Grayscale Investments has officially made the long awaited Ethereum Classic Investment Trust available to investors on the market. The firm announced on Wednesday that the fund is live for accredited investors.

The fund is not the first offer from the firm. Barry Silbert introduced a similar fund for Bitcoin tracked shares as early as in 2013.

The fees differ though. While the Bitcoin Trust has an annual fee of two percent, the new Ethereum Trust is at three percent this includes a one percent “development contribution” that Silbert announced. This will go to development and marketing of the currency for the first three years.

1/ ANNOUNCEMENT: 1/3 of @EthereumTrust mgmt fee will be donated to Ethereum Classic development, marketing & community activities for 3 yrs

— Grayscale (@GrayscaleInvest) March 31, 2017

Conflict of interests

The initial capital comes from Silbert himself, Digital Currency Group and Glenn Hutchins who is the co-founder of private investment company Silver Lake.

When the fund was initially announced, some within the community raised questions about a possible conflict of interest, or rather the influence of the fund via Digital Currency Group.

DCG has business interests in news provider CoinDesk.

ETC price skyrockets

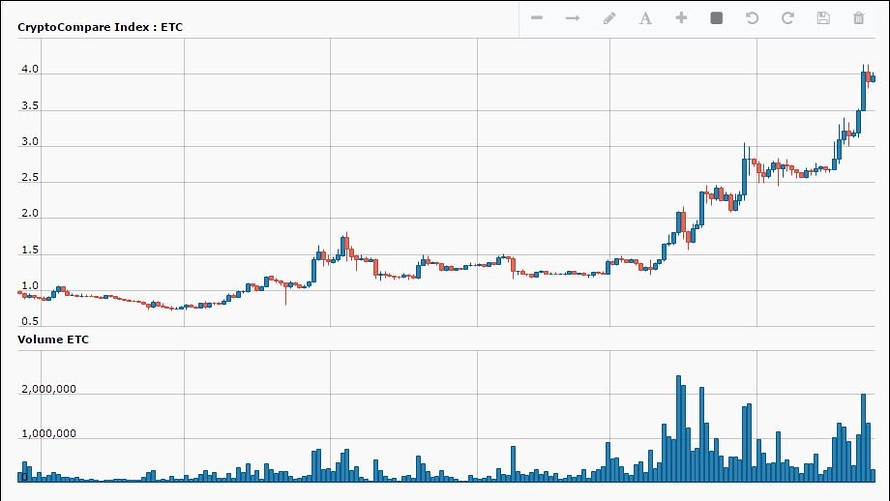

The trust was announced to the public in early 2016 and immediately caused waves in the ETC market, which was depressed since the fork of Ethereum/Ethereum Classic. The anticipation of the fund going live has already caused a surge of over 200 percent over eight weeks for the $419.1 mln market capital of ETC.

Silbert explains to Reuters:

“We’re excited about the Ethereum Classic, as opposed to Ethereum because ETC has a fixed supply and the potential to serve the smart contract and micropayment layer to the Internet of Things.”

All eyes on SEC

Although the Winkelvoss application for an ETF was shot down, the cards are back on the table.

As Cointelegraph reported, the SEC is reconsidering a number of exchange traded funds that could be made available to the public. Ethereum’s possibility has gained renewed interest after it was pointed out that the digital currency is not purely a store of value.