With most new technologies, it's rare that mainstream investors dive in and take risks with the unfamiliar and untested. Organized crime, on the other hand, will invest in cutting-edge technologies to drive their initiatives, just like any legitimate business.

Criminals use the Internet, mobile phones, encryption technology, instant messaging and social media. But none of these technologies have sustained a bad reputation like Bitcoin.

Giving it bad name

From its launch in 2009, bad press has littered headlines involving Bitcoin, partially due to the Silk Road marketplace, the Darknet and other platforms that maintain their anonymity, finance terrorism, traffic drugs and allow them to launder money.

During this period, investment capital in Blockchain was a mere $93 mln in Blockchain investments according to CB Insights.

From 2014 to early 2016, VC funding increased tenfold to over $993 mln. A report by FinTech Global shows 2016 alone closing with half a billion dollars in funding. Within this figure, non-finance related Blockchain projects increased by 325 percent compared to 2015, confirming that Blockchain is more than just a Fintech phenomenon.

Despite the healthy growth, Bitcoin continues to have a negative reputation to some. What is needed to grow venture capital funding to $5 bln, $50 bln and beyond?

Establishing standard business practices

One approach led by the Blockchain incubator Adel Ecosystem Ltd. has been to establish standard business practices to attract mainstream investors and business experts. Their vision is to develop projects with a commitment to the crypto industry and establish confidence with serious investors.

Besides regulatory oversight, this responsibility lies in equal measure with Blockchain service providers. Sustainable and profitable services, in the long-term, establish confidence with the mainstream investment community, philosophy of integrity and regulatory compliance.

Despite the bad press, Bitcoin has established a niche success.

Creating this market presence was inspired by a vision of a stateless and decentralized currency. Similar to how Skype disrupted international calling revenue and Facebook and Twitter uprooted journalism, the notion of decentralizing money hadn’t been considered until Satoshi Nakamoto’s white paper in 2008.

Until this point, money was considered authoritarian, not to be challenged. Bitcoin continues to be a contentious issue for governments and banks. But those same institutions recognize the value of Blockchain as a technology.

Pull Blockchain out of the Darknet stigma

However, Blockchain is far from a mainstream success. Its relative newness, combined with scams, hacks, anonymity and legalities, prevent Blockchain and cryptocurrencies from becoming a “household” technology. Angel and VC funding communities currently view Blockchain as too complex and volatile to be considered a viable investment vehicle.

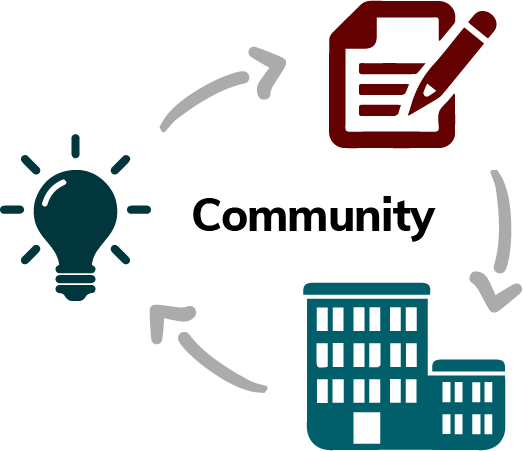

- Idea to Business Plan to Projects - Life Cycle

To pull Blockchain out of the Darknet stigma, an era of integrity is required. According to Market and Markets, Blockchain technology will be worth $2.3 bln by 2021 and is expected to grow at a compounded annual growth rate (CAGR) of 61.5 percent. It is the collective responsibility of Adel to change the perception of Blockchain and cryptocurrency and to legitimize this technology by creating ethical, moral and legal platforms.

Gabriel Dusil, co-founder and board member at Adel, says:

“At Adel, we set out to create a powerful Blockchain ecosystem with a spirit of integrity. Our aim is to have passionate and talented members who have a collective goal to be successful. Our approach to achieving this goal is through a platform that incentivizes the contribution of ideas, converts those ideas into business plans, and launches profitable projects.”

- By Gabriel Dusil and Jessica Allen