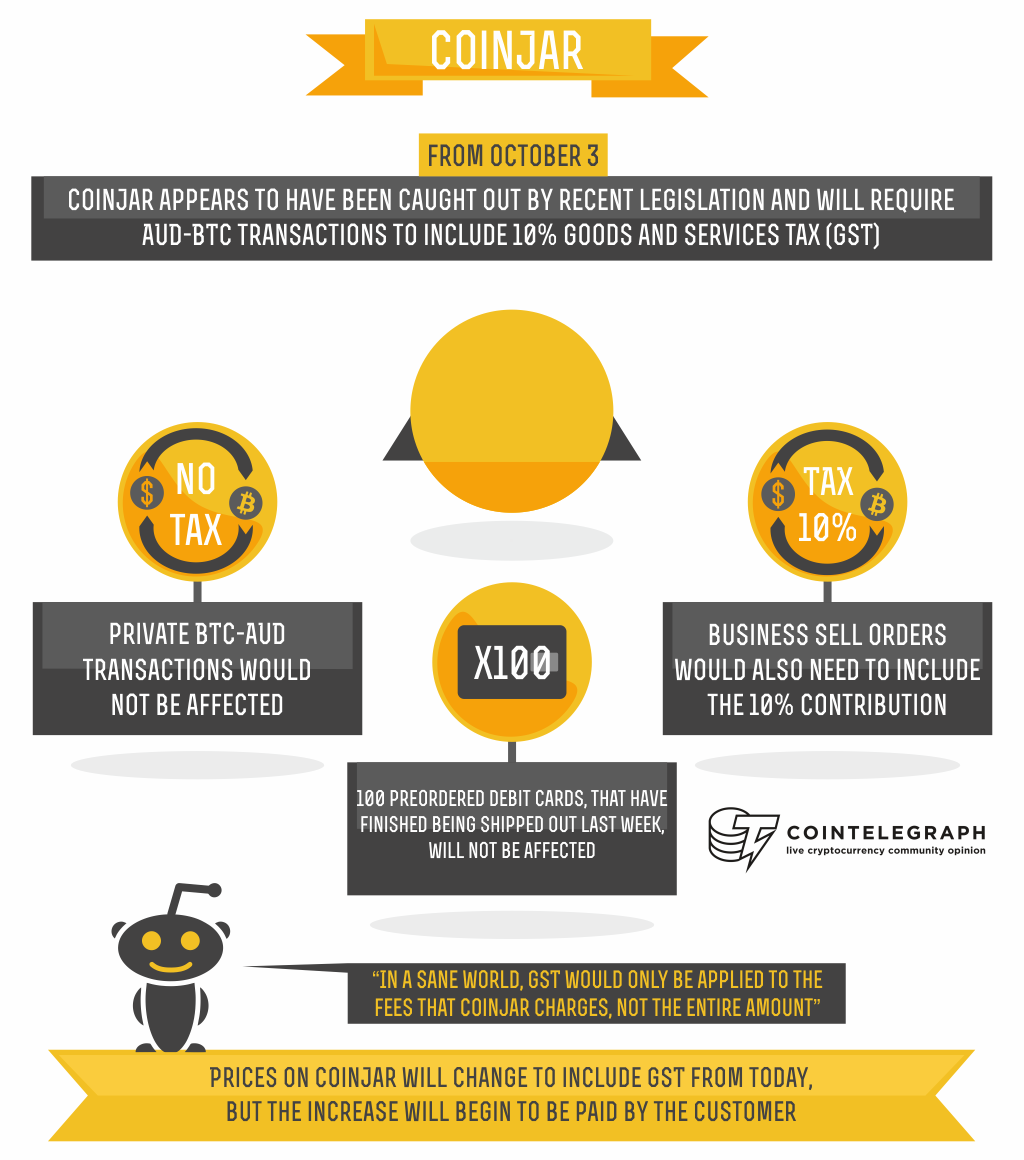

Following the launch of its Swipe EFTPOS debit card, Australian exchange CoinJar appears to have been caught out by recent legislation and will require AUD-BTC transactions to include 10% goods and services tax (GST) from October 3.

In a blog post released today, CoinJar stated that private BTC-AUD transactions would not be affected, but that business sell orders would also need to include the 10% contribution.

“We wrote previously about the steps we’re taking to understand [the Australian Tax Office’s (ATO)] guidance,” CoinJar writes, adding that the fees are “what they have determined” from the legislation.

Prices on CoinJar will change to include GST from today, but the increase will begin to be paid by the customer on October 3.

“In many ways the guidance has brought clarity to the position of Bitcoin users in Australia. However, we don’t believe the ATO’s guidelines are ideal for Bitcoin in this country,” it added. “We believe in a simpler financial system, and we will continue work with the ATO to help them discover a fairer position.”

The legislation in question is stated as “general guidance” by the ATO, and should apply to “crypto-currencies, specifically Bitcoin.” Altcoins are notionally covered by the same ruling, “where they have the same characteristics as Bitcoin,” it states.

While crypto-crypto transactions are unlikely to be affected, exchanges operating with AUD or providing AUD processing facilities to Australian citizens will seemingly need to conform to the tax requirement. CoinJar has stated its debit card, whose initial rollout to 100 customers out of a long preorder queue was completed last week, will not be affected, but that its wallet will unavoidably need to levy the 10% fee.

“Farewell, CoinJar. It was good while it lasted,” a popular Reddit reaction by u/platypuii reads in response to the news.

“In a sane world, GST would only be applied to the fees that Coinjar charges, not the entire amount,” u/murbul continued. “… This is going to kill (legitimate) Bitcoin adoption in Australia.”

Reactions from other sections of the Australian Bitcoin economy to be affected are still forthcoming, but just as with previous tax rulings elsewhere, it is safe to say that it will take a lot more before Bitcoin receives a lethal blow.

Nevertheless, given more hospitable environments in many parts of the world, most recently Europe, where the Bitcoin Foundation is concentrating its bridge-building efforts, the temptation for Bitcoin investors to flock to other markets is plain to see.

Community commentary

Sheree Ip (Academic in Digital Currency Law):

"I have spoken with Australian bitcoin companies and some have relocated, or are in the process of moving offshore, just to avoid the provisions of the GST and CGT legislations. The outcome of the draft determinations significantly affects bitcoin startups. With bitcoin it is a digital currency that is not subject to strict international borders, bitcoin companies recognise this potential and find more favourable jurisdictions, that suit their product and services.

" There is a broader Senate inquiry happening as a part of a Financial Systems Inquiry (which includes Bitcoin) with the main aim to reduce the red tape on all these policies. But no date has been set yet, due to a lot of inquiries before the senate in Australia.

Did you enjoy this article? You may also be interested in reading these ones: