Santa Monica startup claims to have produced the very first dollar-backed crypto currency. If the company succeeds, the new currency has great chances of exploiting the direct payments network and inexpensiveness of Bitcoin while evading its tremendous volatility.

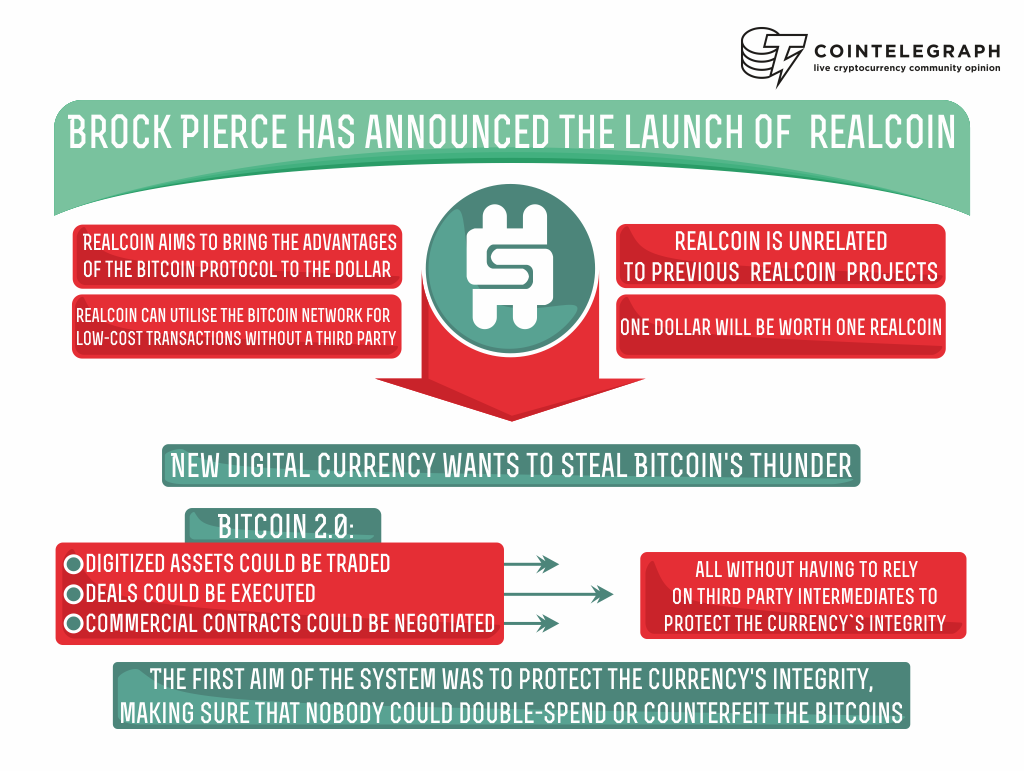

New digital currency wants to steal Bitcoin's thunder

Realcoin is a new startup based in Santa Monica whose aim is to develop a virtual currency that can easily be used by average people in real life. The currency won't be trying to replace currencies already existent on the market, yet it does want to offer an auxiliary coin for real cash. Realcoin is preparing the launch of this new currency known as realcoin, and from what we know thus far, it will be backed by a verified reserve of cash.

Possessors of realcoins will be allowed to exchange them for US dollars. This should make realcoins seem a lot steadier than Bitcoin, which witnessed an 86-fold rise in the first 11 months of 2013; in the following 4 months, however, it declined by 70%. Bitcoin's fickleness makes it less reliable than a other payment mechanisms, which is why Realcoin wants to offer a much more stable currency.

The founder of Realcoin is a former Disney child actor and Bitcoin Foundation Director, Brock Pierce. Pierce founded Realcoin together with software engineer Craig Sellars and entrepreneur Reeve Collins. They claim that their business is the hottest in the nascent industry of Bitcoin 2.0 schemes, which makes use of Bitcoin's technology and computer infrastructure to execute contracts and exchange property without having to rely on third parties. All these projects are meant to foster Bitcoin's peer-to-peer network and reduce volatility by applying cryptocurrencies to a wealth of commercial uses beyond mere transactions.

The Bitcoin blockchain system

The blockchain is a ledger of transactions shared publicly and maintained by a decentralized network of users referred to as miners. They have special machines to keep the blockchain updated, and in return they get periodic pay outs in BTC. At first, the aim of the system was to protect the currency's integrity, making sure that nobody could double-spend or counterfeit the bitcoins.

Chief Executive Officer for Realcoin, Mr. Collins, says:

“Unfortunately, there has been confusion for people between the currency called Bitcoin and the technology called Bitcoin, when they are distinctly different things.[...] In effect we are digitizing the dollar and giving that digital dollar access to the Bitcoin blockchain.”

After the launch of Bitcoin back in 2009, developers of Bitcoin 2.0 started developing programs that made use of the blockchain for various legal arrangements. Therefore, digitized assets could be traded, deals could be executed, and commercial contracts could be negotiated, all without having to rely on third party intermediates.

Realcoin will use Mastercoin, a Bitcoin 2.0 software protocol

Realcoin will make use of Mastercoin, which is a Bitcoin 2.0 software protocol. It works by taking digitized information concerning specific contracts or assets, and inserts it into the Bitcoin transaction. The information will label the rights linked to Realcoins. Mr. Collins adds:

"To ensure realcoins retain their value at one dollar, the firm will maintain a real-time record of its dollar-based reserves, all held in conservative investments, and will subject that record to the blockchain’s authenticating system."

Realcoins will be added/removed from circulation based on whether US dollars are introduced/removed. Mr. Collins also mentioned that Realcoin will partner with an important banking associate and that they're looking to close deals with ATM providers, digital-currency exchanges, and other banks as well. Apparently, they want to become “gateways for buying, trading or redeeming realcoins around the world".

By crafting a global network for people where they can quickly and cheaply trade claims on the world's reserve currency, the demand for dollars could increase even further. Realcoin's lawyers are currency working to get US money transmitter authorizations from states that require them; the company additionally plans on issuing digital currencies backed up by Yen and Euros.

Nobody can predict how Realcoin will be perceived by countries with capital controls like Argentina or China, whose people could implement it to dodge fees and commissions on foreign currency conversions. Realcoin may also draw disdain from Bitcoin-supporters, who see the crypto currency is a successor and not a facilitator of fiat currencies controlled by the government.

When Brock Pierce was asked about his Bitcoin, he said:

“I’m not selling any of my bitcoins. I’m trying to build a host of businesses that are taking advantage of this new emerging payments protocol as well as the currency.”