Investment platform Cyber•Fund provides a tool for asset management in different crypto-projects. The project has just launched a crowdfunding campaign to raise money for the future improvements of its service.

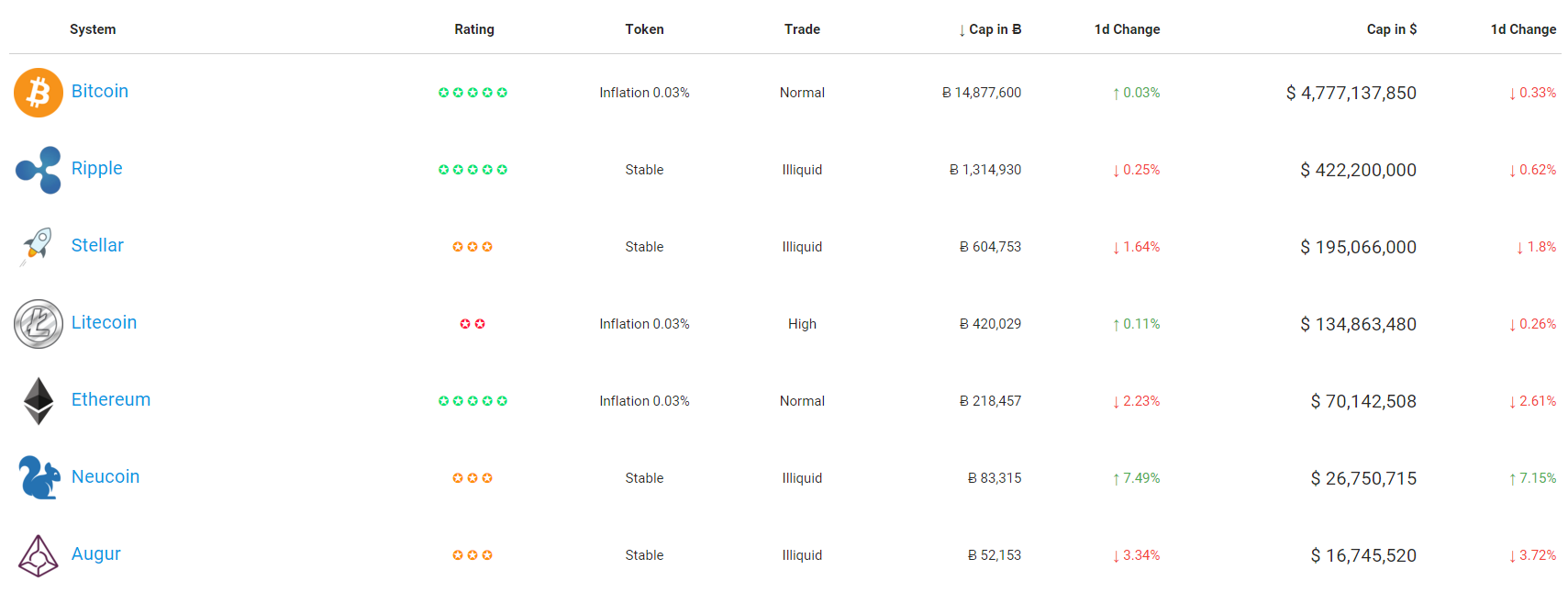

The Cyber•Fund project was launched in August 2015 with the introduction of a rating system with automatic updating in real time. The rating system showed detailed asset information, including liquidity ratio, market capitalization, inflationary features and specifications.

Cointelegraph spoke with Dima Starodubtcev, founder of Cyber•Fund, to find out more about the fundraising:

CT: Who is the Cyber Fund project created for, and what is your mission?

DS: The platform was created for people who already possess shares (or tokens) in at least 3 different blockchain projects and are going to expand investments and thus need a tool that can track money real-time and simplify due diligence. So our mission is to make crypto investments comprehensible, accessible, easy and safe.

CT: What benefits will people who take part in this crowdfunding receive? How are you organizing the fundraiser?

DS: Benefits include tokens that allow investors to get services from the platform as well as the opportunity to accumulate investment gains. Crowdfunding is organized using all best practices that the industry has gathered recently. All funds go into a multisig address. All spending from the crowdfunding address is transparent. Reporting is organized using the Cyber Fund platform itself. Tokens are issued using the Open Assets Protocol, thus you don’t need to trust us as tokens will be distributed. You can use a Coinprism wallet for securely storing CFUND tokens.

CT: In your opinion, what is the size of the investment market at the moment?

DS: We estimate that the market of blockchain investments is about 1/200 of it’s economy. That is about 100k bitcoins. We don’t count investments using fiat currencies as we are not going to operate there in the near future.

CT: What do you think about investing in existing projects and how risky is it?

DS: From one side it is very risky as any venture investment. Soon will I release a paper about crypto property evaluation where I’m going to offer a systematic approach for risk assessment.

It depends on the design of a project. I do believe that some projects by design have low long-term investment risks as they are technology superior, have confident signs of establishing network effects, resilient and trustless by design (Ethereum, BitShares). Some projects could not brag with this. Thus SAFE Network still not launched so MaidSafe team could run out of cash and a network remain a dream. General advice is to forget about better cryptocurency approach and think in terms of the internal value of tokens: What is unique that a token could offer that others could not. But of course that is not the only right question.

CT: How many people are in your team and what are your future plans?

DS: Our project has 4 founders, 3 of them working on the project full time. Also, 1 developer involved full time. We see early interest from dev community so at least 2 more devs working on the project part time. We are going to focus on building a kind of Uber of blockchain investing. From one side we have founders who need money, and from the other side we have a investment crowd who want to maximize returns while minimizing risks. All that will be necessary to deliver on this idea will eventually be done. To accomplish this we want to get the best from working technologies and mix it in with a usable and trustless Dapp. For example we are considering Factom as a decentralized and cheap data layer for a system of blockchain reporting. Ethereum contracts will be used to run agreements. and BitShares could be used to offer the possibility to invest in non-blockchain companies such as Google and Uber using market-pegged mechanics.