Businesses around the world are discovering that it pays to develop and employ a Bitcoin strategy — just ask Overstock and TigerDirect.

Outside of the inherent benefits Bitcoin provides (fast transactions, lower transaction costs, no chargebacks, it’s pretty easy to use), simply announcing “Bitcoin accepted here” brings with it attention: Attention from news media (ahem) and attention from Bitcoin’s user base, many of whom will go out of their way to support a Bitcoin business.

That’s all well and good, but how can a family business in Mobile, Alabama, or a small online retailer that sells, say, handmade soap actually begin processing Bitcoin payments and get a good seat on this bandwagon?

[Full disclosure: This piece will link to a number of businesses, none of which are in any way partners or affiliates of Cointelegraph. Those two examples above were chosen at random. Later businesses cited as examples were chosen due to their familiarity or due to their being high up in Google search results.]

The Bitcoin Wiki is a good place to start. It suggests two basic options:

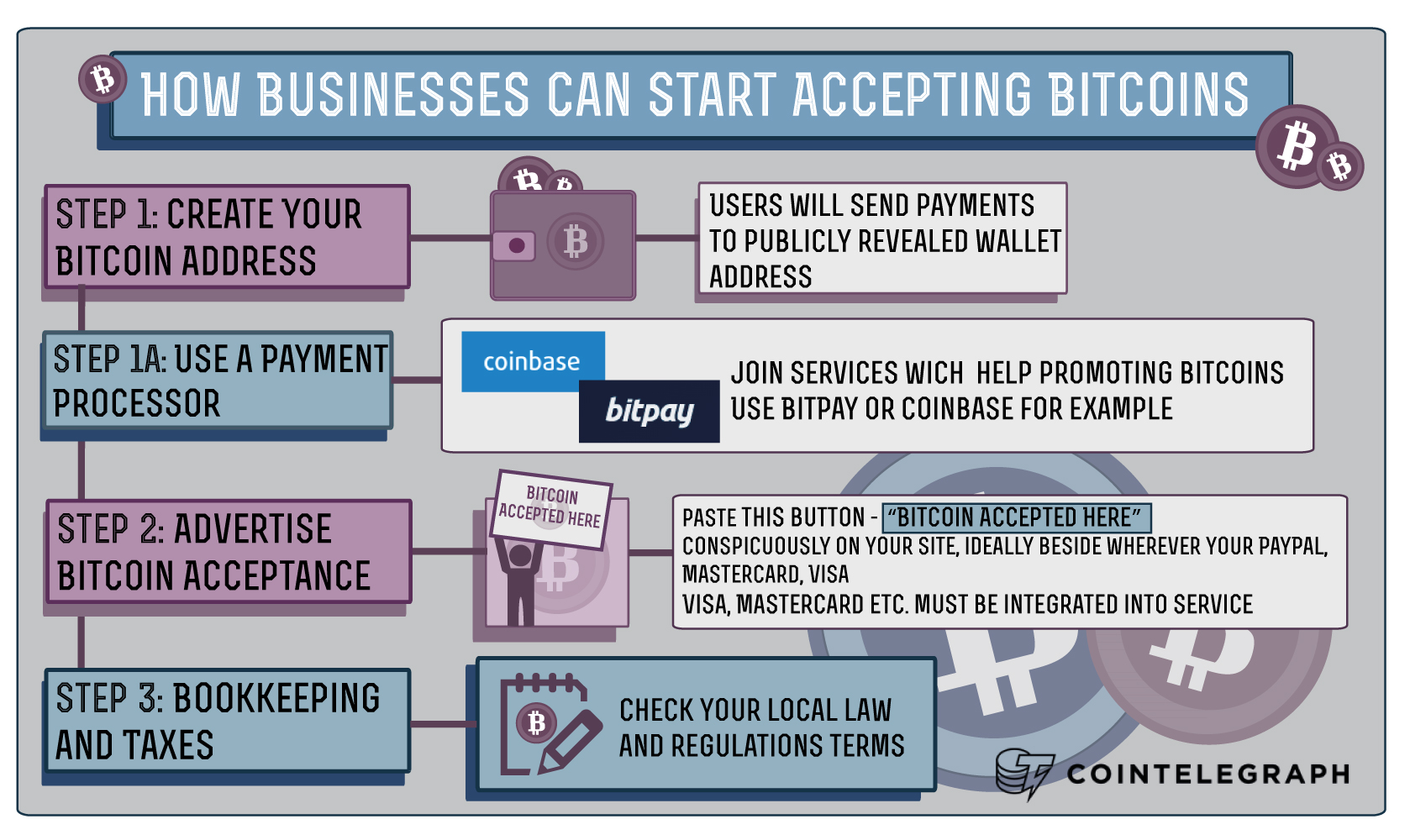

1. You can simply create a Bitcoin address and ask customers to send money there (this only works if you have a small number of potential Bitcoin payers), or

2. You can use a merchant payment processor.

Step 1: Creating Your Bitcoin Address

First, you will need a Bitcoin wallet. This is the address where customers will send their money, and that process works a lot like email: They input your address (or, more likely, scan your QR code with their smartphones so they don’t have to type a huge alphanumeric address), enter the desired amount and hit “Send.”

A useful metaphor for merchants is that of the cash register. And like a cash register, you will probably need to take the money out at the end of the business day and store it somewhere safe. Bitcoin.org says:

“A Bitcoin wallet is like a wallet with cash. If you wouldn't keep a thousand dollars in your pocket, you might want to have the same consideration for your Bitcoin wallet. In general, it is a good practice to keep only small amounts of bitcoins on your computer, mobile, or server for everyday uses and to keep the remaining part of your funds in a safer environment.”

Go here to see some options for creating a Bitcoin wallet and tutorials on how exactly to set one up.

Don’t forget to establish some best practices for securing that wallet, too: A tutorial on securing your wallet can be found here.

Step 1a: Using a Payment Processor

If your sales process is a little too complicated for direct Bitcoin payments into a wallet, or if you handle many transactions during your business hours, then consider using a payment processor. BitPay and Coinbase are two of the best-known examples.

Payment processors will charge either a percentage or a monthly fee for their services, but their prices are designed to be still far cheaper than what credit card companies or even PayPal charges.

Furthermore, payment processors will offer a few applications of their technology: You can send email invoices, set up a POS (useful if you are running a restaurant or cafe, for example) or add a shopping cart plugin to your online shop.

Finally, if you don’t want to hold onto your Bitcoin (say your suppliers and landlord want cash in fiat), these kinds of processors can convert your money into fiat instantly. In other words. You never have to handle of hold any cryptocoins if you don’t want to.

For a larger list of payment processors, go here.

Step 2: Advertise Bitcoin Acceptance

Then, you will need to indicate somehow to your customers that you do, in fact, accept Bitcoin. If you have an online storefront, grab this “Bitcoin Accepted Here” button and paste it conspicuously on your site, ideally beside wherever your PayPal, MasterCard, Visa and whatever buttons you already have are.

If you have a brick-and-mortar establishment, grab similar stickers for your door or cash register here.

Step 3: Bookkeeping and Taxes

Reach out to your accountant to determine how to keep records of Bitcoin or Litecoin or Darkcoin or whatever altcoin transactions.

“You don't need to get into a discussion with your accountant about block chains and private keys or the philosophy behind a decentralized currency,” the Bitcoin Wiki reads. “By comparing the fundamentals of Bitcoins to accounting concepts already well understood by the public, you can probably get all the answers you need. What would you ask your accountant if you decided that you wanted to accept Berkshire Bucks or 1-ounce gold coins as payment?”

Some accountancy firms are beginning to emerge that specialize in Bitcoin and other cryptocurrencies. Bitcountant is one such example.

Tax Ninja in San Francisco is another firm that can handle Bitcoin-related tax issues. For American Bitcoin businesses, meeting tax obligations under the IRS’s guidelines is fairly straightforward, Tax Ninja founder Matthew Whatley told Businessweek in March.