On June 27, a major correction in the cryptocurrency market occurred, bringing the market cap of the cryptocurrency market below the $100 bln region.

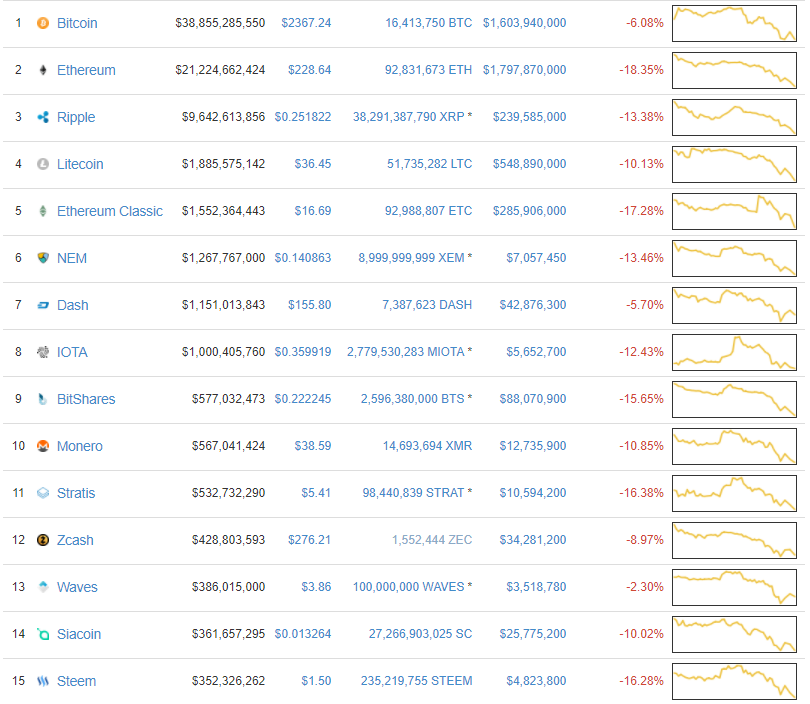

All top 30 cryptocurrencies fell significantly in value, recording nearly 20 to 30 percent decline in market cap. Bitcoin and Ethereum, the two largest cryptocurrencies, also recorded substantial decline in value.

Bitcoin’s drop in value

As demonstrated by previous cryptocurrency market corrections, the decline in Bitcoin price has always led to the correction of the entire market.

Thus, when Bitcoin price fell from around $2,700 to $2,370, the cryptocurrency market underwent a major correction, with Ethereum falling from around $30 bln to $22 bln in market cap.

When evaluating the short-term fall of Bitcoin price, it is important to consider the analysis of two financial and security experts, Max Keiser and Andreas Antonopoulos.

On June 15, after a minor correction, in response to the inquiries of investors and traders regarding the fall of cryptocurrencies in value, Antonopoulos wrote:

“Some of you are wondering "why are cryptos crashing like crazy?" Yet you didn't ask "why are cryptos climbing like crazy?" That's why.”

The value of Bitcoin and other cryptocurrencies are solely based on the demand of the market. Hence, like any other market, the value of cryptocurrencies alter based on the rise and decline of demand from the market. Therefore, if investors can’t justify the increase in the value of Bitcoin or other cryptocurrencies, it is likely that a market correction is imminent.

New peaks after corrections

Max Keiser, an American broadcaster and the host of RT’s Keiser Report, previously emphasized that Bitcoin has always had recovered beyond the previous peak in all of its previous market corrections. For instance, when Bitcoin price fell from $2,400 to $1,900 earlier this month, Bitcoin price hit new all-time high at $3,000.

For this reason, on June 20, Max Keiser noted that a new Bitcoin price all-time high of $5,000 is in sight. Especially since scaling issues will be addressed shortly and Bitcoin Core’s Segregated Witness (SegWit) can be activated without the execution of a hard fork that could lead to a split chain.

“New all-time high for Bitcoin in sight. Regulators will be twiddling their thumbs at $5,000, $10,000, and beyond. Welcome to NCO (New Crypto Order),” said Keiser.

Demand rising

There is an increase in demand for Bitcoin rapidly across the world, and an increasing number of governments and countries are starting to recognize, acknowledge and adopt Bitcoin as a digital currency. Most recently, Poland’s largest food delivery platform Pyszne that supports more than 5000 restaurants started accepting Bitcoin despite its rising fees.

Demand for Ethereum, Bitcoin, Litecoin, Ethereum Classic and other cryptocurrencies is rising at a rapid rate. Short-term market corrections are important to evaluate, but investors should not consider corrections as factors for long-term growth.