Last weekend, seven Chinese financial regulators, including the People’s Bank of China, have published a joint decree, criticizing crypto token sales as “an unauthorized and illegal public distribution of financial tokens, the illegal issuance of securities and illegal fundraising, financial fraud and pyramid scheme.”

Such statement has been seen as the sign of total ban of ICOs in China.

Soon after regulators announcing their decision, several influential Chinese investors have responded with support.

"Li Xiaolai, the legendary Bitcoin investor as well as the co-founder of Yunbi, one of the world’s largest cryptocurrency exchanges, has shown his support verbally and practically."

What’s more, Li then halted all trading of ICOs in Yunbi, including QTUM, GXS, EOS, ANS, DGD, 1ST, GNT, REP, SNT, OMG, PAY, LUN, and VEN.

“The regulation of ICOs is necessary”

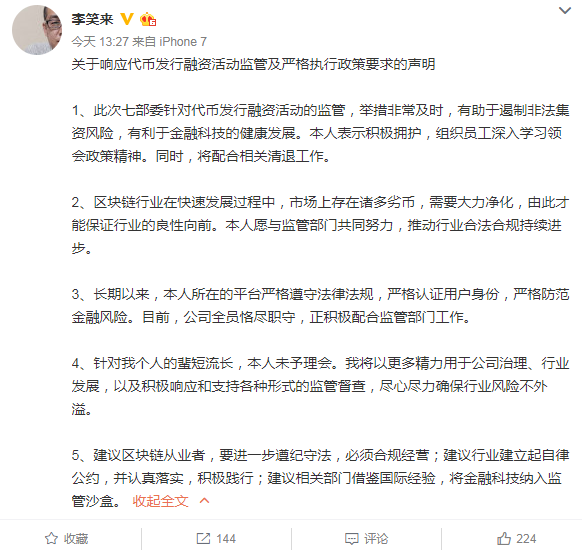

On his Weibo (Chinese Twitter), he posted that:

- “The regulation of ICOs is necessary and just on time. Such regulation can eliminate the behavior of illegal fundraising and promote the development of fintech in China. I advocate the decision and will do my best to assist government’s job.

- During the boom of Blockchain industry, a large number of unqualified coins have been created. For the better future of the industry, I am willing to cooperate with the regulators to eliminate those coins.

- My company has always been and will continue being the well-performed player in the market. We have strictly certificated our users’ information and fought against illegal behaviors, following the regulations and laws. Now, all my staff are working in front of their tables, cooperating the regulators.

- I will not respond to any rumor about myself. Instead, I will pay all my attention to my company and the industry. Besides, I will do my best to cooperate with the regulations, assuring that the risks are always under control.

- I suggest all Blockchain investors to follow the rules, and invest lawfully. I also suggest the industry to form a self-regulated treaty and following it in the future. Finally, I suggest the related government departments including fintech into the current financial regulatory system.”

- Alex Gao, Guest Author