The first Blockchain system-Bitcoin-saw astronomical returns of over 1,300 percent in 2017. As we progressed through 2017, Blockchain technologies became hard to ignore and more of the corporate world took an interest in Blockchain technologies. In 2017, the NYSE filed for two Bitcoin ETFs with the SEC, the CBOE became the first institutional investor to launch a Bitcoin futures market and CME group followed suit a week later doing the same. But it is not only large exchanges interested in getting some skin in the Blockchain game, a multitude of industries have been interested in incorporating Blockchain technologies to make their businesses more economically efficient.

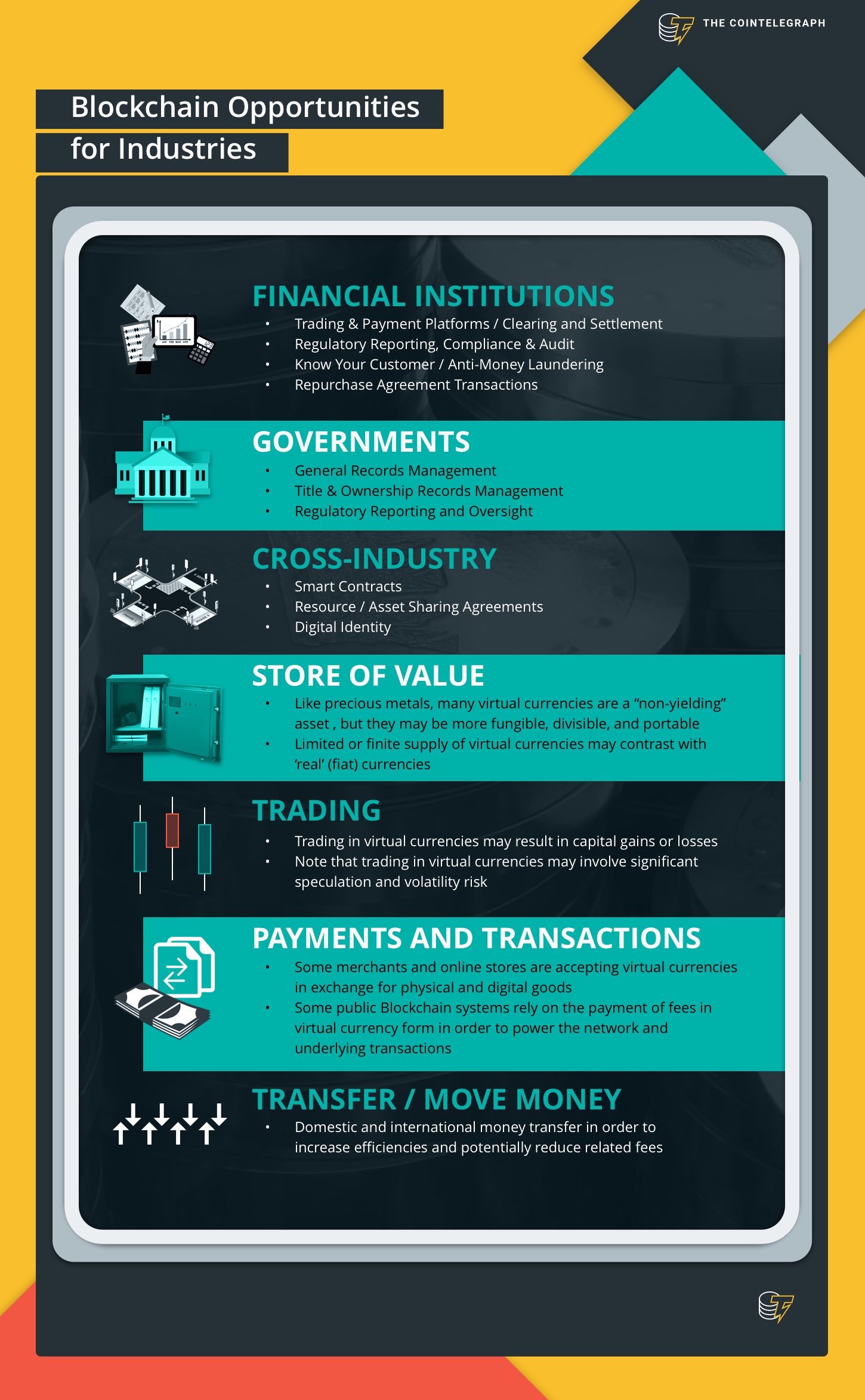

The increasing interest around Blockchain technologies in 2017 led the CTFC to release a Primer on Virtual Currencies which acknowledged that Blockchain technologies can be used by governments, financial institutions and cross-industries to optimize everyday operations via a Blockchain system.

Use cases

Blockchain technologies can be used as a store of value, in trading and payment transactions, and to transfer and move money either domestically or international at a faster speed and a lower cost than the traditional financial institution or intermediary is able to--just to name a few use cases.

Blockchain technologies have been revered for their cost-cutting, security enhancing, speed enhancing capabilities. A Blockchain system is a distributed ledger secured by a cryptographic proof of work/stake. Viz, powerful computers crack algorithms that encrypt the transaction data into each block. When a computer is able to crack the algorithm, a block full of relatively recent transactions is added to the chain, a copy of the updated ledger that has the new block is broadcasted to the other nodes--any computer connected to the network--and the nodes update themselves on the networks transaction history. If an updated ledger is broadcasted that a majority of the nodes on the network are not in consensus with, then a node will not update to retain that copy of the ledger because it is not a truthful and honest representation of the transaction data.

Record keeping

The cryptographically secured Blockchain and the system of node consensus is believed to produce a more accurate copy of the ledger than the current system of centralized record keeping is capable of.

In Blockchain: An Emerging Solution for Fraud Prevention Jun Dai, a computer scientist at California State University Sacramento argues that “altering or deleting information in the companies accounting systems, changing electronic documents, and creating fraudulent electronic files were the main methods to conceal frauds.”

In industries like accounting where human workers handle and manage tasks such as verifying records and confirming the truthfulness of transactions, it is possible that human error or individuals with ill incentives manipulate records or create fraudulent records that are not an accurate representation of transaction history.

That is why record-keeping industries like the accounting industry have been attracted to Blockchain technologies; the Blockchain network is secured by cryptography and verified by a network of computers--not human workers. Because of this, Blockchain technologies allow a nearly tamper-proof record to be created and allows individuals to transact peer to peer without having to put their trust in a third party to honestly facilitate their transactions.

Blockchain technologies allow business operations to take place without the use of a middleman--something that was not feasible before the invention of Blockchain technologies unless individuals transacted in cash; but even cash is becoming inefficient to manage and transact with. It is unnecessarily costly to operate a business, financial institution, or financial intermediary where human workers are doing jobs that computers are capable of handling faster, more efficiently, and with less error than human workers.

When human workers carry out operational tasks for business, the business must pay costs associated with owning or renting infrastructure, electric, gas, and the water expense concurrent with operating infrastructure, employees salaries, paper for printers, etc. If intermediaries were able to invest or save the money that they have to put towards operating or paying for a service that can be automated by computers, it is possible for a business to become more economically efficient.

A system secured by cryptography that only needs to connect to the Blockchain network to operate can effectively diminish some of the costs associated with running a business. Blockchain technologies are capable of reducing the amount of human workers needed, reducing salary costs, eliminating the need for a business to own/rent and operate infrastructure, and making the record of data kept by the business less susceptible to fraud and manipulation.

But the Blockchain does not only allow businesses to operate over a more efficient, economical, and secure system; in 2017 we began to see Blockchain technologies change the way that businesses raise capital.

Capital raising

An ICO-- Initial Coin Offering-- is a method of crowdfunding a business can use to raise capital by selling the right of ownership or royalties to a project to investors. ICOs are often likened to IPOs--Initial Public Offerings--in which businesses raise capital by selling shares of ownership in the company to investors. However, it is far easier for a company to launch an ICO than an IPO. This makes ICO an attractive option for start-ups looking to get off the ground, and gives Blockchain technology the ability to change the process of raising capital.

To launch an ICO, all a company needs to do is bring the project to a respectable technological checkpoint, publish a white-paper, and announce the date they plan on holding their token sale. No underwriting or government approval needed, compared to an IPO, in which an investment bank underwrites a business, then files with the SEC and then has to wait for the SEC to evaluate their business before the SEC finally announce an IPO date for the company.

Digital revolution, age of the Internet

Similar to the idea that offices had of going paperless to become more efficient, cut costs and enter the future by aligning themselves with the digital revolution, businesses and governments have their eye on Blockchain technologies because they seem to be leading the corporate world into the digitized future.

The economical efficiency, increased transaction speed and cryptographically secure features of Blockchain technology make Blockchain technology an attractive upgrade for businesses who incur a hefty operating cost from processes that an automated machine can handle more efficiently.

2017 was really the first year we saw Blockchain technologies flood the mainstream’d public. Before that, only the crypto-community was concerned with Blockchain technologies. And unlike the mainstream’d public, the crypto community valued these technologies more for their utility than their speculative aspect. But nevertheless, Blockchain technologies made a positive first impression on the mainstream media in 2017. With wide adoption by businesses interested and capable of using Blockchain technologies to optimize their operations, and both the retail and institutional investor enticed by the return on investment of Blockchain technologies, it is safe to say that Blockchain technologies will be here to stay for 2018.