Art by: Jing Jin

Last month we brought you an interview with Nathan Wosnack, David Mondrus and Matt McKibbin, who had left the crowdfunded Bitnation days before the launch of its crowdsale due to concerns over transparency, customer/investor protection and potential regulatory issues. Last week, we caught up with two of the former Bitnation members, Nathan Wosnack and David Mondrus, to talk about what they are doing now.

While they never came out and said it, their current projects seem to have been born directly from their experiences at Bitnation. Wosnack has started a company, uBitquity, that focuses on “PR/Media, Advisory/Development, and Compliance Services (AML/KYC manual dev and consulting).” Which shouldn't be surprising considering his concerns over the potential legal issues he fears Bitcoin 2.0 projects may be running headlong into.

Of more interest to Bitcoin users is what he is working with Mondrus on, Blockchain Factory. Blockchain Factory is a company that, along with various tools designed to make navigating and using the Blockchain more accessible, also is building some projects that are very much in line with what Bitnation is offering.

But, it is also no mere imitation. Blockchain Factory isn't trying to be the “other” Bitnation, and their short term goals with government services are less lofty and more lighthearted. Blockchain Factory doesn't so much plant to replace your current government as much as it gives people the tools to add supplementary services using the Blockchain. That is essentially the same goal of Bitnation, but the feeling isn't that they are coming to create “Governance 2.0” or at least not right away. They are both borderless, decentralized and voluntary services, but the difference is in tone and Blockchain Factory seems willing to take it one step at a time.

The feeling I got speaking with them was that the Blockchain Factory's governance services, at least in the early stages, aren't designed to make Bitcoin-citizens, but simply offer up alternatives for services that may or may not be offered by their current government. Citizens in the U.K. are used to supplementary health insurance. Why not supplement marriage or pass ports or notaries with the verifiable security of the blockchain?

A particular point of pride with them is how Blockchain Factory is being funded. As of now, there is no Blockchain Factory coin (although a coin is coming, it isn't a share or pay any kind of dividend and details are scarce at this point), no IPO or ITO or ICO or whatever people want to call it today. Instead, they are going to traditional route, self-funding the project and bringing in select outside investors. They don't hate the idea of crowdfunding or even crowdinvesting, but they do have concerns about the legal ramifications and how distributing a company, regardless of what you call it and the reaction of U.S. regulatory bodies.

We spoke about their upcoming projects, their concerns about crowdfunding and the future of governance services on the blockchain.

Why don't you start with telling our readers about what you offer.

Nathan Wosnack: We offer Blockchain Development, Crypto Consulting, Crypto Project Management, Identity Management. Our main products are: Mining Slicer, BTC2MySQL, BitzME. And in the near future; BitMarriage, BitDeeds, [and] BitNotary.

Our unofficial slogan is "Let the Crypto Revolution Begin...” I do believe we are in the midst of a crypto revolution, and I'm happy to be part of it with Blockchain Factory, and with my partnership via uBITquity (my company out of Vancouver BC, Canada)

David Mondrus: Except, we're not calling them BitMarriage, we are still working on the branding. But the idea is a cohesive set of governance services on top of an extensible framework. But, this is a long term goal and will depend of course on financing.

Nathan Wosnack: And with real proof of concept code to go along with it and no crowdfunding.

Perhaps we should go through each of the features one at a time. I'd like to start with BTC2MySQL.

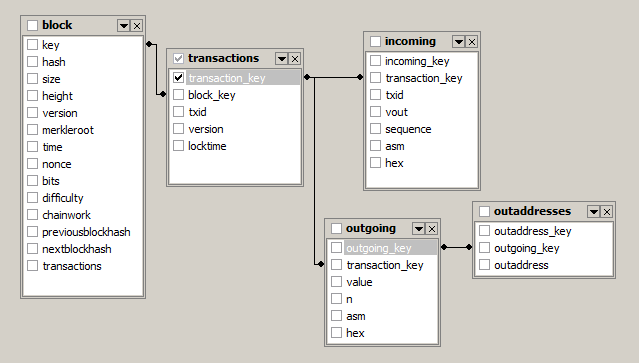

Nathan Wosnack: As you know traditional tracking of a transaction on the blockchain requires digging through a plethora of addresses, keys and identifiers (i.e. transaction id, sender/receiver, change addresses) which can be arduous and very time consuming for people.

BTC2MySQL takes blockchain transactions and arranges them in an easy to query relational table. Now you no longer need to map out an entire transaction in your mind as it is all done for you on screen on our web-site with simply using SQL commands.

Who do you see as the target market for it? It seems like journalists and criminal investigators (private and public) would have a huge use for it, but are there other markets you hope to tap?

David Mondrus: There are two I guess. Forensic research is one, so that's investigators both professional and amateur. The second is hobbyists and researchers. At the moment, we have a 100 row limit, but when we develop the premium version of the site we'll do larger downloads, exports, etc. to make it easy to get the data out in a format more people are comfortable with.

Yeah, I can see how that could make my job easier when I'm trying to look into things.

David Mondrus: I was talking about it on FB one day and people expressed an interest, so we wrote it.

Nathan Wosnack: Definitely. And to be clear, we're neutral about who uses our service. So long as they're lawful in their activities.

Any other major features for BTC2MySQL [other than following a transaction]?

David Mondrus: Select * from join on ... etc. That's it for now, we're moving on to BitzMe next and we'll circle back to premium features when there is demand/funds.

Nathan Wosnack: For anyone who comes to our site and is confused about what to do, if they check the FAQ there is a link to SQL command help.

Speaking of BitzMe, that is really interesting too. It forwards all your cryptopayments to one address. The first question I have is: What are the "major" cryptos that will be supported? Do you have any that you can confirm at this time?

David Mondrus: so this isn't a "crypto" specific product. So, we'll support as many crypto currencies as we can, likely the Cryptsy set. But we'll also support Paypal, FB Credits, Visa, Checking account. BUT, this is not integrated with a wallet, so don't get excited. It's a dir service, a payment page to rule them all (although the wallet integration is a good idea).

Nathan Wosnack: With traditional addresses people find them hard to remember, they expire very often, and they're impossible to change once the address is posted. BitzME are easy to remember, it never expires, and you can change the payment methods as often as you need to.

So, let's say someone sends me an obscure coin, when I want to collect that, how would I do it?

David Mondrus: well, when you set it uip, you have to tell us your wallet address, so at that point you've [already] got the wallet.

Nathan Wosnack: BitzME is an address shortcut for Bitcoin and crypto currencies (think bit.ly). When your wallet address changes, it is recommended as a good rule of thumb that you change your address on every single transaction - resulting in a link that is no longer valid. By simply using Bitzme you can leave your tip information on the Internet and not worry about it becoming obsolete and then losing payments. Since crypto currencies are irrevocable you can count on those payments being lost forever. So instead of "3J98t1WpEZ73CNmQviecrnyiWrnqRhWNLy," you will be bitzme.com/satoshi

Can you use an exchange wallet addresses?

David Mondrus: Sure, we don't care.

Nathan Wosnack: In fact we welcome it!

Awesome, so someone could use that to open up donations to pretty much everything, without having to download or find a web wallet?

David Mondrus: Well, it does rely on the wallet actually being there, but you can certainly populate from all your Cryptsy wallets and manage it all from one panel.

It's launching November 28nd, will that be a full release to a private or public beta or something along those lines?

David Mondrus: Hopefully, the 29th. But it'll be a public beta.

Nathan Wosnack: It was the 22nd and we postponed it until the 29th due to being busy with paying clients for the Mining Slicer and other contracts, and also we want to make sure that Bitzme is working in the way we want by that date. Hence the slight delay.

Will most of the features be available?

David Mondrus: The first subset will. Cryptsy integration won't be there and no wallets either, it's an MVP.

Nathan Wosnack: Early beta release, but we'll have many updates as we progress. We're a small team, and we do have some volunteers for beta testing, and outsourced staff available to help with our development, along with contractors for design. Under promise, over deliver. That will be our motto.

What about the Mining Slicer?

David Mondrus: The mining slicer is a fork of the CGMiner code that allows you to break up a large ASIC into smaller components. So, say you ahve a 2T (Th/s) machine. You can point that entire 2T to the BTC blockchain and make some money, or you can point it to something like Mazacoin and run a 51% attack; not a lot of good choices. But mining slicer allows you to take that 2T and turn it into 2000G (Gh/s), and you can point each of those 2000G's independently. So, 1 here, 50 there, 200 over there, etc … They will all work on their respective jobs, and they are all statistically independent.

Obviously, that has some great uses. I am wondering though if someone would be able to break up their 2T, but then still point it at one network and perform a 51% attack without people noticing that one party has most of the hashing power?

David Mondrus: Sure, but that's not really something we can control. Hypothetically, you can take a little BFL mini and run a 51% on a very tiny coin.

Nathan Wosnack: We definitely condemn that behavior. 51% attacks are unethical and generally frowned upon in the community.

Nathan Wosnack: So our clients and interested clients for licensing have obviously been cloud mining companies.

David Mondrus: But, it also works well for large independent installs.

I noticed your site doesn't list pricing. I assume there is a reason for that, but would you want to reveal a rough idea on what customers can expect? Would it significantly impact their ROI?

David Mondrus: No, we aim to always stay within the profitability window. For that reason our pricing is client specific

Nathan Wosnack: We do a call, and try to figure out the customer's size and needs before giving a proposal based on our pricing. As David pointed out, it is client specific. We want to be flexible and fair so we scale with each mining operation.

You are planning some government services stuff. Obviously this is going to compete on some level with your former employer/company Bitnation. Do you think we will see several technologies offering governmental services and do you think that is a good thing or a bad thing?

David Mondrus: Yes, I do and I think it's a great thing. The problem is monopoly and a monopoly leads to bad customer service. So, the more companies there are in this space the better. As a matter of fact, the idea is that we're a platform offering basic "core" services and an API and allowing others to build on top of that.

Nathan Wosnack: I think it's a good thing. So long as it's consensual, someone can opt-out of it or in it at their leisure, and any use of "governance 2.0" services are without the use of force or taxes being used to facilitate it.

David Mondrus: You know in the same way that you used to have just one job most of your life, you also used to have one government, but these days that's not really true. Aside from all of the border changes people migrate more and more. If you could have the same data, in the same format, recognized world wide, that would be a plus and there are many use/cases where it becomes obvious how useful this is, from Nathan's passport debacle to Joyce and mine deed ownership to our "official" marriage records. They would all benefit from an world wide available, immediate recognition veracity guaranteed storage.

Could it potentially help solve the problems that cause those aforementioned inconveniences? Like, if passports were done on the blockchain, it would be easier for security institutions to prevent terrorists from traveling.

David Mondrus: Well, it's more like if they're on the blockchain then if you lose your passport it's easier to recreate one. Hypothetically it could be in your phone (although of course that's a long ways away due to recognition issues).

Nathan Wosnack: I lost my business stamped Canadian passport at the hotel at Coins in the Kingdom, then the lovely staff found it. But in between then I was told I would have to fly to Miami and wait a minimum of 3 days in order to get this cleared up. With services like "BitPassport" (name pending) one could utilize the power of the blockchain to verify who I am, based on my WoT (Web of Trust). IDCoin by David Duccini ("The Little Duke") has a great whitepaper on Web of Trust and reputation and ID systems. https://github.com/IDCoin/IDCoin.

David Mondrus: so we're going to start by making fun, "gamefied' experiences based around for example Bitmarriage to generate excitement and traction. Then over time we'll try to influence existing law similar to how Uber and AirBnB are doing.

Nathan Wosnack: I could see institutions integrating PEP (Politically Exposed Persons) and Anti Terrorist databases to reference a bitpassport type system with existing software like WorldCheck. AML/KYC firms could definitely take advantage of this as part of their services. I know I would with uBITquity and my partners at BitComply would likely enjoy that extra functionality.

What different government functions do you think could be handled in this way? And could high level functions, like Healthcare, be done on the blockchain?

David Mondrus: So, the idea of medical records on the block chain is an obvious one. The trick is in integrating with existing laws, regulations and systems.

So, what turned you away from crowdfunding / crowdinvesting in general and do you think its something you may utilize in the future?

Nathan Wosnack: We are strong believers in traditional fund raising. Having a prospectus, a pitch deck, reasonable projections. And a solid foundation so we can give a good ROI for our investors and shareholders.

David Mondrus: Investors, esp early investors, bring more to the table than just money. Their connections, networks, experience, all play a key role, especially early. Also, many of the successful ICO's this year were directed towards the industry (Bitnation being an exception). Since we're trying to bridge that gap between the crypto and the RL world, an ICO would be less successful IMHO.

We want to avoid stepping on the toes of regulators, and following the letter of the law. Crowdfunding at this point is not the best direction to go.

David Mondrus: We won't rule it out in the future, but we want to make sure its' 100% legal, and that takes time, traction, and etc …

Do you think the legal problems will be an issue for IPO/ICO/ITOs in the future?

David Mondrus: Yes

Nathan Wosnack: Yes.

David Mondrus: In the past, the model has been to pretend, or act as if the regulations don't matter. But, while "you can avoid reality, you can't avoid the consequences of reality" (Ayn Rand), as I'm afraid many people in this space will find out in 2015. The arm of US law is very long and has a very old memory. I have no intention of being on the wrong side of that line

Nathan Wosnack: The song "No where to run" by Martha And The Vandellas comes to mind.

The FEDS love making examples of people. And they have unlimited funds backed by taxes the hard working men and women of the United States of America. The SEC definitely considers that a security. And if someone is selling unregistered securities to unsophisticated investors, they should expect to be held accountable for that behavior. Know the risks, uncertainties before investing. The same goes for anyone in the space looking to do an offering of this type. Get legal counsel and look before you leap.

That said, we're not saying be overly conservative. The crypto space is about innovation and taking risks. Just know that the risks you take won't have negative consequences that could land someone in prison or fined.

Final question: You are working on BitMarriage, what about BitDivorce?

David Mondrus: I prefer not to handle "bitdivorce". As I say, a marriage is a promise. A divorce is a contract. So, I can see divorce contracts happening when assets are on the blockchain, but that's still a bit of ways away.

Nathan Wosnack: I'll handle BitDivorce. I'm jaded about relationships right now anyway!

We want to thank Nathan and David for taking the time to talk to us. You can find more out about uBITquity and Blockchain Factory and their official sites.

Did you enjoy this article? You may also be interested in reading these ones: