All systems that preserve user privacy are alike; each system that violates user privacy does so in its own way. As more people earn income in Blockchain-based currency the social norm of salary confidentiality is challenged.

Salt wage

Consider the modern word salary, derived from the Latin salarium, the root of which means salt, an ancient medium of exchange. To be “worth one’s salt” is an expression meaning that one contributes value in proportion to the amount one is paid.

Under a regime of wages dispensed in salt, there are doubtless a considerable set of challenges to overcome in the implementation and management of an efficient remuneration system.

What are the problems we’re confronted with in designing such systems with Blockchain-based cryptocurrencies like Bitcoin?

Transparent salary

Information pertaining to the amount of compensation awarded to different individuals is often considered sensitive, commanding a certain degree of privacy.

As Bitcoin and similarly designed cryptocurrencies evolve into a recognized medium of exchange for larger swaths of the world economy, an increasing number of people will earn income in the form of Blockchain-based payments.

The nature of these transactions is such that the minute details of an affected individual's compensation package and spending habits will be exposed to public scrutiny.

In some cases, this violates cultural norms which respect the confidentiality of salaries, yet in other cases, it could be regarded as providing the benefits associated with greater transparency.

For instance, a policy of treating salary data as openly available can preempt compensation differences between similarly skilled workers based on spurious criteria like gender.

Unimagined business models

The practice of compensating employees via Blockchain-based cryptocurrencies has made possible the realization of heretofore unimagined business models.

Bitcoin facilitates the compensation of contributing individuals across the world regardless of whether or not they have a consistent home address or a bank account.

The practice of paying salaries with this contemporary medium of exchange is growing in, if not popularity, at least notoriety, as indicated by corporations ranging from machine learning focused hedge funds to small start-ups proclaiming their affinity for remunerating their workers using Bitcoin.

Alice’s payments

Let’s examine the public Blockchain of Bitcoin for evidence of this new paradigm.

Consider a particular live address, hereafter referred to as Alice, which receives regular payments for goods and services rendered from an institution, which we will denote Bob & Company.

This is a real case study of a real-world company that pays its employees in Bitcoin, although the names have been changed.

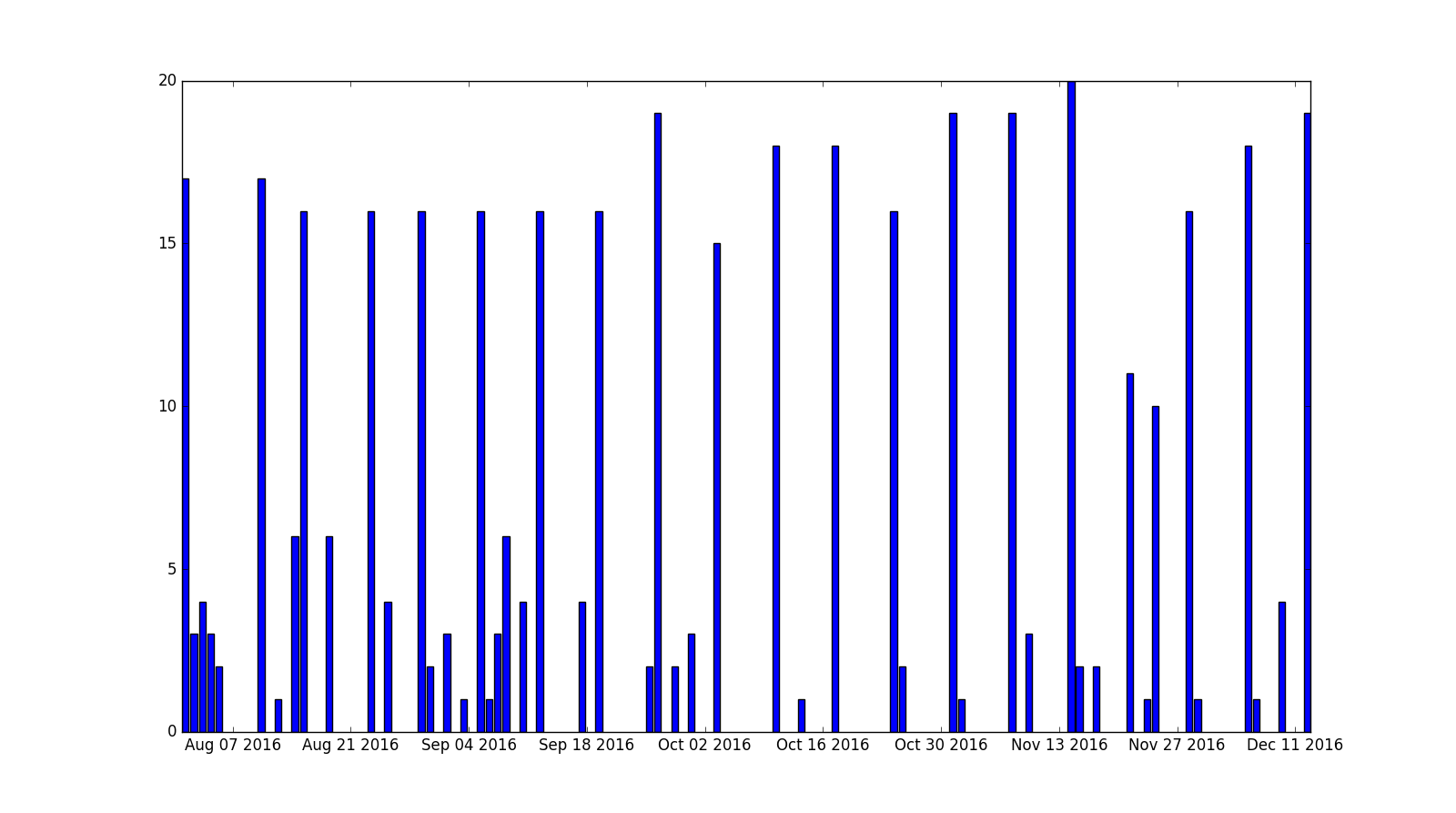

Fig. 1. Histogram of the 50 most recent transactions emanating from Bob & Company. The y-axis represents the number of contributors, colleagues of Alice. The x-axis represents calendar days. The regular periodicity of payments to approximately the same number of addresses indicates behavior characteristic of remuneration.

Fig. 1. Histogram of the 50 most recent transactions emanating from Bob & Company. The y-axis represents the number of contributors, colleagues of Alice. The x-axis represents calendar days. The regular periodicity of payments to approximately the same number of addresses indicates behavior characteristic of remuneration.

The tendency for payments to accrue to Alice at regular intervals from the same address serves as a strong indicator that these transactions constitute remuneration. The single address associated with Alice formed the initial basis of our analysis. With this information alone it is trivial to observe that Bob & Company is the sole source of all the transactions listed above.

Blockchain salary detection

By exploring the transaction profile associated with Bob & Company we can generate the histogram in Figure 1, this information yields insight into (at least) a consistent subset of the number of accounts payable (presumably employees) with whom Bob & Company has regularly interacted over the course of the time period depicted.

Based on the behavior exhibited by Bob & Company as described by Figure 1 we can catalog a rule of thumb for the identification of organizations compensating employees over the Bitcoin Blockchain.

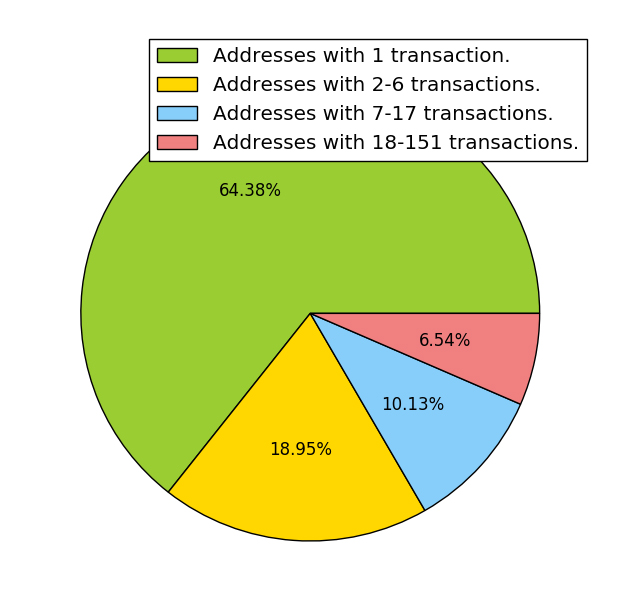

Best privacy practices of Bitcoin recommend that a “fresh,” never before used address be utilized for each new transaction. It is clear that neither Alice nor Bob & Company follow this procedure. This fact notwithstanding, the majority of transactions transmitted by Bob & Company do in fact appear to follow the one address per transaction protocol. In Figure 2 we can see a comprehensive breakdown of the transactions made by Bob & Company to distinct addresses. The Green section (64.38 percent), the majority of cases, represents transmission to an address that has never before been issued to by Bob & Company and is never issued to again.

Fig. 2. The proportion of transactions partitioned according to the number of times Bob & Company transmitted Bitcoin to the address in question.

Bitcoin price influence

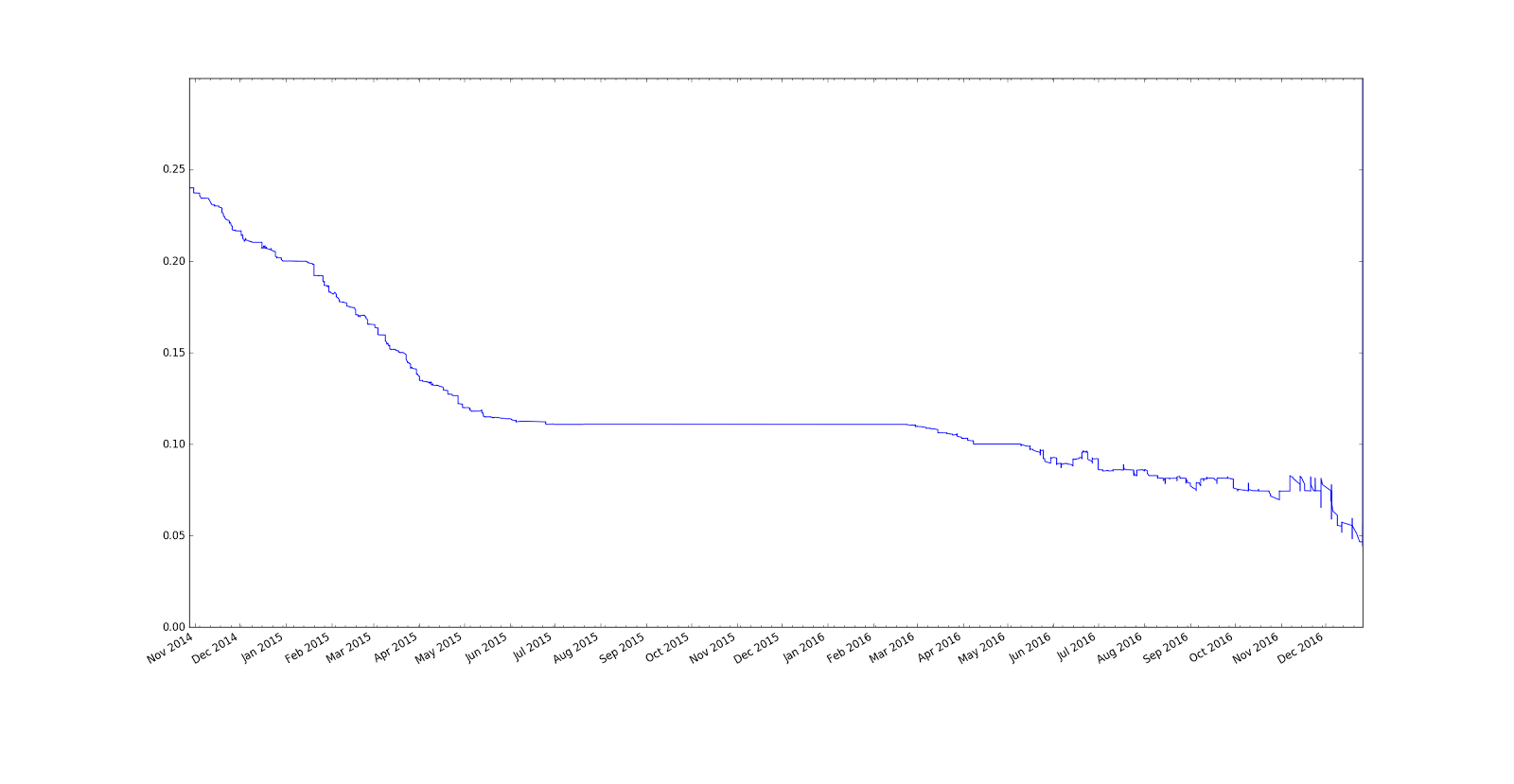

In November 2014, when the Bitcoin price was approximately $340.00, the average compensation from Bob & Company was 0.25 Bitcoin per transaction. In December of 2016, when one Bitcoin typically sold for a price of approximately $930.00, the average compensation from Bob & Company was 0.05 Bitcoin per transaction. Therefore, from the period during which data is first available for Bob & Company until the time of writing, the Bitcoin price has increased and the amount of remuneration from Bob & Company have decreased in proportion to each other as described by Figure 3.

Fig. 3. The median transaction value in Bitcoin sent by Bob & Company over the lifetime of the address. Note that as the Bitcoin price increases relative to the United States, the dollar value of transactions emanating from Bob & Company is decreasing in rough proportion.

Fig. 3. The median transaction value in Bitcoin sent by Bob & Company over the lifetime of the address. Note that as the Bitcoin price increases relative to the United States, the dollar value of transactions emanating from Bob & Company is decreasing in rough proportion.

In this article, we have demonstrated the substantive privacy concerns raised by the practice of awarding salaries using cryptocurrencies with design principles similar to those of Bitcoin by the meticulous analysis of live Blockchain data. In this section, we explore some of the implications of the possibilities unleashed by this mechanism of disseminating personal salaries.

Industrial espionage

In this article, we were able to track the growth of Bob & Company. If this analysis were undertaken by a competitor of Bob & Company it could erode their competitive advantage by divulging information relating directly to the economic viability, growth patterns and trajectory of Bob & Company’s business.

Endangering employees

The Women’s Annex Foundation (WAF) encourages girls in Afghanistan to engage in blog writing, software development, video production and social media marketing, paying them for their efforts in Bitcoin. The heuristics described in this article could be used to identify organizations on the Blockchain, organizations like the WAF. Business models with similar objectives do well to consider whether compensating workers via the Blockchain is consistent with promoting the well-being of their contributors and if decided in the affirmative, to take all necessary precautions to sufficiently anonymize their transaction profile.

Corporate governance

While doubtless there are ills associated with increased transparency there are also considerable benefits. Increased oversight, transparency and participation on behalf of stakeholders is realizable as never before through the deployment of public ledger-based value transmission systems. This could herald a new ethos in corporate governance.

Open budget initiative

There are at the moment projects underway from various governments and civic institutions - e.g. the World Bank Institute - to promote the kind of budget transparency that can decrease corruption and improve living standards, the kind of transparency detailed in this article.

Obfuscation techniques

The poor privacy profile of Blockchain-based currencies with design principles analogous to those of Bitcoin is well established. The most common mitigation to the risk posed by de-anonymization is to utilize a mix to shuffle Bitcoins between different users. There are several of such services operating commercially and while specifics of the remedial measures vary slightly according to the provider there are some common drawbacks. These include the propensity of anonymity service providers to misappropriate funds, either explicitly or by going out of business.

For those willing to consider cryptocurrencies other than Bitcoin, two alternative approaches for the compensation of workers are Zerocoin and Zcash, both of which are Blockchain-based cryptocurrencies that preserve the integrity of personal data in ways orthogonal to Bitcoin while posing their own unique set of risks.

What does it all mean?

In the early days of Bitcoin, the perceived anonymity of this value transfer technology was one of it’s most attractive features, helping to fuel its adoption on marketplaces such as the Silk Road. Today it is clear that the anonymity guarantees of Bitcoin are tenuous.

This article provides a foundation for the creation of mechanisms that might search the Blockchain for evidence of remuneration behavior taking place using cryptocurrencies - i.e. Bitcoin.

In consideration of the ethics of anonymity, we do well not to overlook the multitude of important reasons for anonymity that we might take for granted with traditional currencies. It is still the case that many people are uncomfortable divulging the details of their salaries with friends or coworkers.

The relative ease with which individual addresses in the Bitcoin Blockchain can be associated with a salary through the heuristics herein presented demonstrates a host of new challenges and opportunities. This article presents the first step in the determination of what this paradigm shift will ultimately have in store for the way we relate and interact with one another through one of the oldest social technologies, money.