“The Future of Financial Services,” a 178-page report released on June 30 by the World Economic Forum, explains one of the greatest advantages of FinTech firms. They have the ability to reduce friction by using the most innovative software and technology. Jesse McWaters, project manager of the Center for Global Industries, World Economic Forum, said:

“Today’s innovators are aggressively targeting the intersection between areas of high frustration for customers and high profitability for incumbents, allowing them to ‘skim the cream’ by chipping away at incumbents’ most valuable products. It is hard to think of a better example of this than remittance — banks have traditionally charged very high fees for cross-border money transfers and offered a poor customer experience, with transfers often taking up to three days to arrive at their destination.”

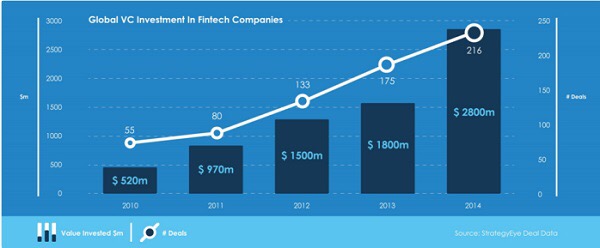

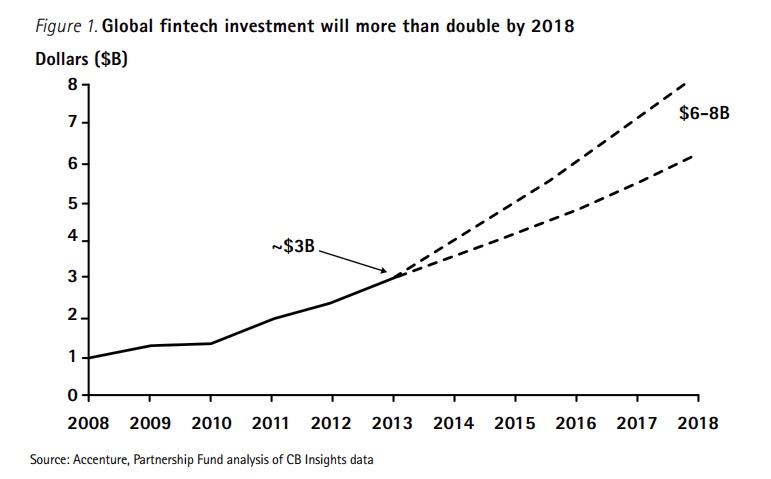

To illustrate how fast global FinTech is growing, total financing in 2008 was less than US$930 million. By October 2014, it had grown to over US$1.04 billion in that month alone. Some raise the question whether this growing ecosystem should form partnerships within the existing banking system. The real question, however, is whether the traditional financial sector can even adapt. Andreas Antonopoulos said in March at the MIT Bitcoin Expo 2015:

"Where do we go when the era of Central Banking dies? Because it's about to die — by decentralized organisms that are dynamically scalable and software that can be modified. I am very confident that software systems can and do adapt dynamically."

Reshaping Banking

In a banking report, the “Future of Finance,” Goldman Sachs analyst Ryan Nash noted that “new technologies are among the top factors [that are] reshaping the traditional banking sector.” Most FinTech environments are exploding globally. A recent survey by customer experience company Accenture finds that global investment in financial-technology ventures tripled to US$12.2 billion in 2014. The survey suggests the old financial industry is not yet ready for the radical changes brought by these new ventures, although as a matter of survival, they are trying to understand. Accenture says:

“Core banking must be adaptive, ready to adopt new business models and leverage new technologies.”

Banks from all around the globe are doubling efforts to enter this arena. Mastercard announced in May its own peer-to-peer remittance service called MasterCard Send, an attempt to duplicate its counterparts in the financial tech world. In the same month, during a US$50 million investment round, Goldman Sachs pumped up Circle Internet Financial, Inc.'s funding, putting the company's name into the minds of watching investors.

In June, the Singapore monetary authority started a blockchain record-keeping project. Last year, Barclays launched a FinTech incubator as well. A graduate from the Barclay team, Aneesh Varma — co-founder of Aire, a credit score startup — said:

“Most of the financial ecosystem depends on common protocols. Having one bank as a ‘buddy’ gives you a head start over your competition and helps reassure clients and consumers that you’re okay to do business with.”

Problems Adapting

Many think it’s helpful for FinTech companies to work with traditional financial institutions, although the most vocal opinion is that the financial sector is not yet ready to adapt or regulate these technologies in a way that’s helpful to both tradition and innovation.

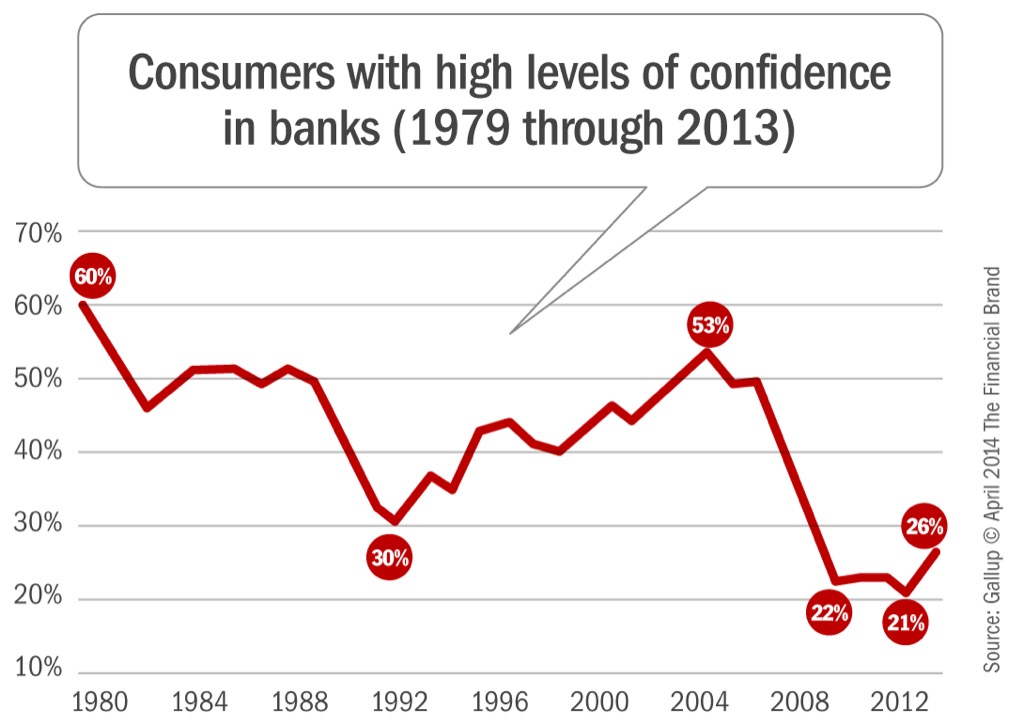

A survey by Accenture found that more than a quarter of U.S. customers have thought about changing their financial service providers after experiencing growing dissatisfied with their own banks. Decentralization techniques are now often the default in new platforms. Many of the creators of the technological revolution are not asking for permission. They are going ahead with building the applications and providing their services.

The emergence of FinTech startups is heavily related to often harsh regulation surrounding the finance industry. FinTech companies often have different sets of policies regarding operations. Slow-moving financial regulators can’t adapt quickly enough to new technical innovations, so new businesses are often able to operate under the radar from governments for a period of time, using it to their advantage, to collect capital and to network without regulatory hassle.

The banking industry must stand on previous foundations made by policy makers, but also learn to adapt to this new environment quickly. McWaters says:

“Innovators are also using their technical skills to automate manual processes that are currently very resource intensive for established players. This allows them to offer services to whole new groups of customers that were once reserved for the elite.”

-This graphic describes the six key “innovation clusters” in the World Economic Forum report