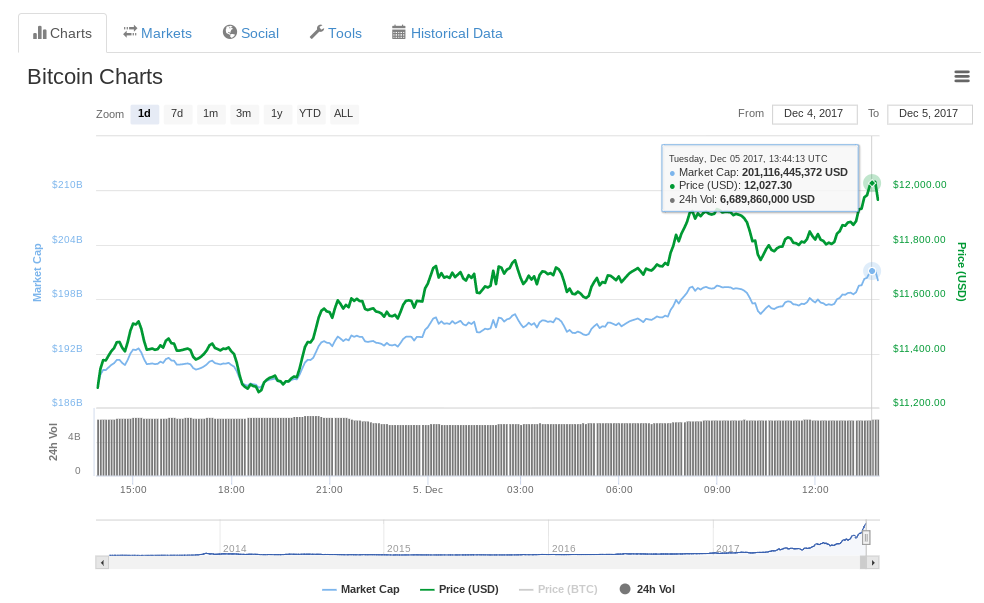

Bitcoin temporarily hit $12,000 and a $200 bln market cap Tuesday before correcting as prices continue their remarkable week-long surge.

As major exchanges such as Coinbase, Bitstamp, Kraken and others trade around $11,850 at press time, lively global markets produced an average all-time high of $12,027.

This is the first time Bitcoin has passed the new barrier, having grown from $9200 lows within a matter of days.

The pace of progress comes as the prospect of a Wall Street influx via regulated Bitcoin futures comes true December 10 and 18 as CBOE and CME Group enter the market.

Commenting on the continuing investment into Bitcoin, Chris Burniske noted the swing away from ICOs in recent months to favor the largest cryptocurrency.

#ICOs feel to have lost some of their luster as #bitcoin has regained its shiny gold reputation in the mainstream’s eye.

— Chris Burniske (@cburniske) December 5, 2017

Bitcoin forks are swiftly becoming the talk of the speculative crypto investment world, with a host of Bitcoin ‘impersonators’ lined up to debut this month.

So far, however, extant forks have failed to match BTC’s progress, Bitcoin Cash up 1.7% in 24 hours and Bitcoin Gold posting flat performance for the same period.

By contrast, privacy-focused altcoin Monero continues as the clear altcoin winner, advancing another 22% Tuesday to hit its own all-time highs of $240.