This article does not contain investment advice or recommendations. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Despite the recent news about banks closing their doors on credit card purchases of crypto; one after the other, there are still available options you can use to buy crypto. Let’s see what they are.

The easiest way is to buy cryptocurrency with a debit card on a centralized exchange.

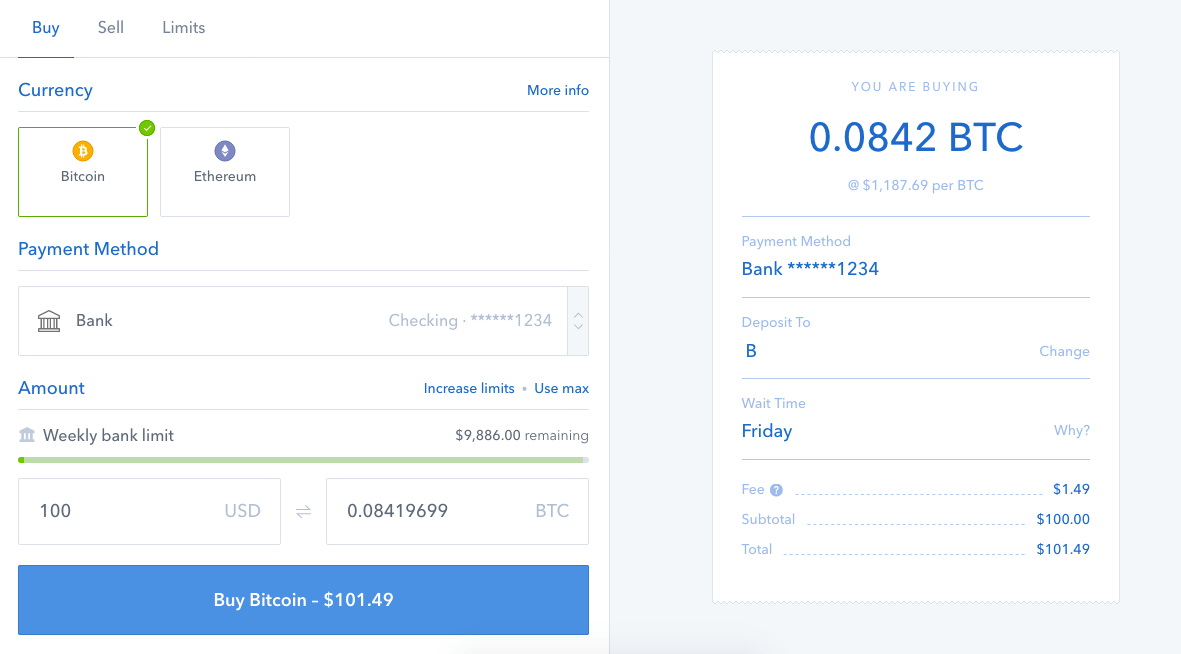

It really is as easy as buying clothes on Amazon. Coinbase, for example, is a popular interface to buy crypto with fiat (fiat = paper currency like dollars or euro).

On Coinbase, users need to create an account and verify identity. After that, they can buy with their debit card.

Rules for verifying identity differ for each exchange/country; generally, users need to at least provide an ID/Passport and enable 2-factor authentication.

Coinbase also has a sister company named GDAX - this type of platform gives users a better idea of how crypto exchanges really work. It features an intuitive interface with many charting tools, trade history, and real-time order books. These are all tools that traders use to make sure that they are getting the most out of their trade. This exchange follows US regulations, bringing it to compliance in USA, Canada, Europe, the UK, Australia, and Singapore.

Image: Buybitcoinworldwide

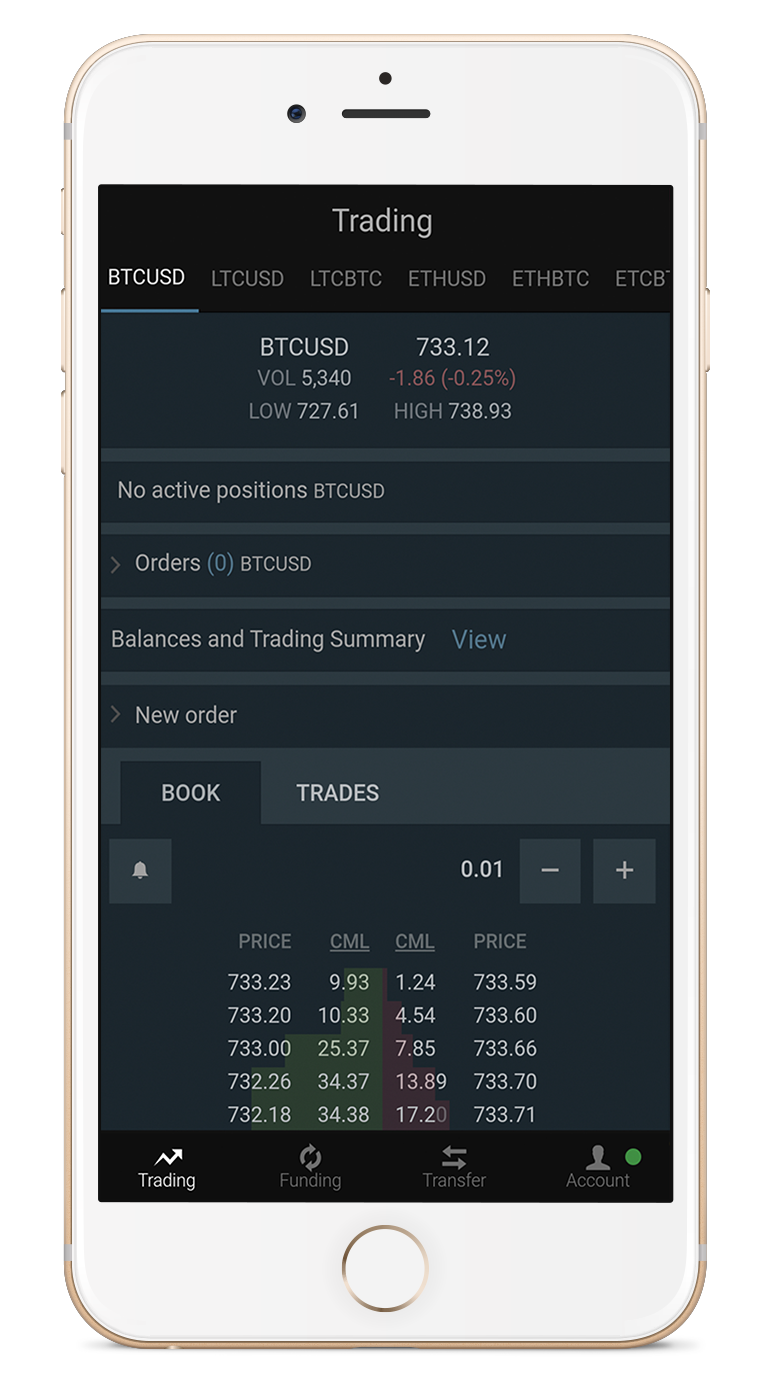

Bitfinex is another very popular exchange that has been around as early as 2012. Its website boasts being the “most advanced cryptocurrency trading platform” in the world, with many advanced charting tools to equip while trading. The website even has an app that is available for both Android and the iPhone. The core of the exchange is made up of three features: Exchange trading, Margin trading, and Margin funding. The P2P financing market integrated into Bitfinex matches borrowers with lenders to bring the advanced tools of margin trading. A beginner’s guide is offered in their support section so that even a first timer can buy on the site.

The Bitfinex exchange app on iPhone

While there are many more places to buy cryptocurrency with fiat, Robinhood is unique in its zero-fee approach and their goals to be an even easier platform to buy cryptocurrency. This exchange/trading app hybrid lets users buy Bitcoin and Ethereum right from their phone with no trading fee. Compare this to Coinbase’s 1.49%-3.99% fees added to every purchase.

Just after the announcement of launching a crypto trading platform, the millennial stock trading app received over 1 million users on their waitlist to try in just five days.

While this app platform is not fully released yet, Robinhood has allowed some users from a few states to begin trading on the app.

We're gradually sending invites to customers residing in CA, MA, MO, MT, NH. We look forward to releasing crypto trading functionality in more states later. In the meantime, you can monitor market data for 16 cryptocurrencies & add them to your watchlist. https://t.co/28TamoX4rO

— Robinhood (@RobinhoodApp) February 23, 2018

Not all cryptocurrencies can be bought with fiat

As of now, it’s mostly Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Ripple that have fiat/crypto pairs. To obtain the ~1,546 cryptocurrencies, commonly referred to as “altcoins”, that are listed right now on Coinmarketcap, users need to trade BTC or ETH. Every altcoin has a BTC/crypto pair, and most have ETH pairs as well.

Coinbase offers Bitcoin, Ethereum, Litecoin, and Bitcoin Cash that users can buy with fiat debit cards. To get involved with other altcoins, users will need to send their BTC, ETH, LTC or BCH over to an exchange that has all of these pairs. The two most popular fluctuate between Binance and OKex, both of which are well trusted global exchange networks.

How to buy with Cash - P2P

Buying Bitcoin with cash can be as simple as giving money to your friend in exchange for BTC. For those who don’t know anyone with BTC (or anyone that wants to sell), there are decentralized, p2p sites to meet with people. LocalBitcoins works worldwide as an advertising community board for users to agree on a price beforehand, and then meet in person to trade. It might take a lot of time to process the exchange process, and it might not seem trustworthy enough, as it involves strangers, but it is still popular and has great reviews from users. It is technically a decentralized platform because it involves p2p trading. No middlemen are used to mediate the deal - which means no fees are paid at all.

How to Simply buy Bitcoin (no exchanges involved)

Bitcoin ATM - Bitcoin ATMs are becoming very popular- March tolls about 2,393 Bitcoin ATM machines worldwide, with a steady trend upwards. With these machines, the user shows up to a physical location and either a) buys Bitcoin using fiat currency and has it sent to a Bitcoin wallet or b) sells Bitcoin from the atm to withdraw fiat money. These devices are extremely convenient and allow traders to not have to deal at all with the “trading” part of crypto.

Image: Finance Magnates

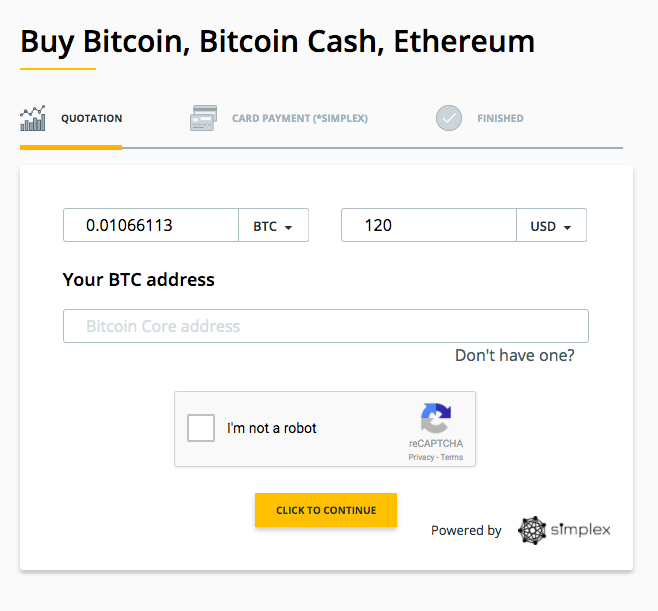

Buy.Cointelegraph - Cointelegraph has recently partnered up with Simplex to offer a convenient way to buy Bitcoin, Bitcoin Cash, and/or Ethereum. Simplex accepts most credit cards (including Visa and Mastercard) and also accepts some debit and prepaid cards.

Coming Soon: Decentralized Exchanges

While not very popular yet, mostly because the technology is still being worked on, decentralized exchanges (DEXs) are set to become more popular in 2018. DEXs use a trustless AI system to connect traders online. In a centralized exchange, the money goes from the user’s wallet to an escrow, and then to the other user in the trade. Funds stored on centralized exchanges are stored in wallets owned by the company, making funds more susceptible to hacks. In a DEX, user funds are stored in hardware wallets on each user’s computer, and value is never lost; when a trade commences, and instant swap, i.e., atomic swap, occurs so that the money never passes through a middleman. A smart contract is used to keep trust between the two users trading the money.

Altcoin.io is working hard to make the first ever decentralized exchanges for traders, by traders. While many DEXs have bulky, complicated interfaces; Altcoin.io is working to make both a simple interface to quickly exchange crypto, as well as an in-depth, customizable exchange. The team was made famous back in October for successfully completing the first ever BTC-ETH atomic swap - a complicated feat because these two coins run completely different blockchains.

Altcoin.io Preview Interface

Bitshares already has a working platform, which works best as a client downloaded straight to the computer. Decentralized exchanges that are already working tend to be for the crypto-savvy; there are many advanced features, and the interfaces are not as easy on the eyes. While the number one exchange, currently OKex, is trading $1.75 billion million daily, Bitshares is only trading at approximately $2 million.

Crypto is easier than ever to buy now, and this year should see some huge improvements for both centralized and decentralized exchanges. Centralized exchanges will focus on scaling, usability and adding of new tokens, while decentralized exchanges will be focusing on getting their product out on the web and involving the existing crypto community. But for now, and forever, it’s a good time to buy crypto.