The recent move by the Indian government to demonetize high value currency notes has resulted in higher demand for alternative assets. The premium that Bitcoin commands in the Indian market, as compared to international markets, has widened.

Demonetization claimed to curb black money

In a move to tackle the twin problems of counterfeit money and undisclosed income, the Indian Government declared on Nov. 8 that currency notes of Rs 1000 ($15) and Rs 500 ($7.5) would cease to be legal tender. These notes will be replaced by new ones with additional security features. Indians were asked to deposit their current holdings in banks and the withdrawal of new notes was rationed to deal with the huge demand.

People look to alternative assets

There has been a large demand for assets like gold, post the government’s decision. Jewellers at traditional shops accepted the demonetized notes, for purchases of gold bullion and jewellery at a huge premium. The tax authorities have conducted raids to prevent jewellers from acting as money laundering fronts.

Bitcoin explored

Given the dark reputation of Bitcoin as a pseudonymous currency, which operates outside the purview of government control, enquiries for the purchase of Bitcoins have increased by 20-30 percent. Leading newspapers in India, like the Hindustan Times and Mint, have reported on the increased demand for Bitcoins. People who wanted to convert cash into Bitcoins have been left disappointed, as Bitcoin exchanges in India follow the same stringent “know your customer norms” followed by banks.

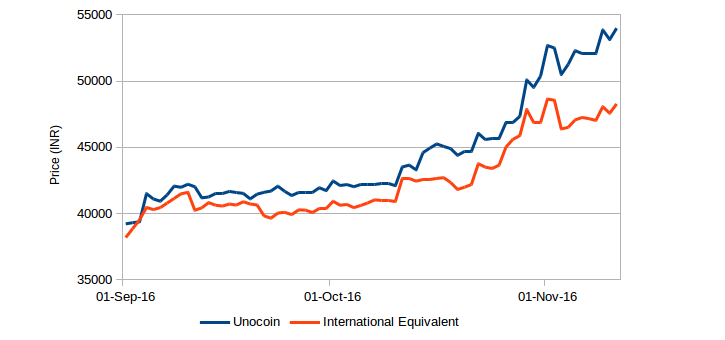

Premium due to additional demand

The increased demand for Bitcoins has resulted in a widening price gap between Bitcoins in the Indian market and Bitcoins in international exchanges. The price of Bitcoin at India’s Unocoin exchange was ~INR54K ($800). This represents a 12 percent premium over Bitcoin’s price in international exchanges. The Reserve Bank of India has imposed restrictions on forex trading by Indian residents and hence this difference in price cannot be arbitraged.

Fiat currency

The Indian Rupee, like all other government currencies, is a fiat currency. It exists through the fiat - order - of the government. As seen in the recent instance, its existence can also be terminated through an order from the government. With the passage of time, Bitcoin’s superiority as a currency is becoming more and more apparent.