The Chinese government took several measures in the past year to deal with the recent decreases to economic growth. The measures led the population to look for means to bypass them, and the Chinese government acted again to stop unlawful activities. The final result seems to be driving the adoption of Bitcoin.

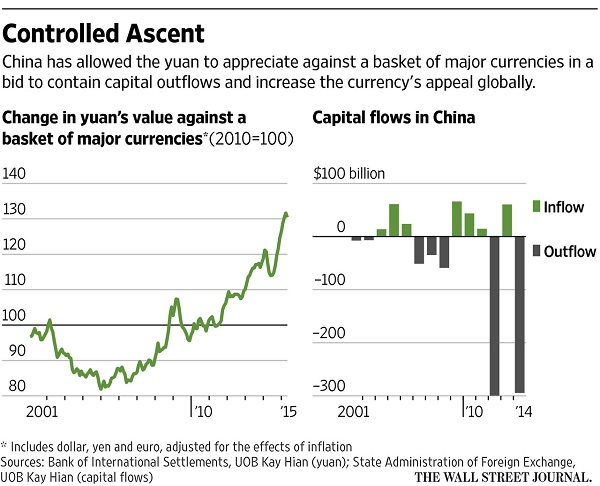

China’s economy is growing quickly, but the growth is also slowing down. Beijing’s government is dealing with one of the problems that are creating this situation: people are sending money to invest in other countries. In an effort to block this trend and stabilize the economy, the Chinese government has issued a yearly limit of overseas investments and has imposed a policy of Yuan devaluation.

The Long Economic Run Slows Down, sending Capital Outside China

A long economic rush has left China out of breath and the Beijing government has taken a series of measures this year to try to regain control of the situation. Two of these measures are most evident and shocking: a 50,000 Yuan yearly withdrawal limit and a devaluation of the Yuan up to a 2% in a single day.

“The restrictions apply to holders of UnionPay bank cards issued in mainland China. For the remainder of 2015, withdrawals will be limited to 50,000 yuan ($7,868). Starting in 2016, an annual limit of 100,000 yuan ($15,737) will apply.

UnionPay customers are also bound by an existing daily withdrawal limit of 10,000 yuan per card.

The new rules will apply to the vast majority of Chinese citizens, because UnionPay has a near monopoly on cards and card payments in China.

China already limits the amount of money an individual can move out of the country to $50,000 per year.”

“After recent Chinese data showed falling exports and a stalling manufacturing sector, the country’s central bank said on Tuesday it was allowing the yuan to weaken by nearly 2%.”

Chinese Government Forces Population To Keep Capital In The Country

Unsurprisingly, the Chinese population did not cheerfully accept the limiting measure, and they liked even less that their wealth devalued by 2% in a single day. People began to try to escape these measures by using underground banks and credit cards transfers, but the government tracked down these channels as well; the last remaining option, a possible UnionPay shenanigan that could show transactions happened in China even though they were done outside, was cut down by an order requiring UnionPay to compel all merchants to validate and certify their PoS systems with UnionPay itself.

Luca Dordolo, enthusiast Bitcoin entrepreneur with a long past political career, thinks that Bitcoin is the popular resource to fight against governments invasive behaviour:

“This is just the umpteenth time abuse from central authorities has occurred with respect to private prosperity and liberty. Luckily, Bitcoin is here now to rebalance these absolutely antidemocratic situations. The recent Greek crisis event is an example of this in the Western world. The solution is to place Bitcoin alongside FIAT currencies with the function of value control and rebalancer of the economy and personal financial freedoms.”

Last Resort: Bitcoin

We are witnessing yet again a government that tightens and cuts freedom to its population by the means of money, similar to what happened in Greece, even though on a scale of tens of times weaker.

But with all the ways locked down, people are naturally orienting themselves to the only option remaining: Bitcoin.

The Bitcoin word is beginning to flow more and more insistently throughout the wretched population, and the recent steady increase of the Bitcoin value, in part due to the alleged revelation of Craig Wright as Satoshi Nakamoto, could well be due to buildup of demand from China.

If the chinese government is going to tighten the screws even more, a “doomsday scenario” where Bitcoin begins to spread among the chinese population like a meme doesn’t sound so much science-fiction anymore.

We hope that you liked this article. We recommend you get acquainted with our ratings of the top blockchain companies and cryptocurrencies.