Law should always be the handmaiden to innovation. Innovation is like toothpaste: it can’t be put back in the tube.”

CT: The Law Of Bitcoin is a combined effort by several individuals. Whose idea was it to write the book and what challenges did you face in coordinating the project?

SH: It very much was a team effort. About two years ago, I had a vision of a book that leveraged different lawyers’ and academics’ expertise. At the same time, I started speaking with people who shared that vision, including Ryan Straus, Jillian Friedman, Paul Anning, and others. Together we started working on a strategy to make the project happen.

The biggest challenge seemed like finding enough time for our authors to write. All of them are very busy with careers and full schedules, and they deserve a lot of credit for taking the time away from their lives to bring this to completion.

CT: Part of the book’s foreword reads: “The law of Bitcoin is not only fast emerging, but in many ways already exists. It is only a matter of looking at precedent and statutes and applying them to the novel circumstances the new technology makes possible.” Who do you believe is to blame for the misconception that Bitcoin has been completely unregulated?

SH: I think there may be a natural tendency to say that something that may not fit squarely into an existing paradigm or is new or disruptive is "unregulated," but that word means different things to different people and in different contexts. The solution to a lack of clarity is to get back to the facts and an honest description of the technology, and then to prompt debate on its implications and meaning.

CT: What role do you think the Bitcoin community in different jurisdictions should play to influence positive legal interpretation and legislation on cryptocurrency?

SH: The international Bitcoin community – and national communities –can play a key role. Direct political action is always an option, although it’s still perhaps not a “big enough” issue for candidates for public office to pay attention. What might be more helpful is continuing engagement with the larger public, especially with skeptics. That provides education and community growth.

CT: In your research for the book, what picture did you get on bitcoin’s adoption hinging on positive regulation? Is regulation critical or innovation will have its way at the end of the day?

SH: Law should always be the handmaiden to innovation. Innovation is like toothpaste: it can’t be put back in the tube. Cryptocurrency is just one of the examples that are all around us: think about lending platforms, Kickstarter, disruptors like Uber, Airbnb, etc. What’s important is to have an honest discussion about the meaning – and, especially, the possibilities – of innovation, and to try to grapple with forms of sensible, proper regulation around that.

CT: It is now almost three months since The Law Of Bitcoin was published. What has been the reception so far?

SH: We have had some refreshing and welcome interest from several quarters. Many law libraries and firms are keen to have the book in their collections. Professionals and entrepreneurs in the Bitcoin space – very knowledgeable in their own right – have praised it and described it as a great value, which is exactly what we wanted. Our objective was to produce a highly useful, deeply analytical, and unsparing volume on what we know about the intersection of law and cryptocurrencies.

“[…] many regulators have reacted very positively and rationally to the spread of blockchain technology.”

CT: In your opinion, what main challenges do public institutions, at least those located in the countries you cover in the book, face in regulating cryptocurrency?

SH: Knowledge of the technology, not overreaching, and taking seriously the law of unintended consequences. I think our book demonstrates that many regulators have reacted very positively and rationally to the spread of blockchain technology.

“We remain optimistic that many regulators are trying to understand the technology first and act second.”

CT: How does the regulators' lack of knowledge on cryptocurrency affect the legal interpretation of existing laws and future legislation?

SH: It makes for bad law. How can one apply legal principles to technology that’s not fully understood? Thankfully, we remain optimistic that many regulators are trying to understand the technology first and act second.

CT: Are other blockchain applications being overshadowed by Bitcoin as a currency in legal interpretation and legislations around the world?

SH: To a certain extent, yes. In fact, that’s partly why the book is called “The Law of Bitcoin,” when it’s about more than just Bitcoin (the protocol) or bitcoin (the cryptocurrency). Bitcoin has come to be a bit of shorthand to refer to other cryptocurrencies and decentralized ledger technology in general. And that’s okay, so long as we understand that we’re using “Bitcoin” in such a broad way and we’re clear on the details with policy makers and the public.

CT: Are you planning to publish a follow-up book on the same or related subject?

SH: We’re still gauging reaction to the first edition, but if there’s sufficient interest and we can expand the reach of the book and what’s covered, there’s considerable interest in putting together a second edition. There are certainly enough ongoing legal developments to make it worthwhile.