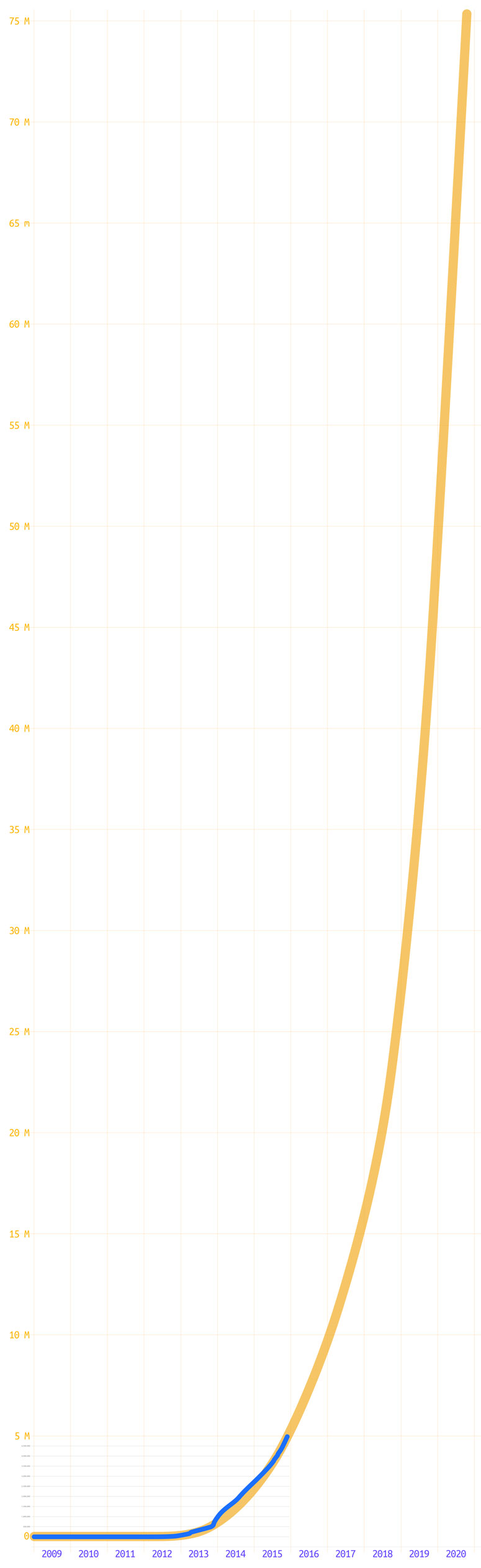

Blockchain.info My Wallets grows to +12000 new registrations per day. The trend chart shows a parabolic curve that implies a hundred million users by 2020. But how reliable is this data in regards to the number of new users entering the world of Bitcoin?

Founded in 2011, Blockchain.info is one of the oldest companies in the Bitcoin market, and their online wallet one of the most used, together with the Coinbase one. Blockchain’s charts page is a good source of data, reflecting a large part of the market, and the last month has seen a further boost in the parabolic curve of wallets registration.

Now at around 12000 new wallets created each day on Blockchain.info alone, and with similar numbers confirmed by Bobby Lee, CEO of BTCC, it’s time to see what this number really means.

7th Year Of Bitcoin

The year 2015 is the seventh in Bitcoin’s life, and that year is coming to an end, as Bitcoin’s genesis block was mined on the 3rd of January 2009. This year has seen a lot of events, while the price fluctuated between 200 and 300 USD, the number of transactions is ever increasing, with more than double the volume in the last three months, but one of the most interesting trends is the number of new wallets that are being opened every day. Arguably a better thermometer for Bitcoin adoption can be found, but how reliable is it? How many of those wallets are real?

100 Million By 2020

In the graph below, the blue line represents actual data from the Blockchain.info website My Wallets page, while the orange line represents its future development with the actual trend. At the moment, there have been around 5 millions wallets opened.

Once cleaned of a couple of bumps due to critical moments like the MtGox affair, that brought a lot of advertising on the mainstream media, the graph shows a curve that is clearly growing in a geometric progression fashion.

If the actual trend persists, a hundred million wallets registered by 2020 is in sight, which predicts that the entrance of Bitcoin into the mainstream is nearer than most people expect. And these numbers only apply to a single operator, albeit one of the largest. Together with Coinbase wallets, and all the more from other operators, the clients installed and smartphones apps, 100 million really just looks like the minimum we’ll have by 2020.

But how many of these wallets correspond to real people?

2015 Just A Passage Point, A Lot To Be Done

Cointelegraph asked Bitcoin.com supervisor and Blockchain.info angel investor himself, Roger Ver, who is already part of Bitcoin history, what is his vision of the future of Bitcoin and if this trend is the final mark to its entrance into the mainstream.

Cointelegraph: What do you think about this number, about these 12000 wallets created every day? The projection of the single Blockchain.info wallets chart leads to somewhere around 100 million wallets by 2020. Bitcoin seems to be going to reach the Moon sooner than most expected.

Roger Ver: 12,000 wallets per day is amazing, but we need to grow even faster than that. If you are are reading this, and are a fan of Bitcoin, and the positive changes it will bring to the world, it is your job to tell your friends and family. Set them all up with a Bitcoin wallet for the new year, and teach them how to use Purse.io or Foldapp.com

CT: Even though I am very happy with this trend, this number looks a bit off reality to me: I don’t see an increase in Bitcoin chatter in forums, initiatives, and such, that should obviously reflect this number. Do you think there’s a considerable number of people opening more than one wallet? Is there any way to know if different wallets belong to the same person? For example, by checking the IP address when a new user is registering. Are you doing that at Blockchain?

RV: I’m sure lots of people have more than one wallet, but I’m also sure that thousands or tens of thousands of new people are signing up for Bitcoin wallets for the first time every single day.

With amazing reasons like 20% off everything from Amazon via Purse.io or 20% off every Starbucks thanks to foldapp.com, it would be more surprising if tens of thousands of people weren’t signing up each day.

CT: Could it make sense for a single person to create more than one wallet? What advantage could they receive from this practice?

RV: I think lots of people have multiple Bitcoin wallets just like they have multiple bank accounts. I don’t think this is abnormal in any way.

CT: This page sports a interesting examination of the number of wallets, and the conclusion is that a large number of the wallets do not represent single users but are opened for different reasons, like wallet shuffling, laundering and coin mixing. What is your point of view?

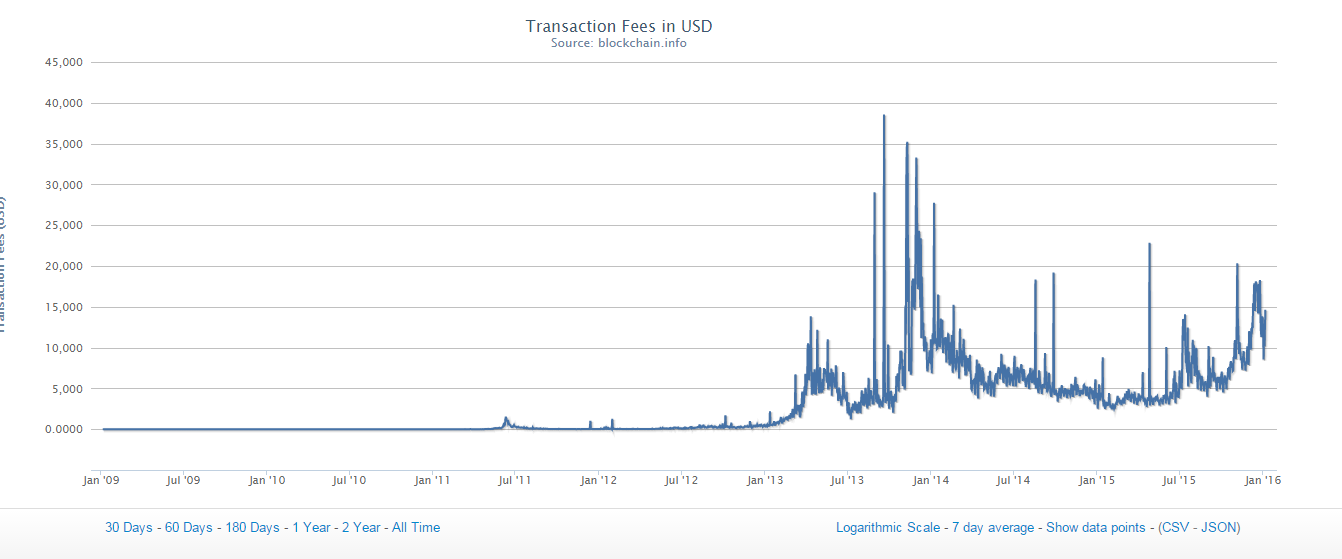

RV: I think this chart is a lot more informative:

The fees are real money that real people are willing to pay in order to use Bitcoin.

We have seen somewhere in the ballpark of a hundred times growth in this metric over the last two years.

From about one hundred dollars a day in fees, to over ten thousand today.

If real people weren’t using bitcoin for real commerce, they wouldn’t be willing to pay the ten thousand dollars in fees each and every day.

CT: I have recently read that 80% of Bitcoins are bought in Yuan. Speculation is that the Chinese population is buying Bitcoin to bypass government restrictions to limit capital migration from the country. Do you see any political implication in this fact?

RV: My hope is that Bitcoin will be used by people all over the world to bypass the arbitrary and destructive economic controls put in place by men who claim the right to rule over other men.

If people in China lead the way on this, I’ll be cheering them on.

CT: There’s another important implication here. As you well know, China has banned financial institutions and banks from executing Bitcoin transactions, but private individuals are free to do what they want. Doesn’t the fact that people buy Bitcoin in a country where banks are prohibited to traffic with it, confirm that it is working? People are buying it, and they don’t care if banks won’t change it back into Yuan. They know they will find somebody that will want to buy Bitcoins back: banks are losing power already, and people are giving value to Bitcoin. I think this is a very powerful “hidden” implication of what’s happening in China now: Bitcoin is already allowing people to escape government's restraints.

RV: I agree, and the more useful bitcoin becomes for escaping government controls, the more attractive it will become for new people to join as well.

It is a self reinforcing cycle that we are watching expand before our eyes.

2016 will be the most exciting year for Bitcoin yet.

We hope that you liked this article. We recommend you get acquainted with our ratings of the top blockchain companies and cryptocurrencies.