Over the weekend Bitcoin price suffered yet another big drop that would have shaken weak hands, but those battle-hardened hodlers would have scoffed at the paltry 29 percent drop. However, under the surface, Bitcoin’s alarm bells were close to sounding as the hash rate fell to around 50 percent.

Bitcoin showed signs of its potential for triggering this dynamic over the weekend.

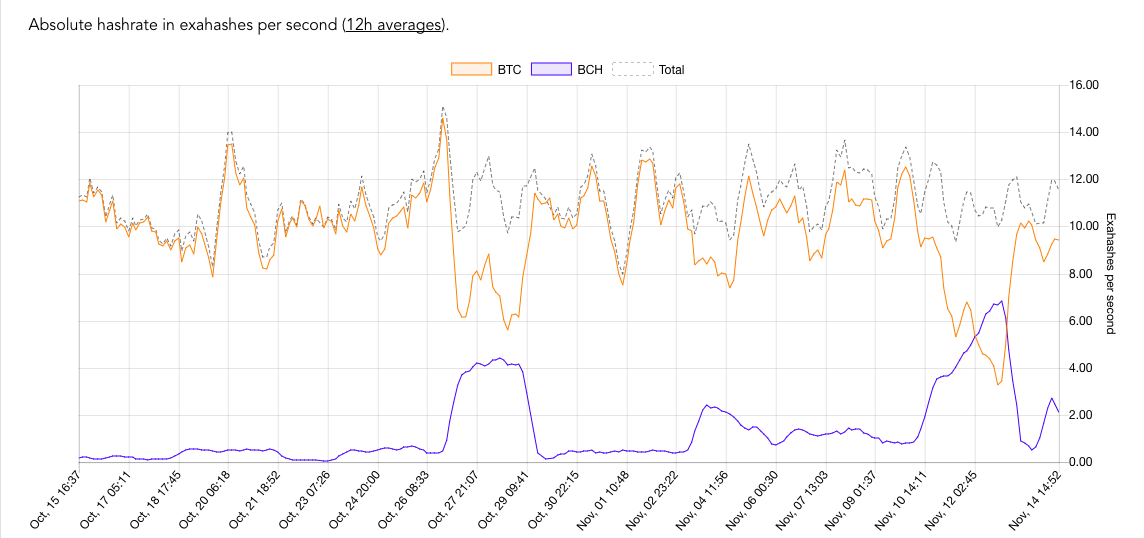

This metric if performance measurements for a coin like Bitcoin is vital, especially when the reason for its drop was a direct competitor taking the limelight. Bitcoin Cash rocketed up its own value, reaching as high as $2,500, but it also sapped a lot of the hash power of Bitcoin.

The danger of losing a large amount of hashing power for Bitcoin is that it could trigger a chain death spiral. Many feel that as a market, there is nothing that can stop Bitcoin, but that is a surface-view under the hood, things are a little more fragile.

Chain death spiral

As terrifying as the name sounds, what exactly is a ‘chain death spiral?’

The Bitcoin network currently adds a new bundle of transactions, known as a “block,” roughly every 10 minutes. The exact time is determined by how long it takes for a miner to process a block of transactions. This, in turn, is set by something called the “difficulty” on the network.

Difficulty automatically adjusts itself to match the hash rate so that transactions won’t take too long. But the difficulty only adjusts every two weeks at the moment, so, if the hash rate suddenly plummets the difficulty could be rendered too high for the amount of processing power on the network. This in turn could mean severe delays in completing Bitcoin transactions.

This was felt and mentioned by many over the weekend and it left Bitcoin on the cusp of a catastrophic failure. The spiral starts once the delays are unbearable and investors decide to dump the coin. This leads to a price drop which ultimately makes it unprofitable for miners who then move to other coins.

“Transactions get backlogged to a point where the coin becomes basically useless,” says Peter Kim, who co-founded a developer tool called Nitrous.

Sounds like science fiction?

Those who had their eyes too closely glued to Bitcoin price, worrying about every little dollar it dropped, would not have seen the bigger picture. It sounds far-fetched, but the signs that a storm was brewing were there.

The transactions slowed on the Bitcoin network over the weekend, and to boot, Bitcoin Cash was also rocketing making it more profitable for miners who switched their operations to the forked coin. Bitcoin’s hash rate thusly fell as much as 50 percent.

That drop meant that transaction times doubled at the very least. Analyst Jimmy Song explains just how much more enticing Bitcoin Cash suddenly became for miners.

“Bitcoin cash was up to 100 percent more profitable to mine because of the price run-up. When it’s more profitable to mine Bitcoin Cash, miners will go there. When it’s more profitable to mine Bitcoin, like right now, miners will go there,” Song says.

Crisis averted

This hash rate flip was only brief however and just like the pump and dump of Bitcoin Cash, the hash rate has fallen and returned for Bitcoin. According to a hash rate analyzer, Bitcoin has recovered its hashrate well enough to avert the crisis, but it is lower than it has been before the Bitcoin Cash pump weekend.