Anyone who has visited or lived in India will tell you that cash is the most favoured method of payments for Indians. In 2016, the Reserve Bank of India (RBI), India’s Central Bank released a concept paper titled ‘Card Acceptance Infrastructure’.

Merchants discourage cards use

The paper noted that whilst there has been a significant increase in electronic transactions in India, the growth has not occurred uniformly in all segments. In fact card usage in India is invisible in many areas. Many merchants actively discourage customers from paying with a card, particularly for smaller transactions and may even charge 1-2% extra for payment processing.

Number of debit cards grows exponentially

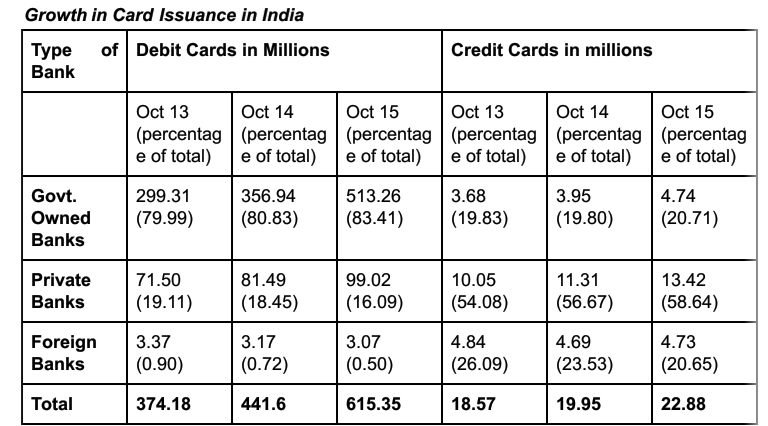

At present, there has been a growth of card usage but mainly at ATMs. Usage of debit cards, for example, grew by 64 per cent between October of 2013 and 2015, while credit card usage rose by 23 per cent in the same time frame. By the end of December of 2015, there were 22.74 million credit cards in use in India and 636.85 million debit cards. One of the reasons for the exponential rise in debit cards in India is the government’s Jan Dhan Yojna, a scheme of financial inclusiveness, which allows people to open bank accounts and receive India’s home grown RuPay branded debit cards.

- Source: Reserve Bank of India

According to the RBI, the rate of card transactions per head in India is one of the lowest in the world and is at the level of 6.7 now. You will be hard pressed to find a POS terminal or an ATM in the remote rural parts of the huge Indian landscape.

As the Indian central bank states, “The growth in the acceptance infrastructure has not been uniform across all locations in the country with higher concentration of such infrastructure noted in urban areas and larger towns and with larger merchants. Thus, the usage of cards has been constrained by lack of accessible acceptance infrastructure, especially in rural areas where the growth in card issuance has been very high in recent times.”

Cash is a headache

In its report ‘Disrupting Cash - Accelerating electronic payments in India’, Price Waterhouse Cooper observes:

“Easy avoidance of taxes, low access to financial services and patchy digital infrastructure and connectivity have put in motion and sustained a vicious circle in which cash thrives. Even as electronic payments have sneaked into the transacting behaviour of customers in the recent past, there are interesting variants like cash on delivery that reinforce the stubbornness of cash. To achieve actual disruption of cash, the ecosystem requires seamlessness that will drive complete fungibility between cash and electronic payments.”

The Prime Minister of India recently used his latest radio address to issue a warning to Indian tax evaders to come clean by September 30 2016. He was direct and ominous and said “There will be no leniency after that.”

Looking at Blockchain as a solution

As the Indian newspaper Mint reported, the Deputy Governor of RBI HR Khan says that officials from RBI will examine the tremendous potential that Blockchain has to offer in conjunction with industry representatives and officials of the Institute for Development and Research in Banking Technology, India (IDRBT). HR Khan also said that the bank may soon set up a committee that will study the use of Blockchain technology with the aim of reducing the use of paper currency.

According to Mint, HR Khan told reporters at an event organised by the IDRBT:

“Blockchain is one thing that has come out of Bitcoin which provides a lot of flexibility in terms of financial transactions. So, we need to study... how this Blockchain technology can be used in financial transactions where the entire data systems move to some more levels.”

The use of Blockchain could be interesting in India because the government has not been able to curb the use of cash by Indian consumers and merchants. Now being able to substitute cash with a ledger system in which transactions can be traced, this could help the government recover taxes. It could also reduce merchant’s costs when they are not eager to use traditional debit and credit cards because of high transaction fees.

As for the consumers using a payments system based on Blockchain tech it can help reduce anxiety about carrying and transporting cash. Overall, Blockchain has the potential to reduce India’s economic and tax woes and it would be interesting how the Reserve Bank chooses to use the technology now at its disposal.