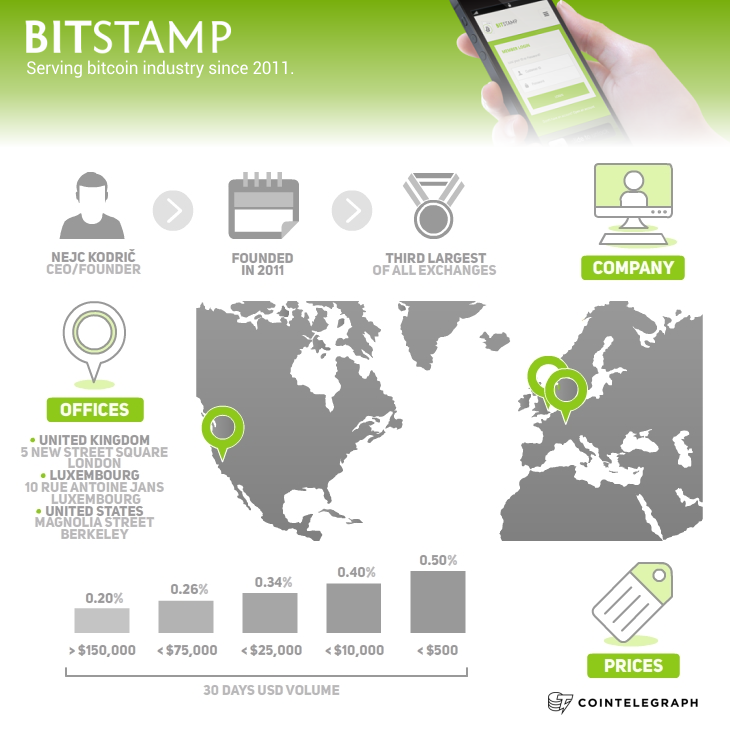

Bitstamp is a major Bitcoin exchange currently based in the United Kingdom. As one of the first exchanges to be founded in 2011 by CEO Nejc Kodrič and CTO Damijan Merlak, originally in Slovenia, the company has risen to become one of the best-known and popular on the market. Currently, its volumes are the third largest of all exchanges on the market according to Bitcoincharts.com.

Bitstamp’s reputation as an innovative yet reliable exchange has been preserved throughout its operational history, suffering from hardly any of the lapses afflicting many of its competitors. Following its move from Slovenia to the UK in April 2013, emphasis has been placed on diversification and strengthening of market position.

Bitstamp provides a bitcoin trading and Ripple gateway platform, which balances intuitive design with features, aimed at both inexperienced users and advanced traders.

As one of the industry’s foremost exchanges, Bitstamp provides advanced security measures and support systems, in addition to efficient operation and slick navigation, which users of all levels have come to expect from the market.

Upon opening an account, the user may access overviews of trading features, which become fully operational once the user is verified as per standard procedure.

The account is laid out in a manner which makes it uniquely easy to access and use Bitstamp’s features, as well as the FAQ and support information.

The account separates functionality into tabs ‘Account’ ‘Buy / Sell’ ‘Tradeview’ ‘Deposit’ and ‘Withdrawal.’

Buying and selling consists of instant, limit and stop orders, as well as an option to purchase ripples. Data regarding the top buyer and seller transactions are listed within the tab. Tradeview opens market charts with customizable indicators suitable for advanced traders. Any open orders are displayed alongside this data.

Deposits and withdrawals are made via international bank transfer, SEPA and Astropay (deposit only) for fiat transactions. All Bitstamp trades are made in USD, which is then converted to the relevant currency and processed. Details of fees are available in the ‘Prices’ section of this listing, with a full fee schedule here.

Extra security measures require users to manually authenticate withdrawal requests prior to processing, regardless of size or currency. This is done via an authentication link being sent to the customer’s registered email address.

Support for customers comes in the form of a one-click template accessible anywhere on the Bitstamp website. The template also allows files to be attached to aid clarity.

Additional information about using Bitstamp as a customer can be found in Cointelegraph’s Spot Test series here.

Bitstamp was designed to provide one of the first significant alternatives to the few exchange operations available for bitcoin, incorporating security measures fitting for mainstream international money handling.

The exchange has further built upon its principles of security and mainstream appeal, facilitating operations using a website format, which is easily comprehensible for both advanced traders and novices or those without a vested interest in the technicalities of cryptocurrency trading.

Bitstamp’s longevity in the dynamic, competitive market has proven the reliability and desirability of its formula, and its reputation continues to lead where many rival operators have fallen prey to attacks or failed to adapt to changing legislative environments.

Bitstamp was founded by CEO Nejc Kodrič and CTO Damijan Merlak in 2011. As one of the first Bitcoin exchanges on the market, the company moved from its operations base in Slovenia to the UK in April 2013 to become a UK registered limited company.

Trading on Bitstamp revolves around a sliding scale of commission, which decreases according to the amount of activity in a previous given period.

Activity below the equivalent of US$20,000 in the preceding 30-day period incurs a 0.25% commission on trades, which decreases in increments of between 0.01 and 0.05% down to the lowest rate of 0.1% once US$20,000,000 is attained. The minimum trade is US$5.

Deposits are all free of charge with the exception of non-SEPA transfers, which incur a 0.1% fee with a minimum of US$15. As Bitstamp operates in USD, payments received in other currencies are converted using the prevailing exchange rate of Raiffeisen Bank Slovenia (accessible here).

International non-SEPA deposits are subject to a minimum deposit amount of US$50.

Withdrawals are charged at 0.90EUR for SEPA payments, subject to a minimum withdrawal amount of US$10. Non-SEPA incurs a 0.09% fee, but the minimum fee amount will be US$15 and minimum withdrawal amount of US$50.

Bitstamp does not allow third party withdrawals and the recipient bank account must be identical to the Bitstamp account holder.

There are no charges for cryptocurrency withdrawals.

A full breakdown of prices may be found here for trading and here for deposits and withdrawals.

Cointelegraph reached out to CEO Nejc Kodrič to get an idea of Bitstamp’s long journey, and how one of the longest-running exchanges continues to perform amid a burgeoning industry.

Cointelegraph: Bitstamp has become one of the most well-known Bitcoin exchanges on the market. What inspired you to start Bitstamp, and which hurdles have you needed to overcome in order to make it a success?

Nejc Kodrič: Back in 2011, which is centuries ago in Bitcoin terms, things were quite different to how they are now. Damijan Merlak and I originally started mining (before Bitstamp I owned a computer hardware store and Damijan purchased hardware through my store), but things were moving forward a lot faster than we had anticipated. We realized this was not our field and that we'd soon be taken out by competitors, so the idea of establishing a mining pool kind of fell apart.

We had another idea involving just buying lots of bitcoins, but it was not as easy to do at that time as it is on exchanges today. We thought Bitcoin is cool, but buying bitcoin is hard, so there was definitely the potential there, so we basically undertook a summer project - that's how it all started. We launched in August 2011.

Faith in Bitcoin companies at the time was strong, as not many went bust. When we started a little later, that had become a problem, but it's also what propelled us forward because we didn't have any operational problems.

CT: Competition in the Bitcoin exchange market has always been fierce. What are your strategies to ensure Bitstamp maintains its leading position in future?

NK: If you operate in very fast-growing economy and provide a reliable service, there's not much of a secret to growth; it just comes naturally. Being in the Bitcoin sector for a long time gives you insight into how to survive. There's huge regulatory pressure, you're under scrutiny from the banks and all sorts of government agencies so you can very well screw things up. You have to invest heavily in regulatory compliance, but you have to make money.

There are exchanges for example that don't charge any fees; this is something that worries me a lot because you need to invest in compliance, in transaction monitoring, enhanced diligence, your employees, anti-money laundering etc. It's very important companies have strong compliance programs so they can survive.

CT: There has been discussion recently regarding the Bitcoin price index and its true accuracy. How do you ensure the reliability of your statistics?

NK: This has been a debate for some time. If you decide to liquidate 1000 BTC on our exchange, you clearly see with us or most western exchanges that what you see is what you get. Order books are very realistic and there's actual liquidity.

CT: How do you view the regulatory trajectory for cryptocurrencies in the UK compared with the EU as a whole? Do you think the country will provide the best support for your operations going forward?

NK: We probably all know that Slovenia is not really the financial center of Europe. We started our business in Slovenia, which was to some degree beneficial, but we quickly outgrew our environment. At times we had 10-20 times more volume than our national stock exchange. In addition, there was uncertainty from regulators - they were unresponsive, and either didn't know or didn't investigate what we were doing. We thought that the UK was moving must faster and at a more predictable rate than Slovenia, so we decided to move our business to the UK.