The Winklevoss twins’ Bitcoin ETF COIN was officially rejected by the SEC on March 10. Yet, the demand for Bitcoin in major stock markets is still on the rise.

UK-based regulated investment manager Global Advisors previously launched two exchange-traded notes (ETNs) listed on the NASDAQ OMX in Sweden. The two ETNs represent the price and the value of Bitcoin as they are traded in the heavily regulated Swedish NASDAQ stock market.

Daniel Masters, Global Advisors chief investment officer, recently told CNBC in an interview that the demand for the two Bitcoin-based ETNs had been rising rapidly amidst Bitcoin’s recent rally. Although Bitcoin price has fallen from its peak, it stabilized in the $2,300 region, which is still significantly higher than its price at the beginning of the year.

“The interest is just going stratospheric”

Year-to-date, Bitcoin has gained around 140 percent in value, surging from $900 to $2,300 within six months. During the interview, Masters stated that “the interest is just going stratospheric," particularly amongst brokers and fund managers that have been purchasing Bitcoin ETNs on behalf of their clients. Over the past few months, Bitcoin has proven its practicality and viability as a safe haven asset and to avoid potential economic uncertainty, both investment firms and individual investors have been purchasing Bitcoin.

One of the most popular Bitcoin-based ETN on the Swedish market is XBT Provider, listed on NASDAQ Stockholm and approved by the Swedish FSA. Each share or ETN represents five percent of a Bitcoin. Each XBT share or note is traded at around $98 euros and Swedish investors have been purchasing ETNs such as XBT Provider to hold onto Bitcoin as a long-term investment and safe haven asset.

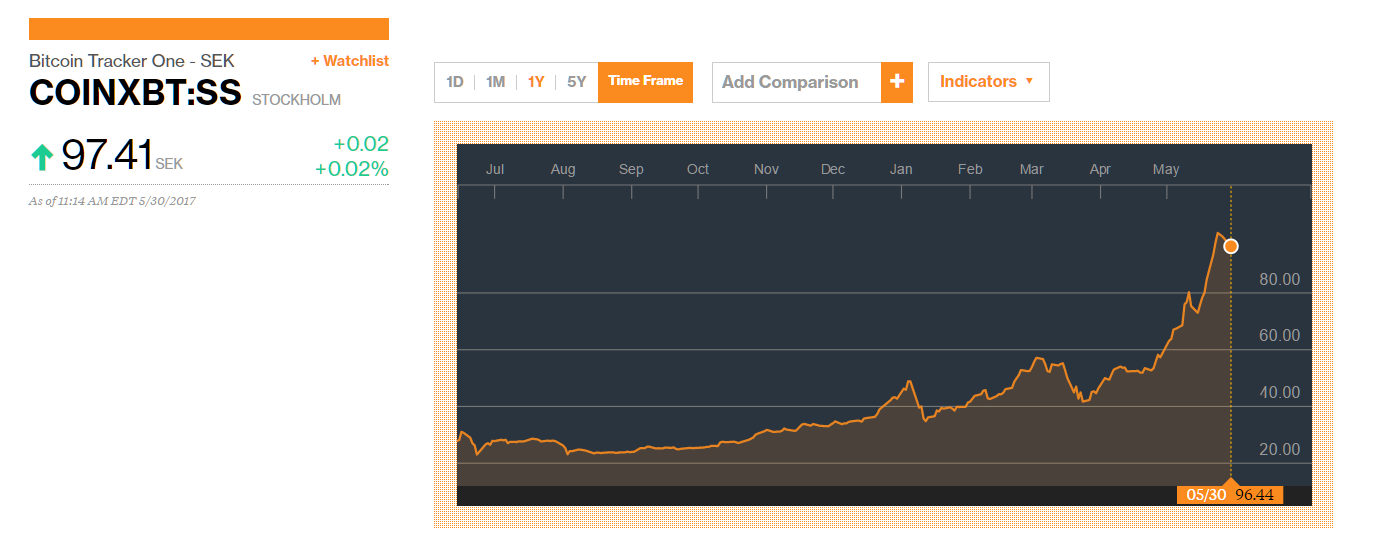

Another popular Bitcoin ETN on the Swedish market is the Bitcoin Tracker One that is also listed on NASDAQ Stockholm. Since last year, the price or the value of Bitcoin Tracker One has increased from 26.30 to 96.44 euros, nearly quadrupling in price.

The growth of Bitcoin in Sweden and Europe will be sustained

The demand for Bitcoin is increasing at a rapid rate internationally, as the adoption rate of Bitcoin has increased significantly since last year. Japan’s legalization of Bitcoin, Australia’s elimination of double taxation on Bitcoin and the Philippines’ recognition of Bitcoin as a currency and remittance method have all fueled the growth of the global Bitcoin industry.

More importantly, as the Bitcoin exchange market has now begun to be regulated by governments, hedge funds, institutional investors and large-scale conglomerates have started to take interest in Bitcoin as both a digital currency and safe haven asset.

Although the US Securities Exchange Commission (SEC)’s previous rejection of a Bitcoin ETF disappointed investors in the US, on a global basis, Bitcoin’s liquidity remains high in both public markets and exchange markets.

Investment firms and executives including Masters believe that the growth of Bitcoin in Sweden and Europe will be sustained and the demand for Bitcoin from institutional investors will continue to increase in the long run.