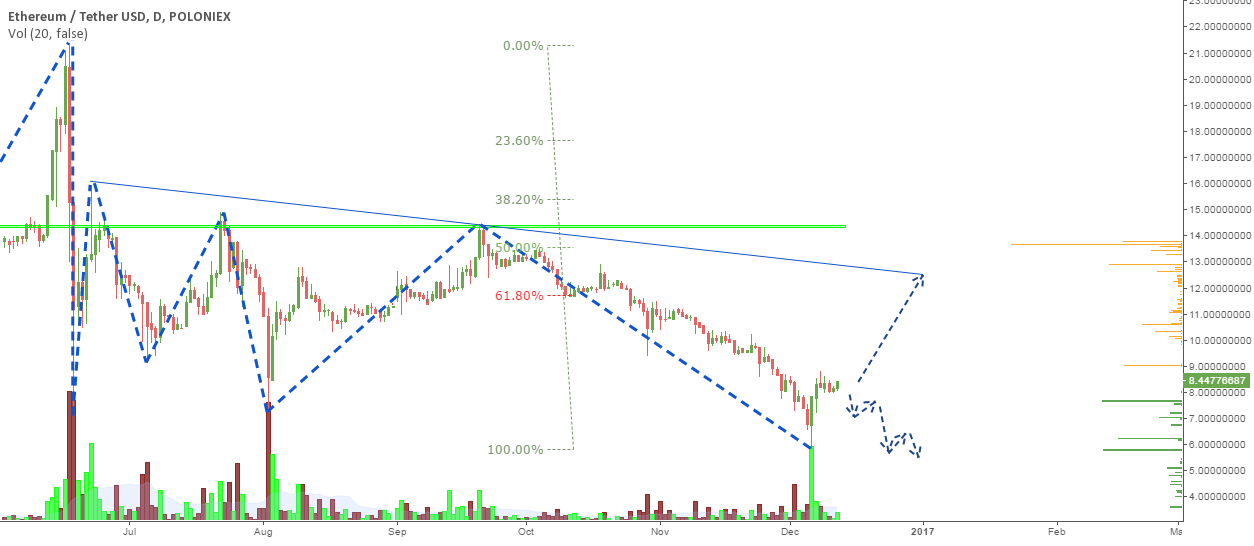

The long-term direction of the trend is being decided at the current level. The bulls are at the bottom limit of the flat, so the growth of Ether’s price can continue up to $13 - 14.

ETH/USD

As we have predicted a week earlier, there was a rebound from the bottom limit of the long-term sideway movement, and Ether’s price has stopped at a key medium-term level of $8.3. The price has previously dropped right before this. At that moment big sellers have taken advantage of the situation and sold a large volume close to $7. After that, they started buying it back at $6. The fact that there was a reaction at the bottom limit is indicative of the existence of support for the upward trend. However, for more confident growth, ETH has to break through the level of $8.3.

A stop near $8.3 is a decisive point for the long-term trend.

Due to the peak of the downward movement which is situated currently near $6 turnout may be limited to the long-term downward correction, which started this summer, the long-term trend can keep rising to at least $20. If someone were to buy now that would result in a profit of 230%. There needs to be an observation of confirmations at key points. First, we need a turning wave at the current level of $8.3. The upward turn structure can provoke the long-term wave of the flat into growing up to $13 - 14. A key long-term resistance is demonstrated at that level. As we can see, a large volume of Ether’s sell orders is concentrated above the diagonal channel. Accordingly, a new rebound can take place near $13, and the price will start forming a new wave of the flat. In a conservative scenario, the price has to confirm the growth towards $20 by fortifying and forming a turn near $13. However, this scenario may not be realized if a big buyer appears on the market. In this case, the price of Ether will break through a key level at $13 - 14 and continue growing without any significant rebounds.

If the price fortifies at $8.3 and forms a downward turn at the level of $6, the declining trend may continue until $3.5. For this to occur there needs to be an upward rebound not higher than $11. The inability of the price to grow beyond $11 will disrupt the structure of the long-term flat, which will indicate that the bears are holding the advantage. After that, there needs to be a confirmation in the form of a downward turning wave, which has to fortify at $6. Under such conditions, the downward trend will stand a better chance to continue.

At the moment, considering the current distribution of sell orders, the downward movement will most probably be flat-like.

ETC/USD

For the first time in 4 months, the growth of Ethereum Classic can grow into a larger upward trend. After several unsuccessful attempts, ETC’s price has managed to fortify near $0.83. This movement was followed by a natural growth towards the next most significant level near $0.95. This mark is significant because a medium-term upward trend can start from it. In turn, that trend can possibly grow into a long-term one.

In the case of a medium-term growth, the minimal targets will be close to $1.5. The long-term scenario will be decided at that level. However, in order to reach that point, the price of Ethereum Classic has to fortify at the current level and form a turn the same as it had at the previous resistance line of $0.83. In the case of fortification, it is imperative that the price does not go below $0.84. Otherwise, the structure of the upward trend will be broken and the long-term downward trend will continue in a flat-like movement.

With key technicals, where a change of trends occurs it is likely that:

- If an upward turning wave is formed and the price makes a turn near $8.3, Ether will be likely to grow at least towards $13.

- A fortification and upward turn at the current level of Ethereum Classic can result in a period of growth until $1.5.