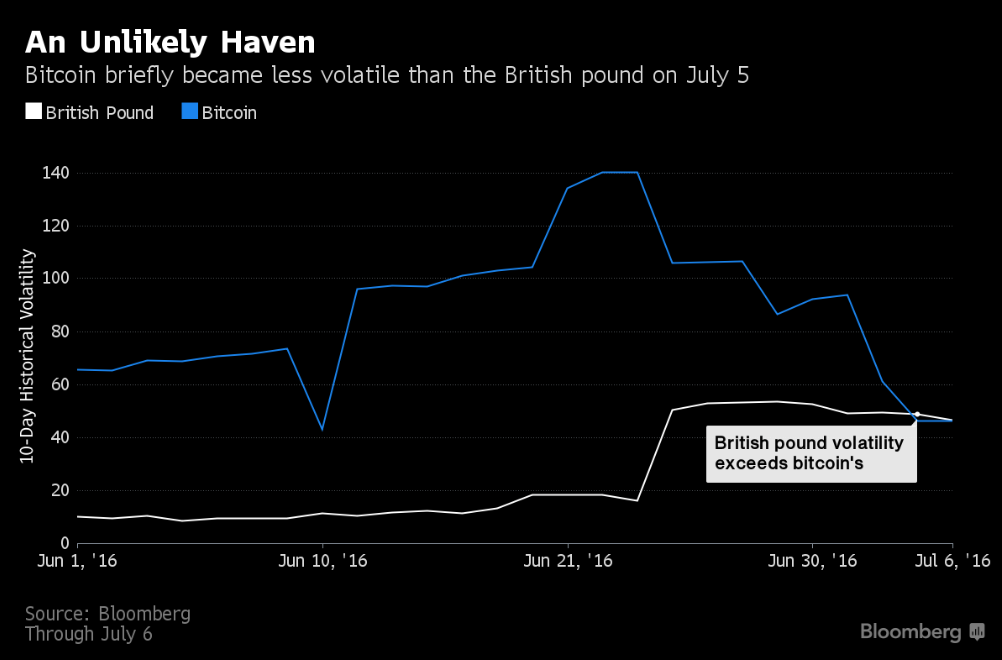

In the aftermath of the United Kingdom’s departure vote from the European Union, Bitcoin became more stable than the British pound.

During the days leading up to and immediately following the Brexit vote, the pound’s instability increased, while Bitcoin’s continued to decline, eventually falling below the pound in early July, according to a graph by Bloomberg. This is significant because of both Bitcoin’s historic volatility and the pound’s historic stability, being the currency of one of the world’s consistently largest economies.

Lily Allen’s Bitcoin tweet

The news of Bitcoin winning out against the pound in the stability competition has reverberated past simply the fintech and political world, and into the domain of popular culture. UK musician Lily Allen reacted to the news with a sassy tweet:

Bitcoin now more stable than the pound. Lolz

— lily (@lilyallen) July 11, 2016

Rob Merrick, reporter for SWNS news, also commented on the upset via Twitter, noting that it had become a talking point for the decidedly anti-Brexit Scottish National Party:

SNP soundbite: "With the pound less stable than Bitcoin..."

— Rob Merrick (@Rob_Merrick) July 11, 2016

Old financial systems look shakier than ever

Cryptocurrency is looking to be a safer bet as the world economy faces increasing turbulence. Puerto Rico has defaulted on more than $800 million in debt, while Mexico’s central bank has raised its rates to stave off a peso collapse. The vast majority of Americans believe the economy is rigged, while former US Federal Reserve chairman Alan Greenspan warns of hyperinflation in the near future.

Meanwhile, Bitcoin has joined gold as a “safe haven” investment, more solid than national currencies during times of economic turmoil. The much-dreaded “Halvening,” the second halving of the block size reward for miners, came and went without fanfare, and Bitcoin is stronger than ever.