Halsey Minor, an American serial tech entrepreneur widely known to have founded CNET in 1993, has set his sights on the Indian market with Bitreserve, his latest venture that he unveiled in 2014.

Following Bitreserve's launch in the US, the UK and China, the startup is now looking to establish its brand in India, with a particular focus on the remittance and mobile payments markets.

"We want to now set up operations in India and we are talking to regulators and potential partners on a range of our Internet-based finance offerings," Minor told the Times of India.

According to the founder, the startup has met with the Reserve Bank of India, the country's central bank, which turned out to be quite conclusive. Minor stated:

"RBI has the understanding of how to look at us from the regulatory point of view, whereas some others did not know where we fit in."

Minor further said that Bitreserve, as part of its expansion plan, is looking to offer its services without charging any commission to the Indian market.

India, China, the Philippines, Mexico and Nigeria are the top five remittance recipient countries, in terms of value of remittances.

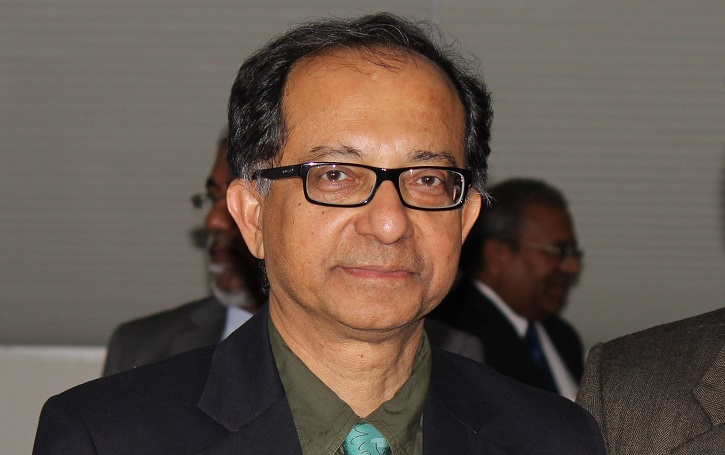

According to Kaushik Basu, World Bank chief Economist and senior vice president:

"Total remittances in 2014 reached US$583 billion. This is more than double the ODA [official development assistance] in the world. India received US$70 billion, China US$64 billion, the Philippines US$28 billion.

With new thinking, these mega flows can be leveraged to finance development and infrastructure projects."

Global remittances are projected to grow by 0.4% to US$586 billion in 2015, the organization estimates.

As the second-largest telecommunications market with more than 900 million mobile phone customers, India has attracted many fintech startups, including US-based mobile wallet and payment system LoopPay, which announced in January its intention to enter the Indian market.

Chinese e-commerce giant Alibaba Group, as well, has been playing its cards in a way to conquer the much-coveted market. The giant announced in February that affiliate Ant Financial Services Group, has taken 25% stake in One97 Communications, the operator of Paytm's mobile payment and commerce platform.

Paytm, the abbreviation for PAY-through-mobile, is one of the fastest growing Indian e-commerce websites. In 2014, the startup launched Paytm Wallet, India's largest mobile payment service platform with over 40 million wallets.

Bitreserve is a cloud-based platform that allows users to hold bitcoins denominated as real-world value, and thus protect businesses and consumers from volatility risk. The startup holds the ambition of helping create "an equitable, safer financial world" and provide financial services to the unbanked.

The team recently welcomed Anthony Watson, former CIO at Nike and one of Fortune's "40 Under 40," as Bitreserve president and COO.