Are Ethereum developers to blame for The DAO hack? Is Ethereum’s price ready for long-term growth, or will the negative news negatively impact the ETHUSD market?

Time to choose a long-term direction

Cointimes news platform has accused Ethereum developers of being partially guilty in the theft of 750 thousand ETC. The money was distributed across several exchanges. Poloniex was used to withdraw a large part of 500 thousand ETC. The rest 250 thousand were transferred to accounts on the Kraken exchange. However, the exchanges’ administrators have frozen all assets which they’ve received.

It’s worth noting that the Ethereum Foundation denies all accusations levelled against it, and that the funds were transferred after multiple complaints from the holders of The DAO assets. Ethereum Foundation representatives claim that the transfer was conducted in secret in order to avoid speculation and misinterpretation. The funds are left to stay on the exchange accounts, with parts on wallets, whose addresses were revealed to the public. The developers claim that they are doing everything in their power to resolve the current situation ASAP.

Ethereum price situation

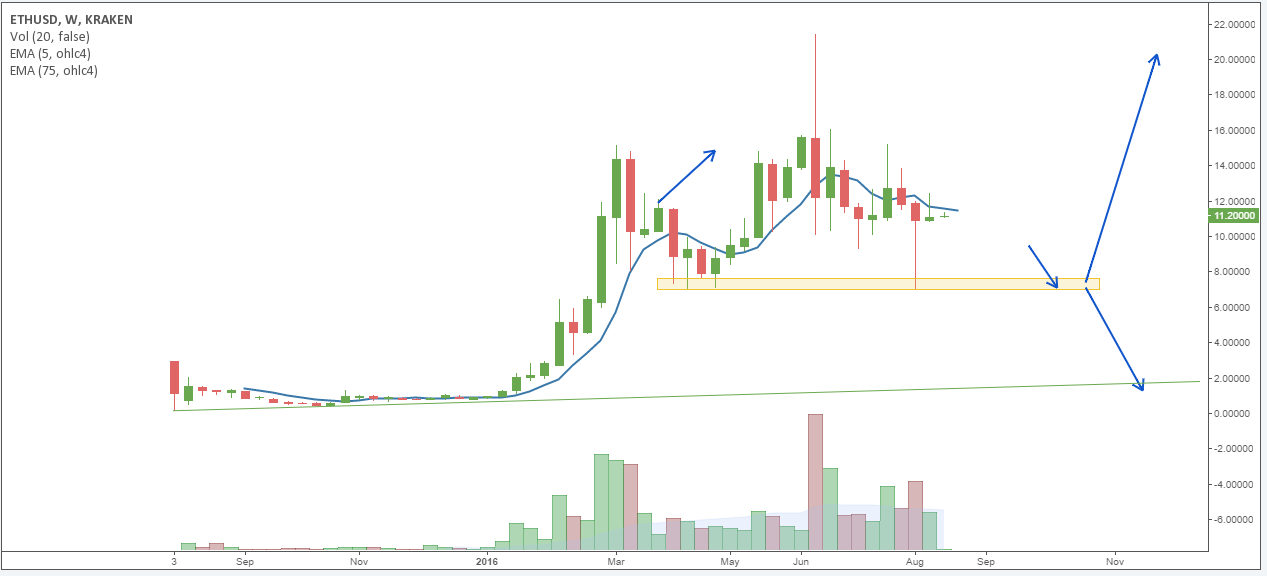

Ethereum’s price has stopped and rebounded from the key level we’ve found near $12.5. The market will decide wether the flat will continue or Ethereum’s price will begin a deeper fall at that mark. In that case, the long-term resistance line will be near the accumulated volume area at $5.

The level, where ETHUSD is being traded at the moment, could prove decisive, because the choice of the long-term direction (change of cycles) usually happens in points like that. As is known, one cycle is always changed by another one. We’ve said, and, more importantly, showed that many times. The downward movement has become of a larger scale than the last subwave of the upward trend. That means that there is a movement of a larger scale underway.

That’s why we have three possible scenarios: continuation of the long-term growth, continuation of the long-term correction, and a flat.

In the first scenario, Ethereum’s price has to pass at least two key levels: $12.5 and $14. And the price can ignore the latter outright, if there is enough volatility. Still, the $14 mark is worth paying attention to, for more conservative traders. A fortification and a turn at the level of $14 will cancel the continued flat scenario.

Just as a fortification and a turn at the level of $12.5 will cancel the deeper fall scenario.

Ethereum Classic situation

ETC price has formed a deeper correction and stopped at a new key resistance. We can already tell that a flat wave has formed between the limits of $1.5 and $3.5. In order for the ETC price to continue going down, it has to prevent the upward flat wave scenario. For that, the price has to fortify at a key level for this downward trend.

The reaction of the price is the highest, when most traders start opening their deals. There are several such levels, and their intersection gives a powerful signal. That’s why the intersection area of a diagonal channel, accumulated volume and the Fibonacci level will be decisive. The $2.3 mark will show the most likely outcome. If the price of ETC fortifies at that mark, it will indicate a bullish sentiment. The advantage will be on the buyers’ side, and if the price forms a turn at that level, a wave of growth at least towards the next flat wave between $3.2-3.5 will be likely. Alternatively, if a rebound forms and is followed by a turn to decline, the odds will be on the side of a downward trend. In that case, ETCUSD will head towards its original positions.

Key technicals:

The $14 mark is the most important level for Ethereum. Long-term growth can start from $12.5, but the level of $14 will still be a final confirmation.

The key level for Ethereum Classic is $2.3. The downward trend can be changed at that level.