From March 2015, users will be able to automatically convert bitcoins to local currency. The Cryptosigma wallet will work for ordinary users along the same lines as the successful BitPay service does for merchants.

Singapore-based Bitcoin exchange Cryptosigma has developed multi-signature desktop and mobile wallets that are set to ease users’ fears common at this stage of development in cryptocurrency. Many customers are still hesitant to use bitcoins because they are afraid of losing out on transaction fees and price fluctuations while selling in and out of the still-volatile digital money.

With its solution to this problem, Cryptosigma is seemingly taking notes from one of the most successful players currently in Bitcoin: BitPay.

Follow the leader

Fresh off its massively successful sponsorship of the first ever Bitcoin Bowl, the Atlanta-based payment processor had a stellar 2014 as far as new merchant customers are concerned. Not only did it process over US$100m in BTC transactions in the past year, but its merchant clientele now totals over 44,000.

While many merchants are certainly realizing the benefits of being an early adopter of the world’s first truly borderless currency and holding it, the main reason for BitPay’s success is due to its ability to keep Bitcoin working behind the scenes by making it possible for the merchant to never actually touch, hold, or see the cryptocurrency (and thus, any risk of volatility) as it gets immediately converted to local fiat currency.

Cryptosigma’s B2C approach

But price volatility can prevent not only merchants but many people from feeling comfortable when using Bitcoin for everyday purchases. Cryptosigma plans to eliminate the fear of a price rollercoaster for potential users by doing for consumers what BitPay managed to successfully do when onboarding merchants.

“I felt that this [volatility] issue was a big one standing in the way of adoption and I saw large merchant payment processors like Bitpay offering instant bitcoin-to-fiat currency conversion in order to attract large merchants like Expedia and Microsoft who have no current real-world use for Bitcoin,” said CEO and Founder of Cryptosigma, Aaron Siwoku, to Cointelegraph. “Consumers are no different. We can’t easily pay for the common things in BTC, such as grocery shopping, electricity bills, [or] rent, but we do want a cheaper and instant way to remit and receive money.”

Siwoku added:

“As there was no consumer wallet in the market offering instant conversion to fiat currency, the same way Bitpay offers [to] its merchants, we decided it would be us, and we came up with the Auto Exchange toggle function that you will find in our web wallet platform and in our soon-to-be launched iPhone app.”

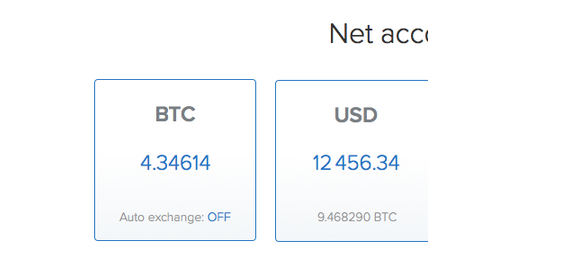

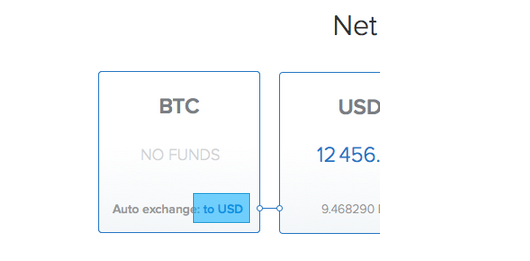

-Auto exchange feature disabled

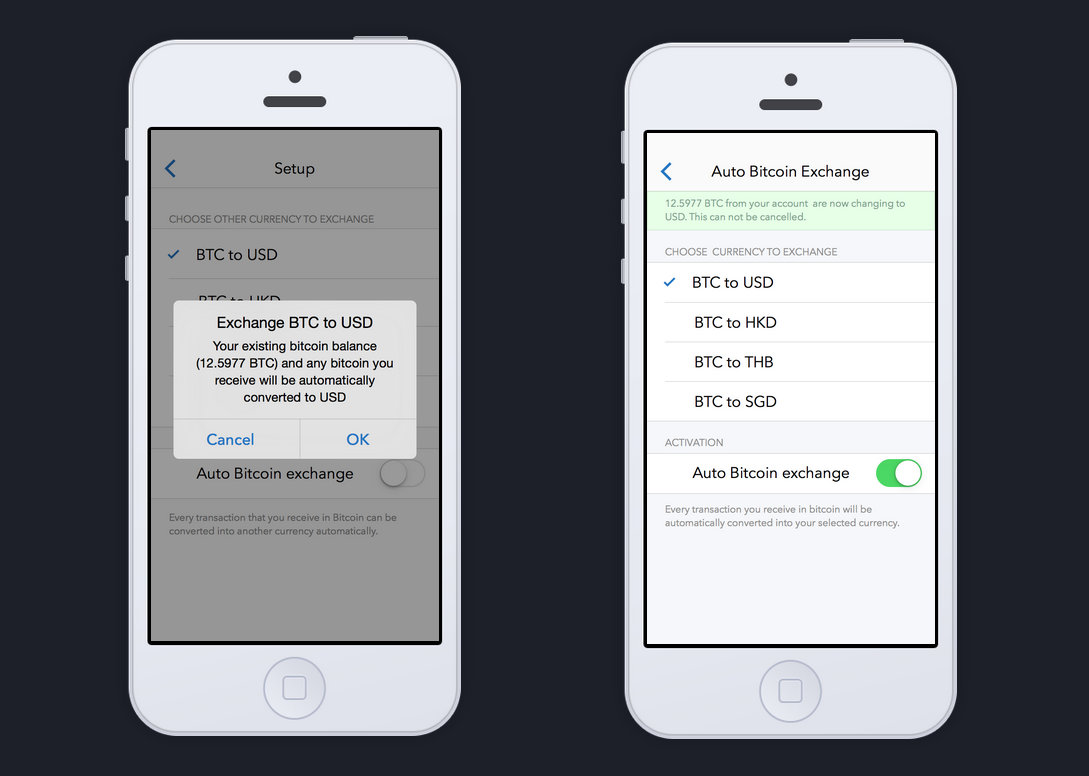

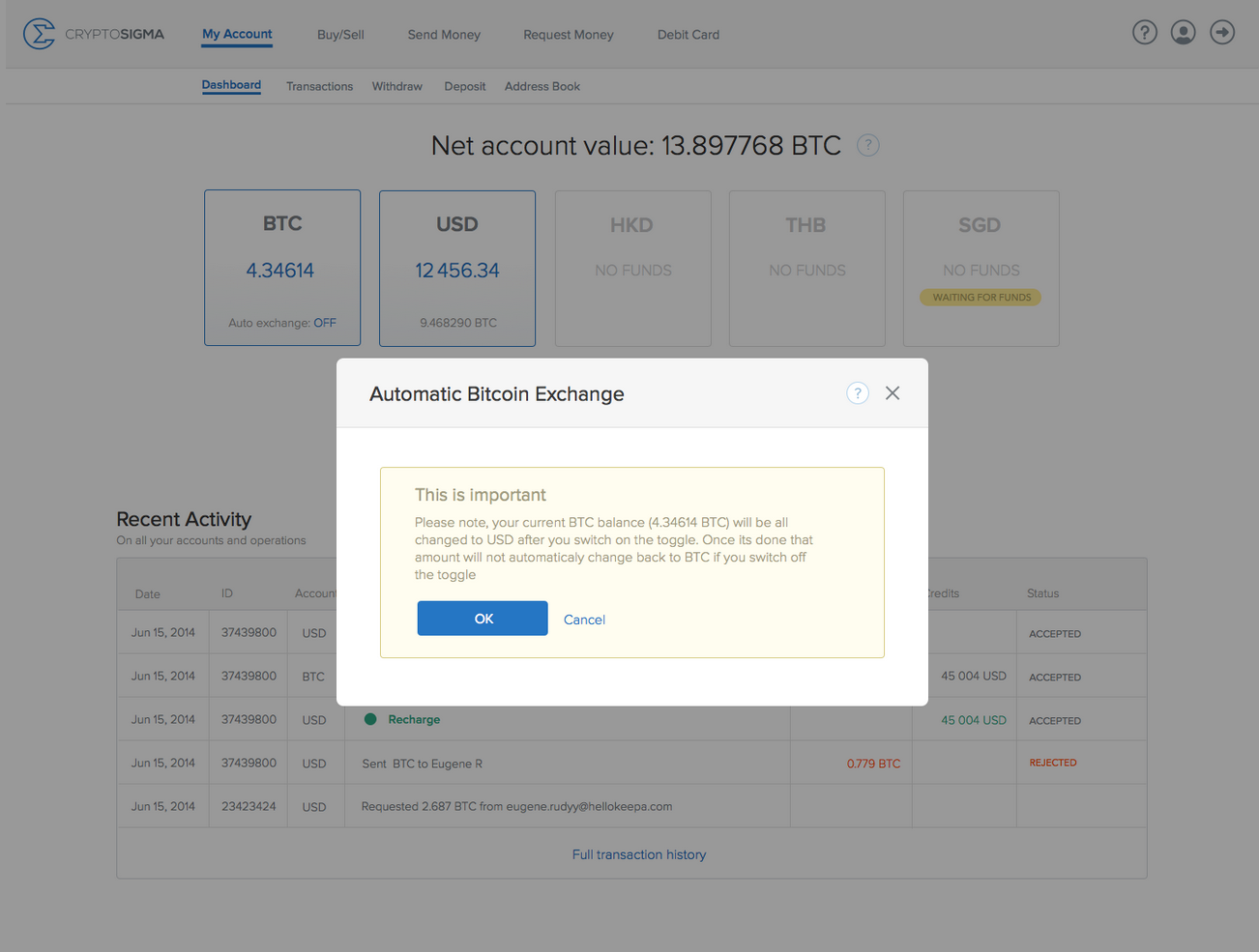

The Auto Exchange feature will work like this: enable the auto-conversion feature (turned off by default) in the mobile app.

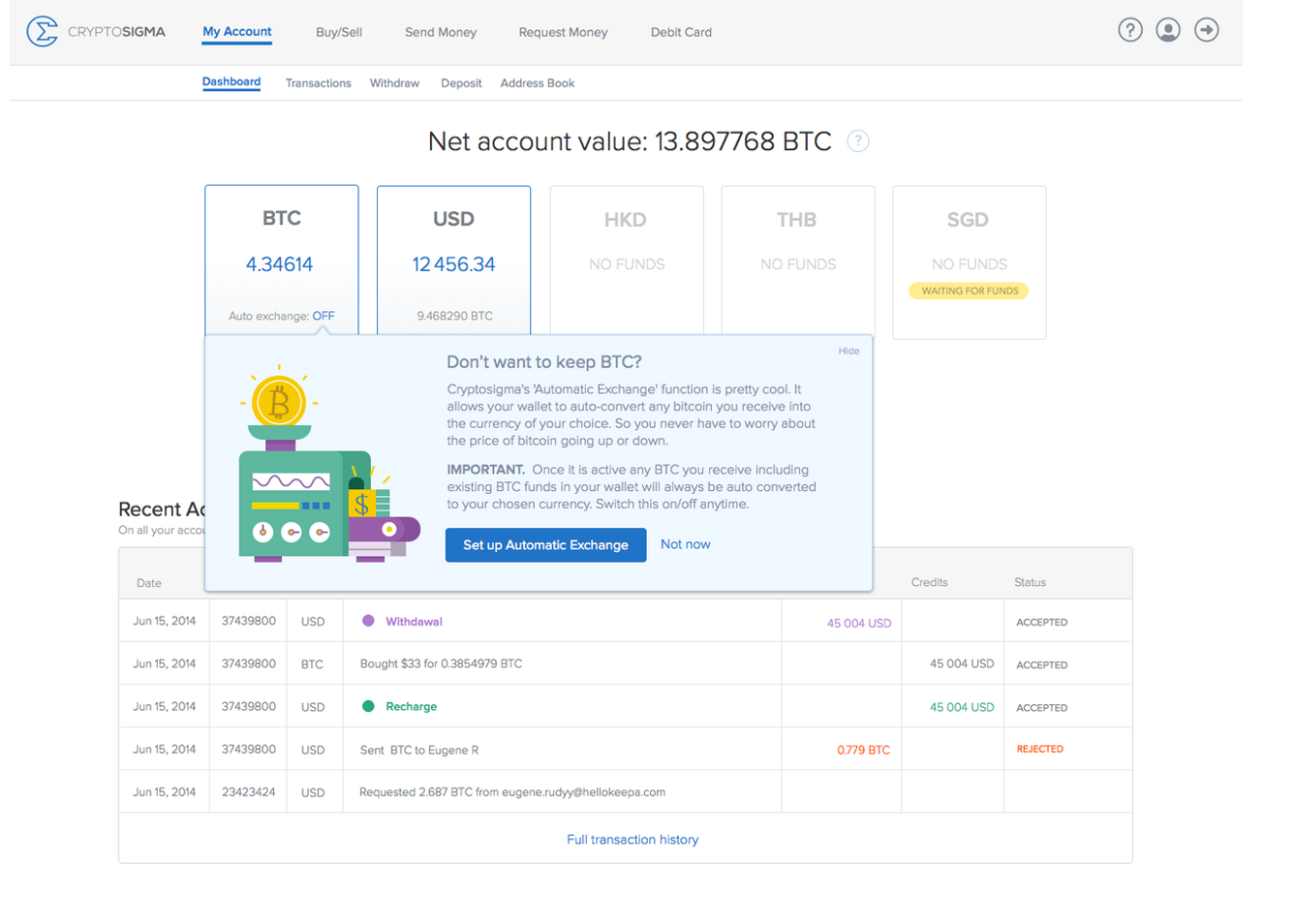

Or via the desktop interface:

- Setting up Automatic Exchange

This auto-exchange function can be toggled on and off anytime. When turned on, it automatically converts any bitcoins a user receives into the fiat currency of choice at a guaranteed exchange rate (the same way large processors like BitPay convert BTC for large merchants).

Now, when a user spends their money, this function will automatically convert the fiat currency deposits back into their amount in BTC for that individual transaction. This way, the user is shielded from any volatility risk while still taking advantage of Bitcoin as a payment protocol and a cheaper transfer method for remittances and direct, P2P payments. “In addition, if I want to pay for something in bitcoin, the Cryptosigma wallet will just convert the exact amount of bitcoin necessary for that transaction,” Siwoku added.

He also noted the auto-exchange function’s potential in attracting new people to Bitcoin:

“[I]t helps people use bitcoin early on as a remittance or payment protocol without having to worry about what happens if the price moves downwards 10 minutes after they receive their bitcoins, and perhaps haven't had time to log in to the exchange and sell their bitcoins for local currency.”

-Auto exchange feature enabled

In addition to being able to access the funds online, via the mobile wallet, it will also be possible to do so using Cryptosigma’s bitcoin (visa) debit card, which can be loaded online or via the app. “The debit card is something we felt would be a useful tool to combine together with Bitcoin, giving people the option to use something we are all familiar with,” explained Siwoku. “As Bitcoin gains adoption, we hope to see people use the card less and the wallet app more for day-to-day payments and spending.”

A ‘temporary’ fix?

Nevertheless, like many Bitcoin enthusiasts, Cryptosigma’s founder is not bullish on this “never hold” approach long term. “Eventually when Bitcoin becomes more widely accepted and the price stabilizes, people will already be familiar with Bitcoin as the thing that has allowed them to remit money instantly and cheaply over the last few years,” said Siwoku. “This creates confidence in the system.”

This confidence will ease users’ fears and will further help stabilize the price as the ecosystem grows and the market cap increases. Moreover, Bitcoin’s deflationary cap at 21 million coins is also expected to help reduce price volatility further down the road.

“Throw into the mix the fact that the supermarket, electricity provider and petrol station now all may potentially accept bitcoin as a payment method, users no longer need to lose transaction fees selling in and out of bitcoin to fiat currency, saving even more money on fees than they were when they first swapped banking remittance for bitcoin remittance,” added Siwoku.

So while BitPay has taught us that automatic conversion into local currency might be one of the best ways to onboard mainstream users while the ecosystem is still young, there is a good chance we could see this function go the way of the dial-up modem if society enters Bitcoin’s broadband equivalent.

Cryptosigma is currently offering a limited number of early-access invites where each user will receive US$10 in their account to try out the platform. The early-access invitation is part of Cryptosigma’s private beta launch, for which you can sign up here. The open beta is expected to roll out in March 2015, at which point everyone will be able sign up for a Cryptosigma Bitcoin wallet.

Did you enjoy this article? You may also be interested in reading these ones: