Investment in financial-technology companies grew by 201% globally in 2014, according to a new report from Accenture. The consultancy firm named blockchain technology to be one of the keys that legacy banks need to “reimagine” themselves in order to keep up with innovation.

“Possibly the biggest opportunity from taking an open approach to innovation is in the area of the blockchain, the protocol that underpins the distributed architecture of the bitcoin cryptocurrency.”

- Accenture Report

Fin-Tech Investment Boom

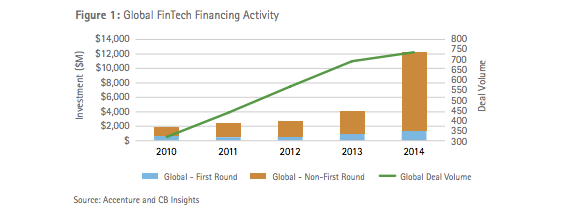

Investment in financial-technology (fintech) companies grew by 201% globally in 2014, compared to 63% growth in overall venture-capital investments, according to a new report from the consultancy firm Accenture titled The Future of Fintech and Banking: Digitally Disrupted or Reimagined.

Global investment in fintech tripled from US$4.05 billion in 2013 to US$12.2 billion in 2014 according to the report. The amount of money that went into first round investments grew by 48% alone.

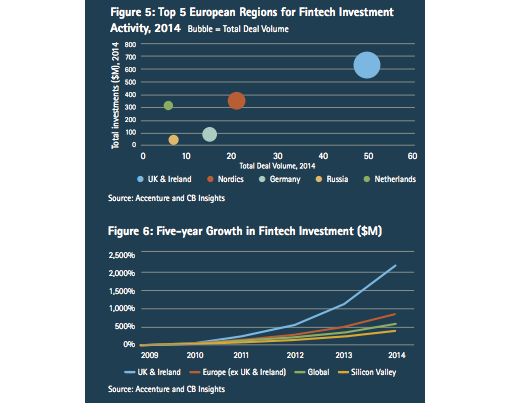

Of the US$12.2 billion invested in fintech, most of it flowed to the US, however Europe experienced the highest level of growth, which increased by 215%. While it is well known that the UK and Ireland dominant fintech in Europe, their growth was slower compared to the Nordic countries, the Netherlands and Germany (see chart below). More importantly, Silicon Valley invested more than US$2 billion in fintech in 2014.

Disruption Ahead

While the report made it clear that the digital revolution in financial services is under way, the impact it will have on the current banking players remains to be seen. It reads:

“Digital disruption has the potential to shrink the role and relevance of today’s banks, and simultaneously help them create better, faster, cheaper services that make them an even more essential part of everyday life for institutions and individuals. To make the impact positive, banks are acknowledging that they need to shake themselves out of institutional complacency and recognize that merely navigating waves of regulation and waiting for interest rates to rise won’t protect them from obsolescence.”

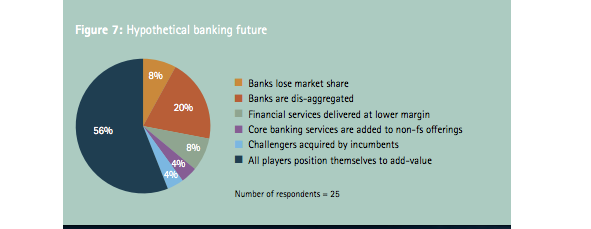

The report interviewed 25 executives from the industry’s major banks. The biggest concerns were that the established players in financial services weren’t doing enough to keep up with the innovation coming from fintech startups and were very slow to deploy new technology in a timely manner while relying heavily on legacy technology.

The survey also revealed that 72% of these executives feel their bank has only a fragmented opportunistic strategy in dealing with innovation. What’s more interesting is that 20% believe banks will be completely disaggregated while another 16% believe banks will continue to lose market share and their financial services will continue to be delivered at much lower profit margins.

3 Keys to ‘Reimagine’ Banks

The Accenture report suggests that if banks are to remain relevant and compete, then there are 3 key behaviors that will enable them to reimagine and reinvent themselves in order to keep up with the blistering pace of innovation in the fintech space.

1) Act Open

Blockchain technology presents the biggest opportunity in this regard. “Possibly the biggest opportunity from taking an open approach to innovation is in the area of the blockchain, the protocol that underpins the distributed architecture of the bitcoin cryptocurrency,” reads the report. “It is early days for cryptocurrencies, and it is unclear what the long-term effects of their adoption will be on the financial services industry.”

It continued:

“However, it is clear that if established players are going to benefit from this revolutionary approach to finance, they will have to engage with a much wider range of technical specialists and developers outside their own organizations.”

2) Collaborate

The big challenge for established players is their organizational culture’s ability to adopt a collaborative approach with new innovators and startups. In other words, learning how to work with third parties and align common interests.

3) Invest

Established financial services firms are building in house corporate venture arms to invest in fintech startups. American Express, BBVA, HSBC, Santander, and Sberbank have all developed corporate investment vehicles over the last four years, each with at least US$100 million to invest.

Conclusion

Fintech has emerged as a major component of venture capitalists portfolios and it looks poised to keep getting bigger. This bodes well for the disruption of traditional financial services and a new breed of more transparent, lower fee structure type companies to emerge in their wake as blockchain technology looks to be a major part of this process.

To get updates of my thoughts on bitcoin and the global financial markets please follow @sammantic.

Did you enjoy this article? You may also be interested in reading these ones: