In our Expert Takes, opinion leaders from inside and outside the crypto industry express their views, share their experience and give professional advice. Expert Takes cover everything from Blockchain technology and ICO funding to taxation, regulation, and cryptocurrency adoption by different sectors of the economy.

If you would like to contribute an Expert Take, please email your ideas and CV to [email protected].

The growing concern about the rise of cryptocurrencies use in illicit activity all around the world is getting louder and louder – almost competing with stories about cryptocurrency volatility.

Over sixty financial investigators from the Interpol and Europol organizations of over 30 countries in January attended a cryptocurrency workshop to discuss measures that can be taken to combat the misuse of cryptocurrencies by criminals.

According to Rob Wainwright, head of Europol, as much as $5.5 billion USD was being laundered through cryptocurrencies annually.

While Blockchain provides a public ledger of all crypto transactions, criminals are using cryptocurrency tumblers or cryptocurrency mixing services to obscure the trail back to the fund's original source.

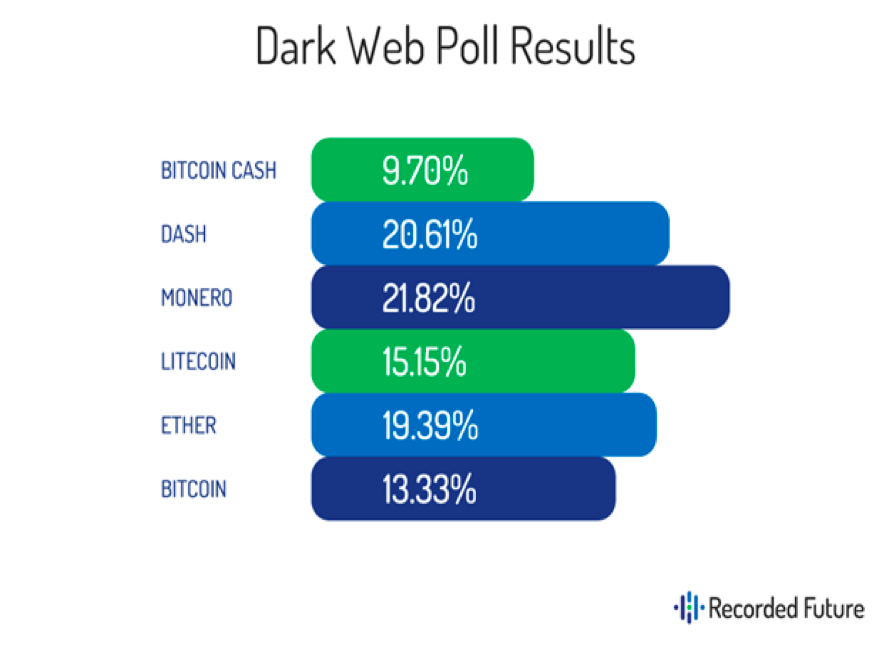

Source: Recorded Future

Newer cryptocurrencies such as Cloakcoin, Dash, PIVX, and Zcoin have built in mixing services as a part of their Blockchain network. Monero, drug dealer’s favorite crypto, provides anonymity without tumbling services due to its privacy-centric Blockchain design. Therefore more effort needs to be placed upon the monitoring cryptocurrencies with privacy or mixing services features, crypto mixers and tumblers since they can impede tax collection, anti-money laundering practices, and law enforcement agencies.

In the aftermath of this workshop, many regulatory agencies around the world, including the US, EU, Japan, and Australia, stepped-up their fight against "financial crimes" utilizing cryptocurrencies.

European Union (EU)

The 45 member committee of the European Parliament will launch an investigation into money laundering and tax evasion related to the digital economy that thrives in the shadows of tax havens. On February 7 2018 the EU Parliament voted to create a committee provisionally entitled Taxe 3, that will investigate for the first time tax privileges established under citizenship programs or non-dom regimes offered by Portugal, Italy, Malta, the United Kingdom, Cyprus as well as crown dependencies and overseas territories.

Since the power to levy taxes is central to the sovereignty of the EU Member States, which have assigned only limited competences to the EU in this area, Taxe3 will need to be confirmed by a plenary vote in March in order to undertake the financial crimes inquiry within the next twelve months.

United States (US)

The US Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) regulates cryptocurrency exchanges under existing legislation for money transmitters. It also requires US holders of a financial interest in or signatory authority over foreign financial accounts (including crypto denominated accounts) to file a foreign bank account report titled FinCEN 114 if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year. FinCEN has indicated that it is “aggressively” pursuing cryptocurrency tax evaders and platforms that lack strong internal safeguards against money laundering– even those located outside of the US.

Internal Revenue Service-Criminal Investigation (IRS-CI) – IRS-CI indicated that it bolstered its staff by ten additional new investigators to make it easier to track down cross-border crypto tax evaders.

The U.S. Immigration and Customs Enforcement (ICE) – The ICE indicated that it uses undercover techniques to infiltrate and exploit peer-to-peer cryptocurrency exchangers who typically launder proceeds by using mixers.

Japan

Financial Services Agency (FSA) – FSA began inspecting all cryptocurrency exchanges after hackers stole $530 million worth of digital money from Coincheck exchange in one of the biggest cyber heists on record.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) – AUSTRAC on December 13 2017 amended its Anti-Money Laundering and Counter-Terrorism Financing Act 2006 to combat money laundering and terrorism financing using cryptos. Under this amendment, crypto exchanges are required to identify customers more stringently and report suspicious transactions. AUSTRAC is currently consulting the industry seeking feedback on the newly introduced draft rules.

The views and interpretations in this article are those of the author and do not necessarily represent the views of Cointelegraph.