Facebook Announces PGP End-to-End Encryption Used by Snowden

Facebook has announced experimental implementation of cryptographic encryption and authentication tool PGP.

The new feature would allow users a specific place to publish their PGP keys on their Facebook profile. In addition, users can also request all notifications and sensitive emails to be encrypted using Facebook’s publicly posted PGP key.

"Facebook's move comes amidst a turbulent international debate on privacy spawned by the Snowden leaks and which have lead to massive market pressure on US tech companies to the tune of up to US$180 billion projected losses of revenue or about 25% of their market."

Apple Approves New ‘Game of Birds’ App with Bitcoin Tipping

Apple has approved a new game that incorporate a tipping function for players to receive in-game rewards called Game of Birds.

Our new Bitcoin tipping game is live "Game of Birds" on iOS t.co/M9rMMG36HM Tweet with the hashtag... t.co/58da9lf0WT

— Christian Moss (@MandelDuck) May 29, 2015

The Bitcoin Community Reacts to the NY BitLicense

This week, the New York State Department of Financial Services released the third and final revision of its BitLicense proposal.

Cointelegraph reached out to the Bitcoin community to have their reactions.

According to Jesse Powell, co-founder and CEO at Kraken:

"The heavy compliance costs on digital currency exchanges will make it much more difficult to operate a profitable exchange in the state. Many fear it will stifle innovation in the industry and exclude New York from the developing currency"

Chinese Exchanges Reject Gavin Andresen’s 20 MB Block Size Increase

Two of China's biggest bitcoin exchanges - BTCChina and Huobi - have criticized Bitcoin Core developer Gavin Andresen's proposal to raise the block size limit to 20 megabytes by next year.

Speaking to Cointelegraph, BTCChina's director of engineering Mikael Wang, said:

"An increase in block size to 20 megabyte would increase operating costs for miners and likely negatively impact the block orphan rates. Higher costs would be propagated to miners and then we may face a scenario where miners cannot run their operations profitably, causing some miners to cease operations. Fewer miners would lead to a decrease in the hash rate, thereby increasing the risk of 51% attacks on the network."

Deutsche Bank Set to Launch 3 ‘Innovation Labs’ to Accelerate Fin-Tech Startups

German global banking and financial services company Deutsche Bank is set to launch three startup innovation labs in Silicon Valley, London and Berlin to accelerate fintech startups.

According to the bank's chief information officer Kim Hammonds, out of the 500 startups, 50 will be implemented either by Deutsche Bank or by the bank's clients.

"The bank plans to partner with Microsoft in Berlin, HCL in London and IBM in Silicon Valley to manage the startup innovation labs. The three companies will provide their expertise, relationships and resources needed to run the startup labs."

Elsewhere

The Ecuadorian government has ordered all local financial institutions to adopt a state-sponsored digital currency. The nation’s central bank has given banks and other players 360 days from May 25 to include it in their products.

A Commercial Court in Kampala, Uganda has ruled that mobile money operations by five telecommunication companies in the country are illegal, reported local media outlet New Vision. This stems from the fact that they handle money while they are not registered as financial institutions under the country’s laws.

Mike Hearn, a Bitcoin core developer and former employee at Google, claims that Google's own hierarchy is limiting the company from using bitcoin. Hearn conducted an AMA on ZapChain where he said:

"Google and Bitcoin hits problems with their internal politics, I'm sad to say. One middle manager there (who shall remain nameless) hates Bitcoin and has the ability to veto most kinds of work Googlers could do on it."

New Bitcoin ATMs

In New York City, two new Bitcoin ATMs were installed this week. The first device, a one-way Cash2BTC bitcoin ATM, is located at the Bitcoin Center NYC, on 40 Broad Street.

The second machine, a one-way Genesis Coin bitcoin ATM, was installed in the Whitehall Terminal of the Staten Island Ferry (South Ferry). The machine is operated by CoinSource and charges 7% per transaction with a daily limit of US$8,000.

In Chicago, the two-way Genesis Coin that was formerly located at Seven Ten Lanes, was moved to MP Mall, on 3973 W Madison. Operated by Red Leaf, the machine is limited to US$2,500 for buy and sell order, with a daily limit of US$7,500.

In Montreal, Canada, a one-way Lamassu bitcoin ATM went live on Friday, at Euromarche supermarket, 11847 Rue Lachapelle. Operated by Instacoin, the machine currently has a buy rate at CA$307.97.

In Australia, a new one-way Lamassu bitcoin ATM was settled at Tank Street Labs, a co-working place in Sydney, on 17-19 Bridge Street.

Awesome to see a Bitcoin ATM in the kitchen at @TankStreamLabs #coworking #sydney #tour #GCUCAU pic.twitter.com/1LSlf0KkHm

— The BizDojo (@BizDojo) June 5, 2015

On Thursday, the Pompey Fabra University of Barcelona announced it has installed a bitcoin ATM on its campus located in Poblenou (Barcelona). The device, scheduled to start running from June 15, is a two-way BTCPoint bitcoin ATM located at the UPF Communication Campus Poblenou, Roc Boronat, 138. The bitcoin ATM is limited to 1,000 EUR per transaction.

In Spain still, another two-way BTCPoint was installed earlier this week in the city of Malaga, in the Vialia shopping center, calle de la Explanada de la Estación. The machine is limited to 1,000 EUR per transaction and doesn't require ID verification.

Market Activity

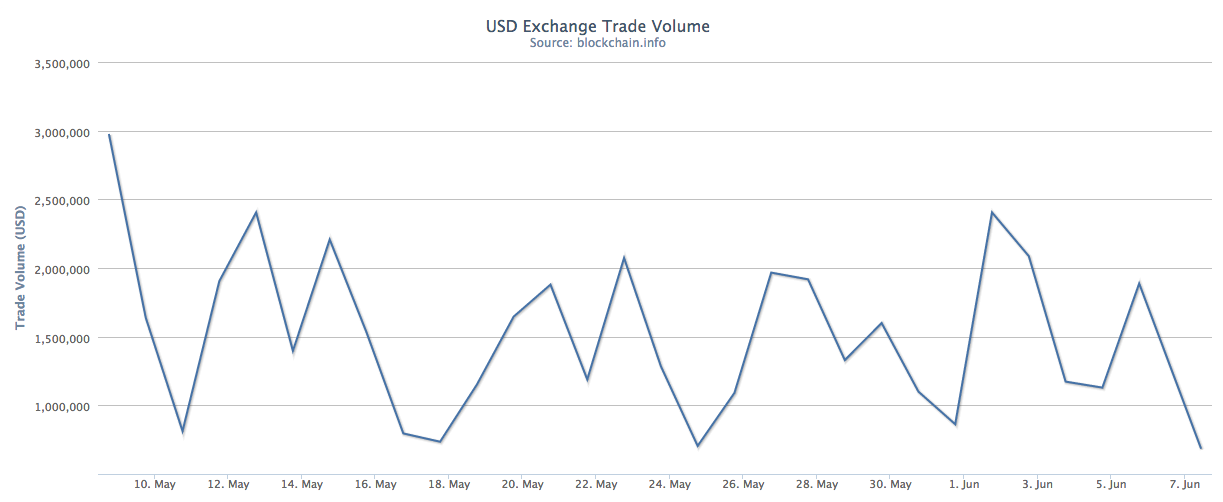

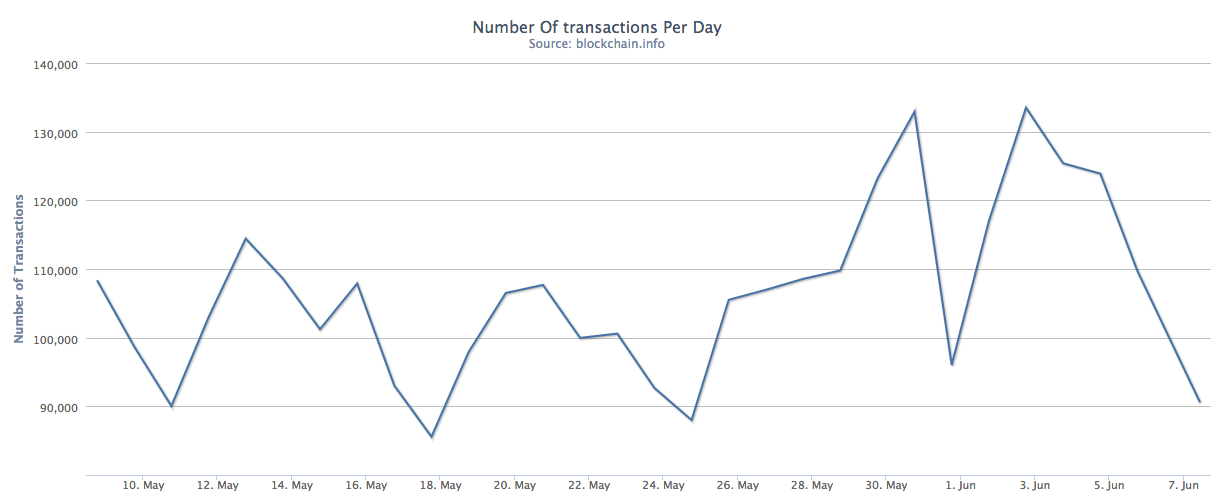

On Tuesday, the number of bitcoin transactions reached an all-time high with more than 133,000 bitcoin transactions occurring that day on the network, according to Blockchain.info data.

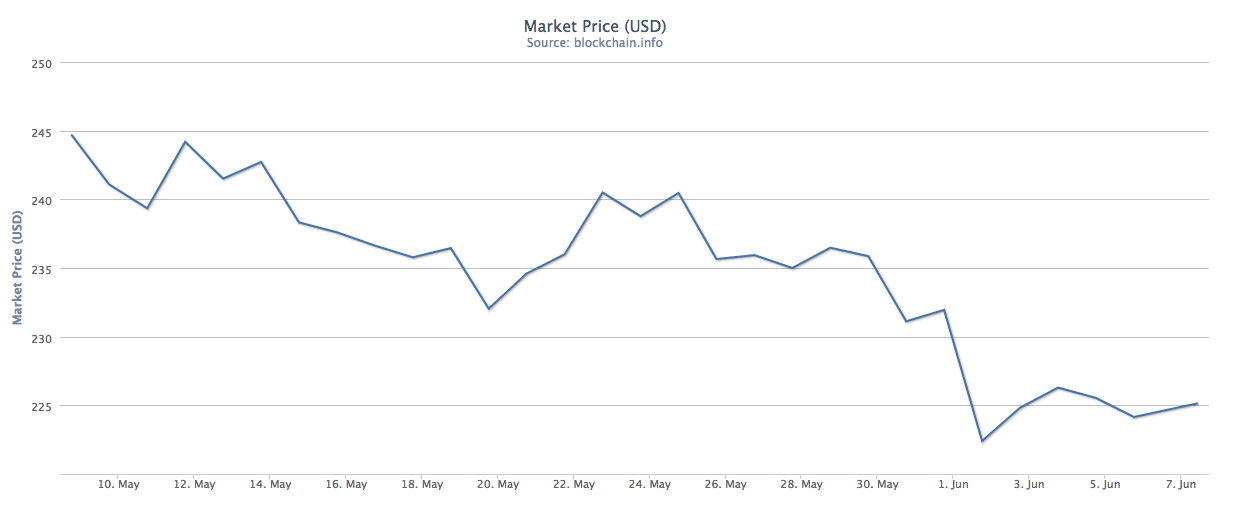

While the number of transactions is experiencing a long-term rise, the bitcoin price has headed lower this week, trading at the time of this writing at 225 USD/BTC, a 2.6% decline from last week (231 USD/BTC).

Earlier this week, we reported that the bitcoin price has broken below some significant levels and is looking like it should be testing lower major levels soon.

Overall, the price is still in a primary downtrend and the big move that we were looking for finally happened. As we wrote in our price analysis:

"The price didn’t hold above US$235 and US$230. Momentum and volume are beginning to pick up to the downside. This is not what the bulls wanted to see."