Elliptic, a Bitcoin analytics and security firm based out of London, announced 'The Bitcoin Big Bang' on Thursday. The software is a Bitcoin 'transaction monitoring and compliance' visualization that could identify in real time which Bitcoins are legal in a given jurisdiction.

Cointelegraph interviewed privacy researcher and security expert Kristov Atlas and market analyst Tone Vays to discuss their perspectives on privacy, price and compliance in relation to Elliptic's Bitcoin blockchain analytics.

Elliptic's team of PhD data scientists and engineers have been working to map the 35 GB blockchain in an attempt to identify major players in the Bitcoin economy. The main goal, according to the team, is to deliver a suite of AML (anti-money laundering) compliance products to companies operating under regulatory pressure, a technology that may bring relief to many in the financial industry.

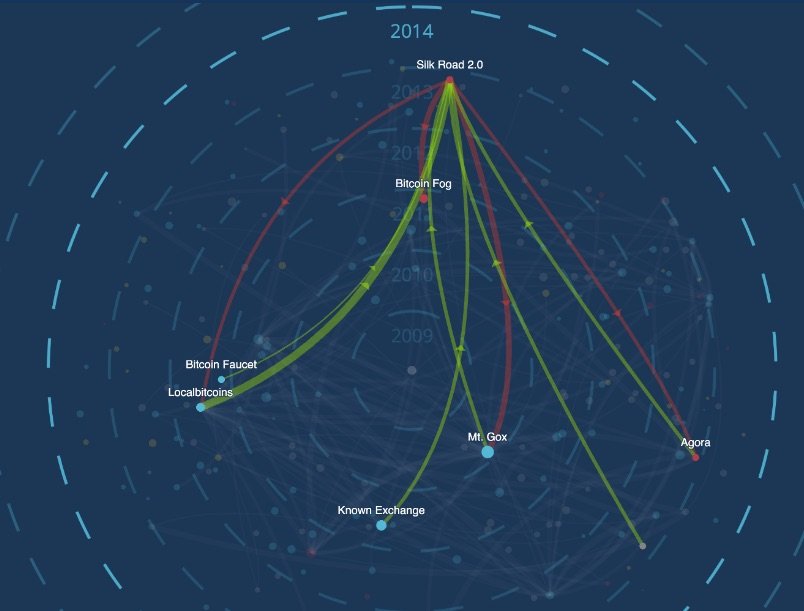

The software has already identified major players — such as Mt.Gox, Silk Road variations, and many other players to whom Elliptic has granted pseudonymity — and exchanges that have, knowingly or not, enabled trades of Bitcoins that have flown through the Silk Road and other Dark Web markets for illegal goods.

This ability is believed to bring much peace of mind to large financial players who may be concerned about entering the Bitcoin market, or about regulatory uncertainty and risk of legal punishment. Elliptic's CEO James Smith said:

"We have developed this technology not to incriminate nor to pry; but to support businesses’ anti-money laundering obligations. Compliance officers can finally have peace of mind, knowing that they have performed real, defensible diligence to ascertain that their bitcoin holdings are not derived from the proceeds of crime.”

What About Privacy?

The consequences of such a technology are vast and certainly controversial. The ability to do mass monitoring of Bitcoin transactions — and automatically alert companies, regulators and law enforcement as to which coins are associated with illegal goods — is basically the definition of surveillance. In this case, blockchain surveillance.

This means that bitcoins associated with illegal goods or services in this or that jurisdiction could be tagged and effectively branded “white bitcoin” or “black bitcoin.” White bitcoins would be accepted by merchants under AML regulatory pressure, while black bitcoins would be rejected and may possibly mark their users as suspects of illegal activity.

This could split the Bitcoin market in two, drying up the fungibility of bitcoins associated with illegal trade in a given jurisdiction. This also raises many questions, of course, about the security of Bitcoin users in such a world.

Atlas, of the Open Bitcoin Privacy Project, told Cointelegraph:

"Elliptic just announced that they are doing what bitcoin privacy researchers have been warning about for years now. Put a couple computer scientists in a room, apply decades-old algorithms, and you get deep insight into the blockchain."

Such teams include Chainalysis and Coinalytics.

One thing that is not clear is to what degree a particular bitcoin holding could be framed by bad actors. Say Pete wants to make Bob look bad on legal records, since they both compete in a given market. How hard would it be for Pete to find one of Bob's public addresses and set up a sale of fake illegal goods in the Dark Web, using Bob's public address? Or to bribe a Dark Web merchant to play along with the attack?

Such a cheap attack could smear Bob's credibility and add him to some suspect list.

Also, what about old bitcoins associated with illegal trade from years ago? A reddit user points out:

“So....I have never done anything illegal with bitcoin; ever. I have purchased all of my bitcoins on Coinbase and then moved them to a cold storage wallet. That said, I have run those coins through mixing services before moving them to cold storage to protect my personal privacy.

“So..in the future, when I want to use some of my cold storage funds, will it get flagged because I previously ran them through a mixer?

Somehow maintaining my privacy marks me as a criminal and makes my bitcoins lose their fungibility?”

This is an important effect of blockchain surveillance to consider: How many degrees of association with illegal trade would be required for a given bitcoin to be considered “black” or “white”?

To what degree individual users will be able to keep their privacy intact with the use of HD hierarchical wallets, or other security practices, is unclear and depends on the tools used to build associations on Bitcoin transactions.

Blockchain Surveillance and Price

Vays explained his view of what such a surveillance capability could look like in the years to come. He said, “Several things will happen. Wallets would have to pick a side: "Do you want to track or not?”

Not only wallets, however. Depending on how regulators react, merchants may have to apply AML as well, based on similar technology.

“This situation might actually be good for Bitcoin's price,” Vays added, “as it will bring in billions of legit fiat currency into Bitcoin, if they know for a fact it will be tradable and legal.”

Research suggests that black markets are an US$10 trillion dollar international economy, bigger than any super power. Foreign Policy reported:

“In 2009, the Organization for Economic Co-operation and Development (OECD), a think tank sponsored by the governments of 30 of the most powerful capitalist countries and dedicated to promoting free-market institutions, concluded that half the workers of the world — close to 1.8 billion people — were working in System D: off the books, in jobs that were neither registered nor regulated, getting paid in cash, and, most often, avoiding income taxes.”

“Hence my view,” says Vays, “that if bitcoin becomes legal and controlled, there will be an anoncoin that will rise to the top and be 30 to 40% of Bitcoin market cap, and many useless jobs in the government will be added to endlessly fight against it."

“If they somehow succeed and break the popular anoncoin, it will spawn more anoncoins for a while, just like there were Kaza, Limewire, Bareshare, etc. after Napster went under.”

As far as the effects on Bitcoin's price, Vays points out:

“When Silk Road closed down, bitcoin fell 30% that day, then over the next two weeks in doubled in price and took off. … The price of bitcoin will rise dramatically once its legal or illegal future is clear.

“The biggest thing setting bitcoin and altcoins back is questions about Bitcoin's future. So everything hinges on whether bitcoin will be criminalized like alcohol in the 20s, drugs in the 70s, privacy in the 00s.”

Putting emphasis on how important this move is for the cryptocurrency markets, Tom Robinson, Elliptic's cofounder, told Business Insider that the tool could be a "game changer for the institutionalization of bitcoin."