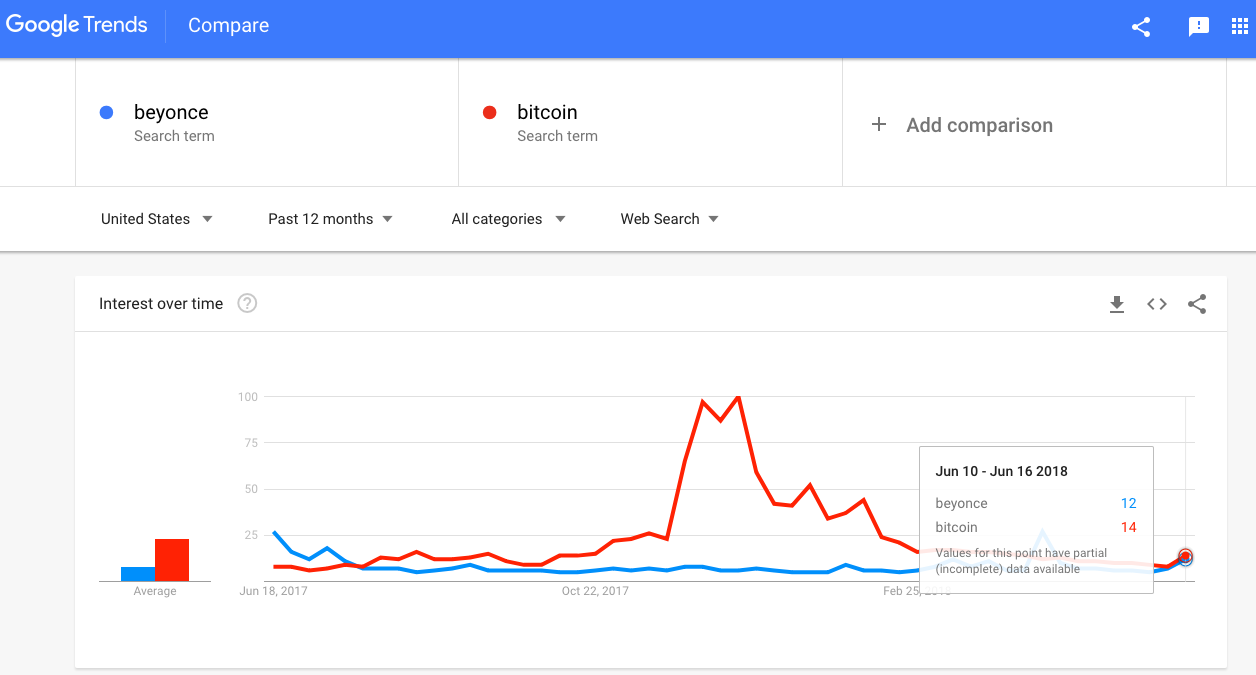

Google searches for Bitcoin have reportedly declined 75 percent through 2018, yet the leading cryptocurrency is still outstripping the famous pop-star Beyonce on Google Trends, CNBC reported Tuesday, June 12th.

Bitcoin analyst Brian Kelly told CNBC’s ‘Futures Now’ that only during her Coachella music festival performance this April did the megastar briefly eclipse Bitcoin (BTC) in terms of internet search popularity this year.

Popularity of search terms “Beyonce” and “Bitcoin.” Source: Google Trends

Kelly more broadly weighed in on June’s undeniably bearish crypto markets, highlighting some key levels to watch in Bitcoin’s price performance short-term:

"What I'm really looking for is some kind of movement, a bounce off $6,500. We don't really have the volume [and] there aren't a lot of catalysts that I can see coming up in the very short term… if i had to look for another level as a short-term trader, I’d look at the $6,800 level, that acted as resistance over the weekend. We saw a jump up above that and now we’ve broken back through.”

According to Kelly’s calculations, the $6,500 level acts as a fundamental mining profitability support level. This assumes that Bitcoin miners need to update their hardware almost every 18 months, bringing the costs of mining to roughly between $5,900 and $6,000.

“On a very short-term,” Kelly added, “$6,800 seems like a pivot to me.” “In this market, as a short-term trader,” he said, “I’d much rather be buying that momentum on a break-through on $6,800.”

Even before the markets’ recent tumble, pro-BTC Wall St analyst Nick Colas raised concerns about signs of waning interest in the cryptocurrency in an interview with CNBC early May. He pointed to weak public interest indicators, including fewer Bitcoin Google searches and low crypto wallet growth. Colas did not comment on a cross-comparison with Beyonce.

Also in May, a fresh report into the current state of global bottom-up adoption of cryptocurrencies suggested that “a majority of early [crypto] adopters are already on board.” The research indicated that on average, only 4 percent of people who did not already own crypto were intending to invest within the next 6 months.

As of press time, Bitcoin is trading around $6,557, bringing its monthly losses to just shy of 25 percent. 24-hour BTC trade volumes are at $4.5 bln, down from around $7.4 bln a month ago.