Pioneering gold and Bitcoin investment firm DigitalTangible has announced it is diversifying into the market afresh – by offering peer-to-peer exchange for gold.

The feature, made possible via a listings service of trusted custodians, will allow users to potentially search out and seal trades with zero commission. DigitalTangible’s existing method, using catalogs from partner dealers Agora Commodities and Amagi Metals, will still be available with the lowest premiums starting at 1.87%.

“The strong demand and immense success of our initial sales volumes push us to expand our capabilities in serving the customer who lacks a well-established marketplace for buying and selling gold with speed, transparency and liquidity,” founder and CEO Taariq Lewis said in a press release issued today.

- Taariq Lewis

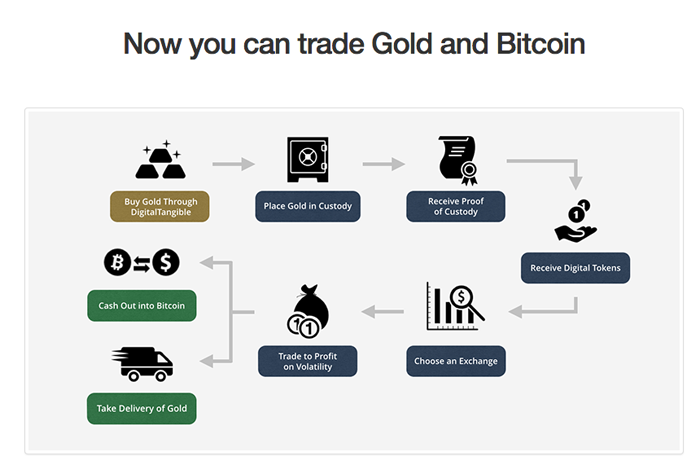

Lewis’ model uses a patent-pending Proof of Custody service to allow customers to purchase gold, have its value linked to the Bitcoin blockchain and then to ‘swap’ its volatility for that of Bitcoin’s. Investments in gold can also be delivered at any point during ownership, and can even be sold for cash at will, without the need for a third party.

The launch of user-to-user listings, DigitalTangible is also adding another layer of autonomy to its trading service while ensuring transparency with the support of its existing framework. Lewis added:

“Online gold marketplaces already exist, but we are now lowering the marketplace transaction costs borne by investors; something that was previously impossible to deliver.”

In addition to its major update for purchasing, DigitalTangible will also unveil live listings for precious metals including gold, silver, platinum and palladium priced in Bitcoin, which will be accessible anywhere in the world.

However, it is not just DigitalTangible which is making headlines when it comes to commodity investment with Bitcoin. Its partner, Amagi Metals has previously been in the spotlight after it announced its intention to stop accepting USD for precious metals purchases by 2017.

“History shows that paper currency, backed by nothing of value, will ultimately fail. It’s only a matter of time until no one will be accepting the dollar,” Amagi CEO Stephen Macaskill said in a press release last month. “By trading exclusively in cryptocurrencies, we’ll still be in business when that time comes.”

Whether digital currency propagation by that time has markedly increased or not will not matter for the scheme, as Amagi will allow customers to instantly sell fiat on its website for Bitcoin, following which anyone will be able to trade.

Did you enjoy this article? You may also be interested in reading these ones: